Exchange Income (TSX:EIF): Valuation in Focus After Q3 Revenue Beats and Mixed Earnings Results

Reviewed by Simply Wall St

Exchange Income (TSX:EIF) just released its third quarter earnings, highlighting a sharp jump in both revenue and net income compared to last year. Investors are taking note because revenue beat estimates; however, earnings per share came in below expectations.

See our latest analysis for Exchange Income.

Shares of Exchange Income have caught investors’ attention this year, with momentum building after these robust financial results. The stock has climbed sharply, delivering a year-to-date share price return of nearly 33%. Long-term holders have even more to cheer about, as Exchange Income’s one-year total shareholder return sits at an impressive 46.9%, and its five-year total return stands at a remarkable 163%.

If you’re keen to spot other companies with strong momentum and compelling fundamentals, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

With shares rallying and analyst targets still implying more upside, the big question is whether Exchange Income’s recent surge leaves the stock undervalued, or if expectations for future growth are already included in the price.

Most Popular Narrative: 7.3% Undervalued

Exchange Income’s most closely followed market narrative values the company above its current share price. With analysts assigning a fair value of CA$83.54 versus Friday’s close at CA$77.40, this perspective sees more upside in the stock than the market currently prices in. The rationale behind this premium lies in projected operational improvements and sector catalysts.

The recent acquisition of Canadian North, combined with a long-term exclusive contract with the Government of Nunavut, uniquely positions the company as the primary provider of essential air services to remote Arctic regions. This leverages multi-decade demand for connectivity and government infrastructure investment in the North, creating a stable, recurring revenue base and supporting future revenue and EBITDA growth.

Want to know the quantitative lever that could make or break this premium? The real story in this narrative is not just about more routes or contracts, but how one specific shift in profitability could supercharge future returns and justify that higher valuation. Dive in to uncover the bold assumptions driving this mark-up.

Result: Fair Value of $83.54 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing labor shortages and heightened maintenance costs could pressure margins. These factors may potentially stall Exchange Income’s momentum if they are not effectively managed.

Find out about the key risks to this Exchange Income narrative.

Another View: Multiples Tell a Cautionary Tale

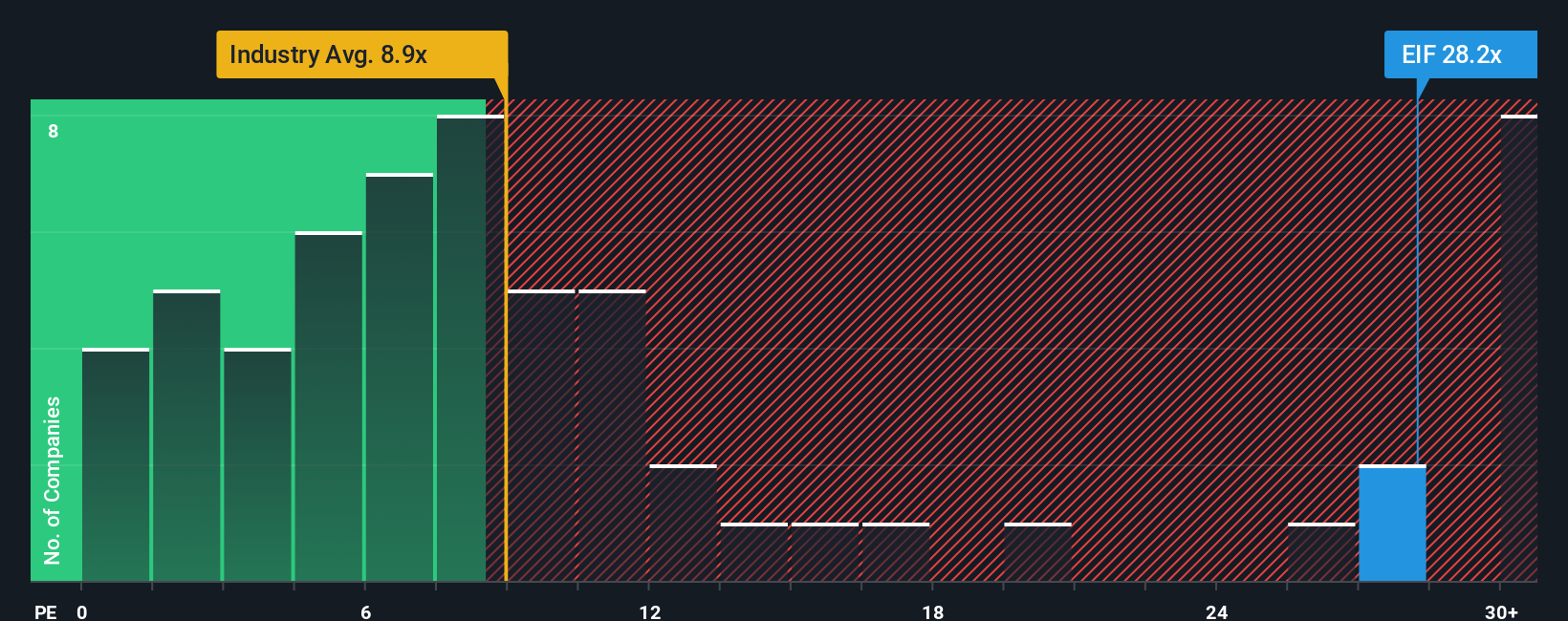

While analysts see Exchange Income as undervalued based on future earnings potential, comparing its price-to-earnings ratio to the market raises eyebrows. At 29.2x, it is much higher than the global airline industry’s 8.9x, its peer average of 13.7x, and even above the fair ratio of 21.6x. This gap suggests investors may be paying up for growth that is already reflected in the price. Could this premium be justified, or are expectations running ahead of reality?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Exchange Income Narrative

If you think there’s more to the story or want to test your own perspective, you can dive into the data and craft a personal view in just a few minutes. Do it your way

A great starting point for your Exchange Income research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Why settle for ordinary stocks? Get ahead of the crowd and spot emerging opportunities by using these unique screeners designed for forward-thinking investors like you.

- Tap into high long-term income streams by checking out these 16 dividend stocks with yields > 3% and see which companies are rewarding shareholders with yields above 3%.

- Uncover tomorrow’s big disruptors and spark your portfolio’s growth with these 25 AI penny stocks packed with companies specializing in remarkable artificial intelligence breakthroughs.

- Catch the wave of financial innovation by browsing these 82 cryptocurrency and blockchain stocks showcasing companies making strides in blockchain and cryptocurrency advances.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Exchange Income might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:EIF

Exchange Income

Engages in aerospace and aviation services and equipment, and manufacturing businesses worldwide.

Reasonable growth potential with proven track record.

Market Insights

Community Narratives