Earnings Surge Could Be a Game Changer for Exchange Income (TSX:EIF)

Reviewed by Sasha Jovanovic

- Exchange Income Corporation recently announced its third quarter 2025 results, reporting CA$680.48 million in sales and CA$68.74 million in net income, both up from the same period last year.

- An interesting aspect of this announcement is the increase in both basic and diluted earnings per share from continuing operations compared to the previous year.

- We’ll examine how Exchange Income’s strong year-over-year earnings growth may influence its investment narrative and forward outlook.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

Exchange Income Investment Narrative Recap

To be a shareholder in Exchange Income Corporation, you need to believe in the long-term stability and growth of its aviation and infrastructure services, particularly its recent momentum from Arctic operations and government contracts. The robust third quarter 2025 results, with strong sales and earnings growth, reinforce optimism around near-term catalysts linked to the Canadian North acquisition, but do not materially reduce the biggest current risk: ongoing pressure on free cash flow from high maintenance capex requirements and elevated operating expenses.

Among recent developments, the upsizing of Exchange Income's credit facility in April 2025 stands out as particularly relevant given the company's aggressive expansion and integration activities. Improved access to capital supports the operational and strategic commitments visible in the latest earnings growth, helping address potential liquidity pressures tied to large-scale maintenance, fleet upgrades, and acquisitions that remain central to the forward investment story.

However, investors should also be mindful that continued growth could bring higher maintenance burdens...

Read the full narrative on Exchange Income (it's free!)

Exchange Income's narrative projects CA$4.2 billion revenue and CA$346.8 million earnings by 2028. This requires 14.7% yearly revenue growth and a CA$215.5 million increase in earnings from CA$131.3 million today.

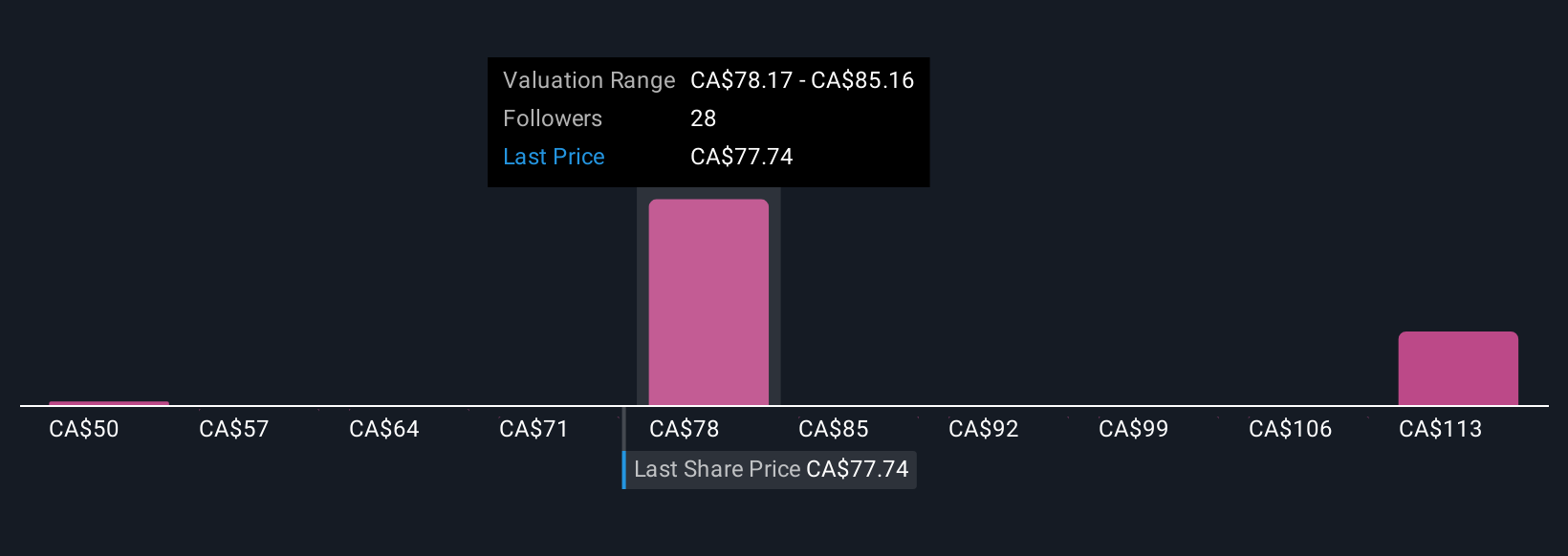

Uncover how Exchange Income's forecasts yield a CA$83.54 fair value, a 8% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community produced six fair value estimates for Exchange Income, ranging from CA$50.20 to CA$126.85. With consensus pointing to significant maintenance capital needs, it is clear that your viewpoint matters in weighing future company performance.

Explore 6 other fair value estimates on Exchange Income - why the stock might be worth as much as 64% more than the current price!

Build Your Own Exchange Income Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Exchange Income research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Exchange Income research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Exchange Income's overall financial health at a glance.

Ready For A Different Approach?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Exchange Income might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:EIF

Exchange Income

Engages in aerospace and aviation services and equipment, and manufacturing businesses worldwide.

Reasonable growth potential with proven track record.

Market Insights

Community Narratives