- Canada

- /

- Marine and Shipping

- /

- TSX:ALC

Algoma Central Corporation's (TSE:ALC) CEO Compensation Is Looking A Bit Stretched At The Moment

Key Insights

- Algoma Central to hold its Annual General Meeting on 1st of May

- CEO Gregg Ruhl's total compensation includes salary of CA$670.0k

- The total compensation is 432% higher than the average for the industry

- Algoma Central's EPS grew by 20% over the past three years while total shareholder return over the past three years was 7.8%

Performance at Algoma Central Corporation (TSE:ALC) has been reasonably good and CEO Gregg Ruhl has done a decent job of steering the company in the right direction. As shareholders go into the upcoming AGM on 1st of May, CEO compensation will probably not be their focus, but rather the steps management will take to continue the growth momentum. However, some shareholders may still want to keep CEO compensation within reason.

View our latest analysis for Algoma Central

Comparing Algoma Central Corporation's CEO Compensation With The Industry

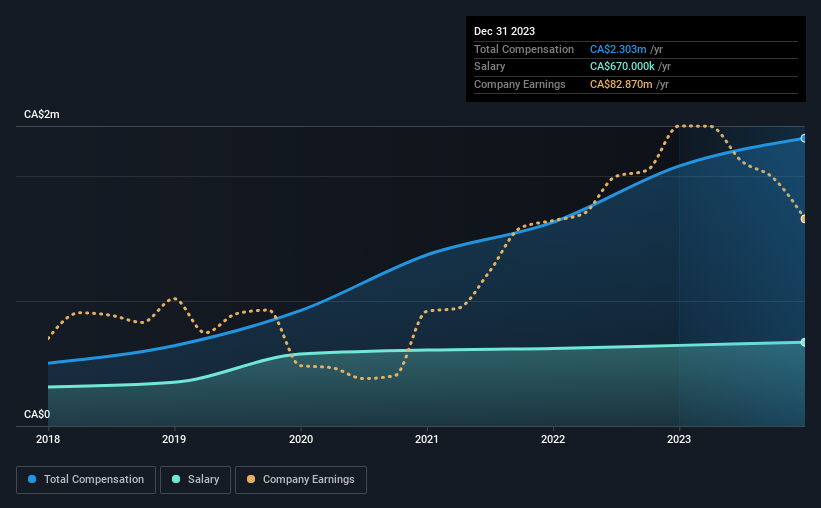

Our data indicates that Algoma Central Corporation has a market capitalization of CA$581m, and total annual CEO compensation was reported as CA$2.3m for the year to December 2023. That's a notable increase of 11% on last year. We think total compensation is more important but our data shows that the CEO salary is lower, at CA$670k.

For comparison, other companies in the Canada Shipping industry with market capitalizations ranging between CA$274m and CA$1.1b had a median total CEO compensation of CA$433k. This suggests that Gregg Ruhl is paid more than the median for the industry. Moreover, Gregg Ruhl also holds CA$118k worth of Algoma Central stock directly under their own name.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | CA$670k | CA$645k | 29% |

| Other | CA$1.6m | CA$1.4m | 71% |

| Total Compensation | CA$2.3m | CA$2.1m | 100% |

On an industry level, roughly 21% of total compensation represents salary and 79% is other remuneration. According to our research, Algoma Central has allocated a higher percentage of pay to salary in comparison to the wider industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

Algoma Central Corporation's Growth

Over the past three years, Algoma Central Corporation has seen its earnings per share (EPS) grow by 20% per year. It achieved revenue growth of 6.4% over the last year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's good to see a bit of revenue growth, as this suggests the business is able to grow sustainably. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Algoma Central Corporation Been A Good Investment?

With a total shareholder return of 7.8% over three years, Algoma Central Corporation has done okay by shareholders, but there's always room for improvement. In light of that, investors might probably want to see an improvement on their returns before they feel generous about increasing the CEO remuneration.

In Summary...

Seeing that the company has put up a decent performance, only a few shareholders, if any at all, might have questions about the CEO pay in the upcoming AGM. However, if the board proposes to increase the compensation, some shareholders might have questions given that the CEO is already being paid higher than the industry.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. We've identified 4 warning signs for Algoma Central that investors should be aware of in a dynamic business environment.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:ALC

Algoma Central

Owns and operates a fleet of dry and liquid bulk carriers activities in Canada.

Solid track record second-rate dividend payer.

Market Insights

Community Narratives