- Canada

- /

- Transportation

- /

- TSX:CNR

Canadian National Railway (TSX:CNR): Exploring Valuation After Recent Share Performance and Industry Comparisons

Reviewed by Simply Wall St

Canadian National Railway (TSX:CNR) has seen its shares trade lower recently, with performance slipping about 1% over the past month and year to date. Investors are keeping an eye on the company’s next moves and underlying fundamentals.

See our latest analysis for Canadian National Railway.

While Canadian National Railway’s share price is down about 9% year-to-date, a 4.7% gain over the past 90 days hints that some momentum may be returning. The total shareholder return stands at -11.4% over the last year. This reflects recent challenges but also suggests there could be potential for a shift if fundamentals improve.

If you’re curious about what else is gaining traction in the market, now is an ideal moment to expand your search and discover fast growing stocks with high insider ownership

With shares trailing both the broader market and their own price targets, investors are left wondering whether Canadian National Railway is undervalued at current levels or if the market is already factoring in stronger growth ahead.

Most Popular Narrative: 0.3% Overvalued

According to TibiT’s widely followed narrative, Canadian National Railway’s fair value comes in almost exactly at the last close, CA$132.87 versus CA$133.31. This sets up a debate about whether current market pessimism accurately reflects the company's prospects, or if something big is being overlooked.

The clear trend is "reshoring" or "nearshoring", bringing manufacturing and production back to the U.S., Canada, and Mexico. This is the central pillar of my bull thesis. This trend will fundamentally re-wire North American logistics, creating a surge in demand for land-based freight. CN is perfectly positioned to capture this demand. Its network is not just a railroad; it is the future artery for North America’s industrial heartland, connecting new manufacturing hubs in the U.S. South and Midwest to Canadian resources and coastal ports. This provides a structural tailwind that should reverse the recent slowdown and drive volume growth for the next decade.

Want to peek inside the numbers driving this valuation? The intrigue: one bold growth driver and margin assumptions power this thesis. What are they? Only the full narrative reveals how these projections back a fair value far above what recent headlines suggest.

Result: Fair Value of $132.87 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, headwinds such as persistent macroeconomic weakness or prolonged labor disputes could quickly test the optimism underlying this bullish long-term scenario.

Find out about the key risks to this Canadian National Railway narrative.

Another View: Valuation Through Market Multiples

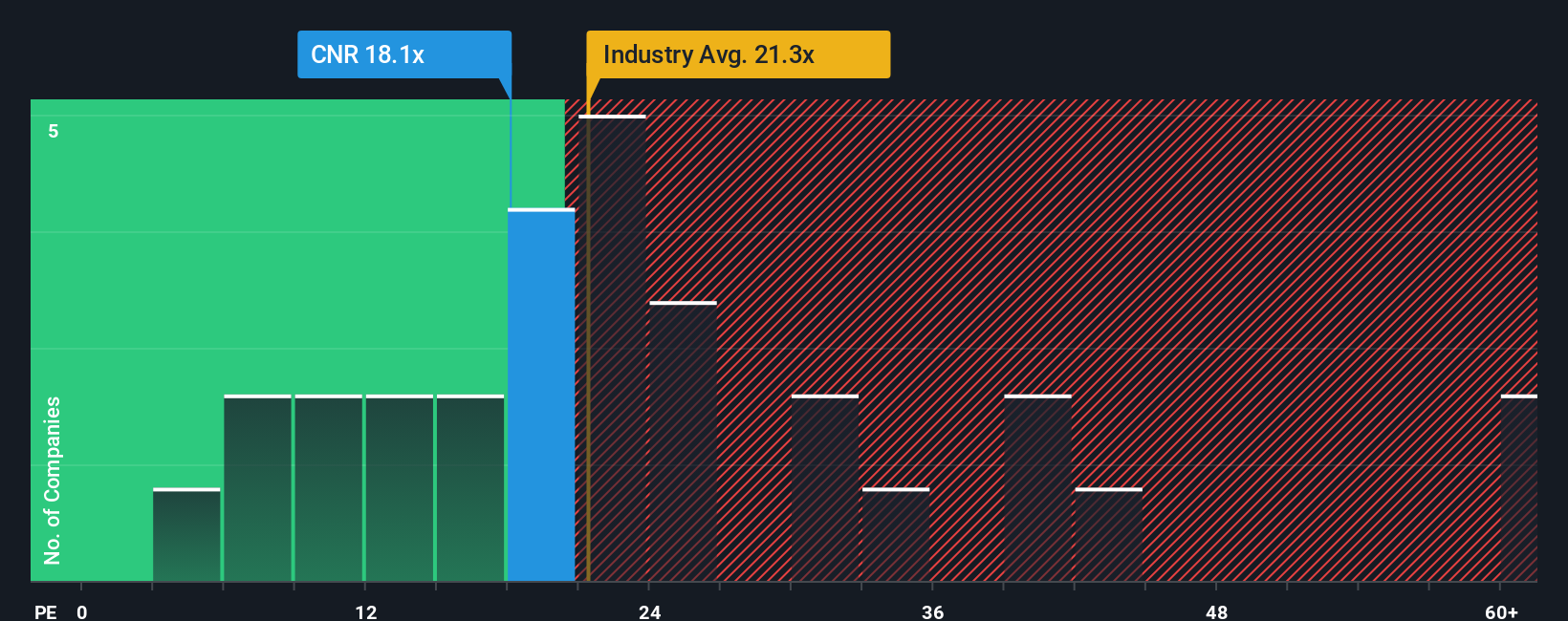

Looking at Canadian National Railway’s valuation through the lens of its price-to-earnings ratio presents a slightly different perspective. At 17.8x, the company trades well below both the North American transportation industry average of 22.7x and the peer average of 21.8x. It also falls under the fair ratio of 18.1x, suggesting the market may be underestimating CNR’s earnings power. Does this gap reveal a bargain, or is it a signal for caution?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Canadian National Railway Narrative

If you see the situation differently or want to dig into the details yourself, you can build and share your own view in just a few minutes. Do it your way

A great starting point for your Canadian National Railway research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let a single stock define your next move. Take charge with fresh opportunities that could transform your portfolio using the Simply Wall Street Screener.

- Capture high yields and grow your income stream by reviewing these 16 dividend stocks with yields > 3% offering stable returns and consistent payouts.

- Position yourself at the edge of innovation by checking out these 24 AI penny stocks shaping the future of technology through artificial intelligence advancements.

- Uncover remarkable bargains with these 870 undervalued stocks based on cash flows where market prices haven’t caught up to intrinsic value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CNR

Canadian National Railway

Engages in the rail, intermodal, trucking, and related transportation businesses in Canada and the United States.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives