- Canada

- /

- Transportation

- /

- TSX:TFII

TFI International (TSX:TFII) Valuation Update Following Earnings, Dividend Boost, and Share Buyback Activity

Reviewed by Simply Wall St

TFI International (TSX:TFII) is drawing attention after reporting its third-quarter earnings. The company posted decreases in revenue and net income, but it addressed these challenges by boosting its quarterly dividend and continuing share buybacks.

See our latest analysis for TFI International.

TFI International’s recent earnings report, coupled with its boosted dividend and active buyback program, has kept investors focused on its long-term strategy despite near-term headwinds. While the 1-year total shareholder return remains deep in negative territory at -30.28%, the company’s five-year total shareholder return of 117.6% still stands out. After a turbulent start to the year, short-term momentum has shown signs of life with a 7.41% gain over the past 90 days. This suggests some renewed confidence even as the broader outlook remains measured.

If TFI’s shareholder-focused moves have you thinking about your next opportunity, now’s a good time to broaden your search and discover fast growing stocks with high insider ownership

With the stock now trading at a notable discount to analyst targets and recent results reflecting both resilience and ongoing challenges, investors must ask: Is TFI International undervalued, or does the current price fairly capture its future prospects?

Most Popular Narrative: 12.6% Undervalued

With TFI International’s fair value estimate at $144.16 based on the most widely followed narrative, the stock’s last close of $126.04 has created a valuation gap that has investors debating whether the market is catching on or missing something.

Continued investments in operational efficiency, including digitalization (Optym rollouts for linehaul and P&D), AI-driven process improvements, and a focus on asset-light brokerage models, are reducing costs, improving margins, and supporting higher free cash flow conversion as volumes recover.

What drives this valuation? The foundation is an ambitious roadmap of expanding margins and unlocking higher earnings, all tied to volume recovery and efficiency upgrades. Can these strategic moves really fuel a turnaround? The true engine behind this price target might surprise you. Discover the crucial growth, margin, and profit assumptions that shape this view.

Result: Fair Value of $144.16 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing weak freight demand and slower-than-expected asset rationalization could challenge TFI’s rebound and put further pressure on its margin outlook.

Find out about the key risks to this TFI International narrative.

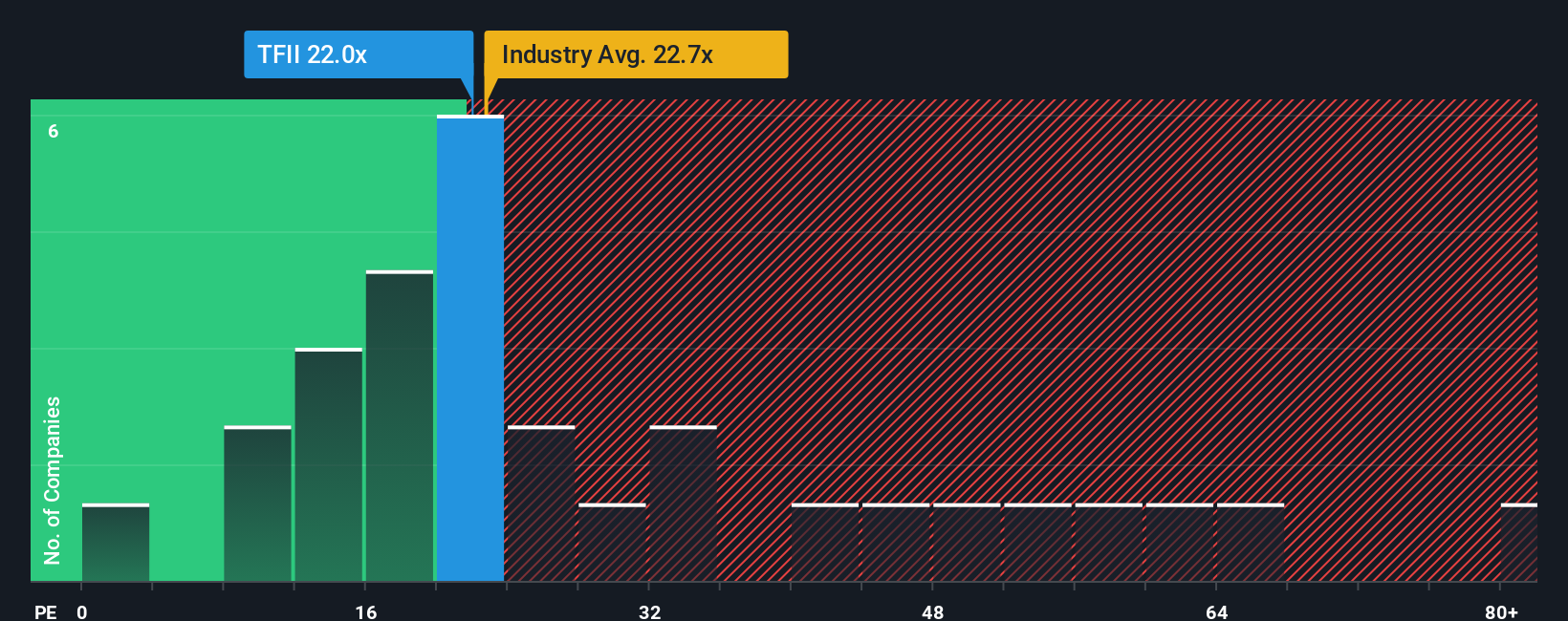

Another View: Looking at Market Multiples

Instead of fair value, let’s see how the current share price stacks up against industry valuation norms. TFI International trades at a price-to-earnings ratio of 20.3x, noticeably higher than the peer average of 16.3x. This signals the market expects more from TFI than from its competitors, but also hints at valuation risk if those expectations are not met. Will this premium persist, or is a correction on the cards?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own TFI International Narrative

If this perspective doesn't fit your view or you want a hands-on look at the numbers, crafting your own narrative is quick and easy. Do it your way Do it your way

A great starting point for your TFI International research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for Your Next Smart Move?

Supercharge your investment strategy by seizing the latest stock ideas others might overlook. These tailored screens give you a clear advantage before trends go mainstream.

- Spot high-growth winners early when you size up potential in these 831 undervalued stocks based on cash flows supported by strong cash flow and attractive valuations.

- Uncover tech trailblazers shaping the industry with these 26 AI penny stocks, leading innovation through smart automation and game-changing AI solutions.

- Power up your portfolio with steady income by checking out these 22 dividend stocks with yields > 3% offering yields above 3% and proven payout histories.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TFI International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:TFII

TFI International

Provides transportation and logistics services in the United States, Mexico, and Canada.

Good value average dividend payer.

Similar Companies

Market Insights

Community Narratives