Will Cargojet’s (TSX:CJT) Global Move and CEO Transition Reshape Its Long-Term Growth Direction?

Reviewed by Sasha Jovanovic

- Cargojet Inc. recently announced the upcoming CEO transition, with Pauline Dhillon assuming leadership in January 2026, alongside the launch of a direct weekly air cargo service connecting Canada's hubs with Liege Airport in Europe as of November 1, 2025.

- This marks a pivotal moment as the company pairs leadership continuity with targeted global expansion, underscoring its pursuit of international growth opportunities amid evolving market conditions.

- We’ll explore how Cargojet’s CEO transition and direct Europe service could influence its long-term growth strategy and investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Cargojet Investment Narrative Recap

To invest in Cargojet, one must believe in its ability to leverage long-term contracts and an expanding international network for durable, profitable growth. The recent CEO transition and European route launch signal leadership stability and geographic expansion, but current results show continued reliance on major customers as the key short-term driver, with concentration risk remaining unchanged. The biggest risk still comes from potential shifts in volumes or terms with major partners, as seen in ongoing earnings fluctuations and customer concentration exposure.

Among recent developments, the renewed DHL contract until 2033, with expanded service terms, stands out as especially relevant, enhancing revenue stability and underpinning Cargojet’s network growth ambitions. While the direct Liege service opens new long-term routes, retention and growth of anchor customers like DHL remain the most critical near-term catalyst for both margin resilience and volume recovery.

On the other hand, investors should pay close attention to the ongoing risk from overreliance on a small group of customers, especially if those relationships...

Read the full narrative on Cargojet (it's free!)

Cargojet is projected to reach CA$1.1 billion in revenue and CA$111.6 million in earnings by 2028. This outlook is based on analysts' assumptions of 3.7% annual revenue growth, but a decline in earnings of CA$34.1 million from the current CA$145.7 million.

Uncover how Cargojet's forecasts yield a CA$120.50 fair value, a 74% upside to its current price.

Exploring Other Perspectives

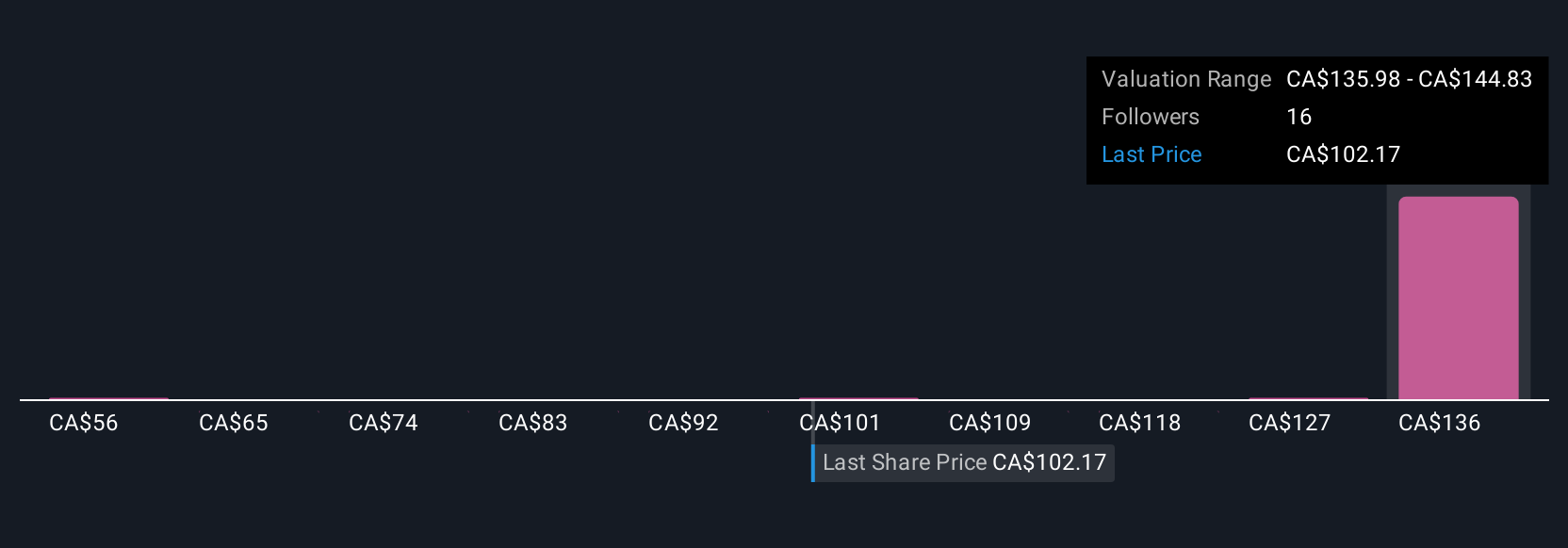

Six fair value estimates from the Simply Wall St Community span CA$56.31 to CA$132.99, capturing a wide spectrum of expectations. While contract renewals with key clients strengthen revenue visibility, maintaining these partnerships remains pivotal for the company’s future path.

Explore 6 other fair value estimates on Cargojet - why the stock might be worth 19% less than the current price!

Build Your Own Cargojet Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cargojet research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Cargojet research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cargojet's overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CJT

Cargojet

Provides time-sensitive overnight air cargo services and carries in Canada.

Solid track record average dividend payer.

Market Insights

Community Narratives