- Canada

- /

- Other Utilities

- /

- TSX:CU

A Fresh Look at Canadian Utilities (TSX:CU) Valuation After Strong Q3 Results and Major Project Milestones

Reviewed by Simply Wall St

Canadian Utilities (TSX:CU) just released its third quarter earnings, showing significant earnings growth and notable progress on major infrastructure projects. This includes a major regulatory nod for the Yellowhead Pipeline Project.

See our latest analysis for Canadian Utilities.

It’s clear that the upbeat earnings and momentum on major infrastructure projects are catching investors’ attention, as shown by Canadian Utilities’ 18.1% year-to-date share price return and an impressive one-year total shareholder return of 24.5%. Confidence appears to be building with each quarter, with the company’s progress supporting both near-term share price gains and a strong multi-year track record.

If Canadian Utilities’ recent run has you thinking about what else is gaining traction, this could be the perfect time to explore fast growing stocks with high insider ownership

With shares up strongly this year and fresh milestones fueling optimism, the key question now is whether Canadian Utilities remains undervalued or if the stock is already reflecting all of its future growth potential.

Most Popular Narrative: 2% Overvalued

With Canadian Utilities trading at CA$41.08 and the consensus fair value pegged at CA$40.14, market sentiment appears just slightly ahead of analyst assumptions. This modest premium hints at optimism, but the underlying forecasts behind the price deserve a closer look.

Substantial investment in grid modernization and expansion, including major projects like the Central East Transfer-Out and 90% contracted Yellowhead pipeline, positions Canadian Utilities to capitalize on rising power and gas demand from electrification and industrial growth. This supports future increases in rate base and long-term revenue growth.

Curious about the assumptions fueling this small overvaluation? There’s an ambitious blend of grid upgrades, new energy hubs, and evolving margins at play. Find out what the most followed narrative projects for revenues, earnings, and profit multiples, and see the precise future scenario analysts are betting on.

Result: Fair Value of $40.14 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent regulatory disputes in Alberta or slow progress on decarbonization could quickly derail the positive outlook that analysts are expecting.

Find out about the key risks to this Canadian Utilities narrative.

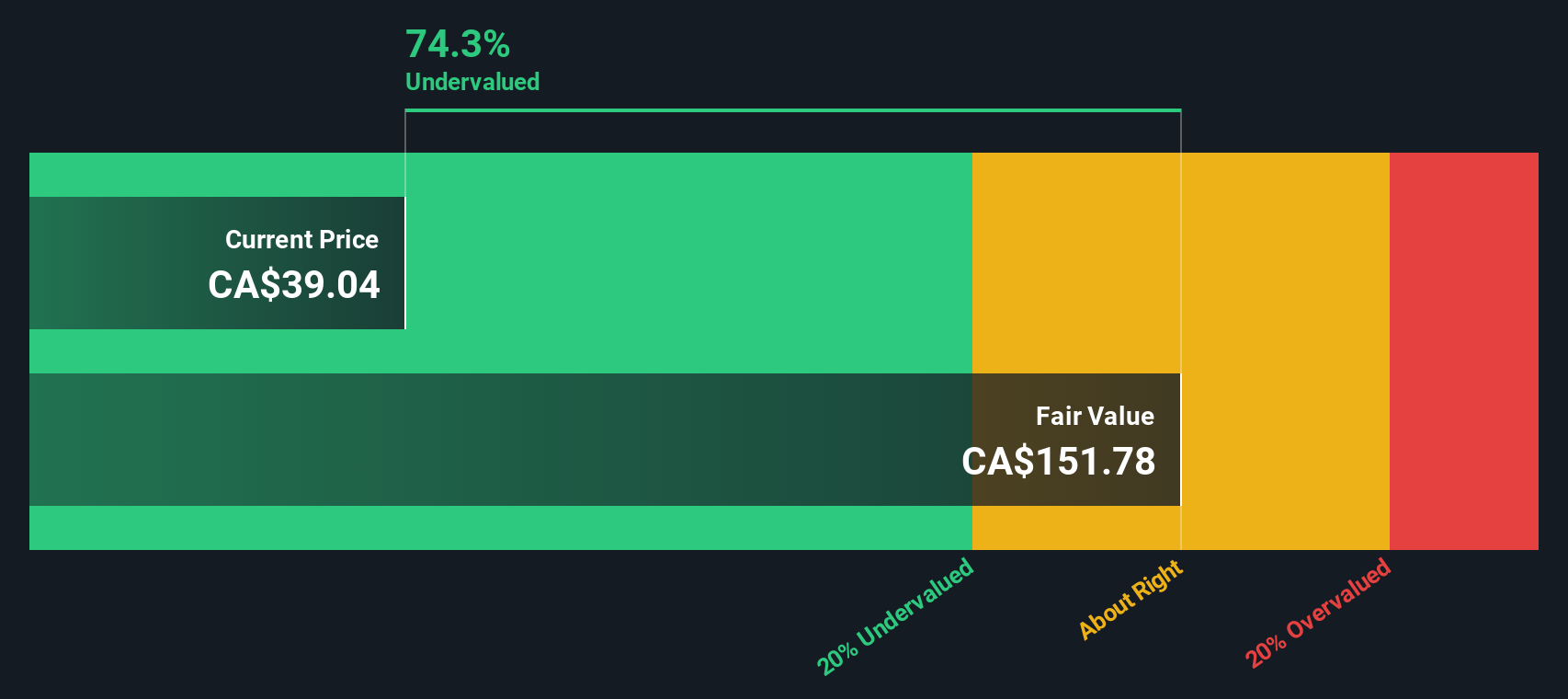

Another View: Discounted Cash Flow Shows Major Upside

While consensus estimates peg Canadian Utilities as slightly overvalued based on analyst price targets, the SWS DCF model tells a strikingly different story. According to this approach, the company’s fair value is much higher than today’s share price, suggesting a significant undervaluation. Which view will ultimately prove right?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Canadian Utilities for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 874 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Canadian Utilities Narrative

If you think the numbers tell a different story or enjoy digging into the details yourself, you can shape your own analysis in just a few minutes. Do it your way

A great starting point for your Canadian Utilities research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for More Smart Investment Ideas?

You don’t want to miss unique opportunities others overlook. Use the Simply Wall Street Screener to find quality stocks that could strengthen your portfolio today.

- Boost your income potential by reviewing these 16 dividend stocks with yields > 3% with yields above 3% and reap the benefits of steady returns.

- Seize early growth by targeting tomorrow’s innovators among these 25 AI penny stocks who are pushing boundaries in artificial intelligence.

- Power up your watchlist with these 874 undervalued stocks based on cash flows to capture companies trading below their true cash flow value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CU

Canadian Utilities

Engages in the electricity, natural gas, renewables, pipelines, and liquids businesses in Canada, Australia, and internationally.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives