Will Weaker Q3 Results and US Route Expansion Change Air Canada's (TSX:AC) Narrative?

Reviewed by Sasha Jovanovic

- Air Canada recently reported its third quarter 2025 financial results, with revenue of C$5.77 billion and net income of C$264 million, down from C$6.11 billion and C$2.04 billion, respectively, in the same period last year, alongside earnings per share that also saw a substantial decrease year-over-year.

- At the same time, Air Canada announced a significant expansion at Billy Bishop Toronto City Airport, introducing new transborder routes to major U.S. cities and elevating the passenger experience with enhanced amenities such as free onboard Wi-Fi and exclusive lounge access.

- We'll explore how the third quarter profit decrease and the launch of new U.S. routes could influence Air Canada's investment outlook.

We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Air Canada Investment Narrative Recap

To own Air Canada shares, you need confidence in the airline's ability to restore profitability despite headwinds like lower earnings and ongoing labor cost pressures. The recent third quarter profit decline has kept margins and near-term earnings at risk, especially with labor negotiations unresolved; however, the latest results do not materially change the biggest risk, which remains elevated labor costs. Near-term catalysts, such as international travel demand and network expansion, may continue to drive sentiment, but their impact could be limited without higher margin recovery.

Of the latest announcements, Air Canada’s expansion at Billy Bishop Toronto City Airport stands out. By introducing several new U.S. routes and enhanced premium amenities for business travelers, the company is reinforcing its focus on attracting higher-yield traffic and offsetting demand weakness in core transborder markets. These moves align closely with catalysts like premium product growth, yet they may not fully address persistent competition on international routes and ongoing cost pressures.

Yet, despite ambitious expansion plans, investors should also be aware of the effects that persistent and increasing competition on key international routes could have on Air Canada's future revenue and profitability if ...

Read the full narrative on Air Canada (it's free!)

Air Canada's outlook suggests revenues of CA$26.3 billion and earnings of CA$869.3 million by 2028. This is based on an annual revenue growth rate of 5.6% and a decline in earnings of approximately CA$630 million from current earnings of CA$1.5 billion.

Uncover how Air Canada's forecasts yield a CA$24.36 fair value, a 30% upside to its current price.

Exploring Other Perspectives

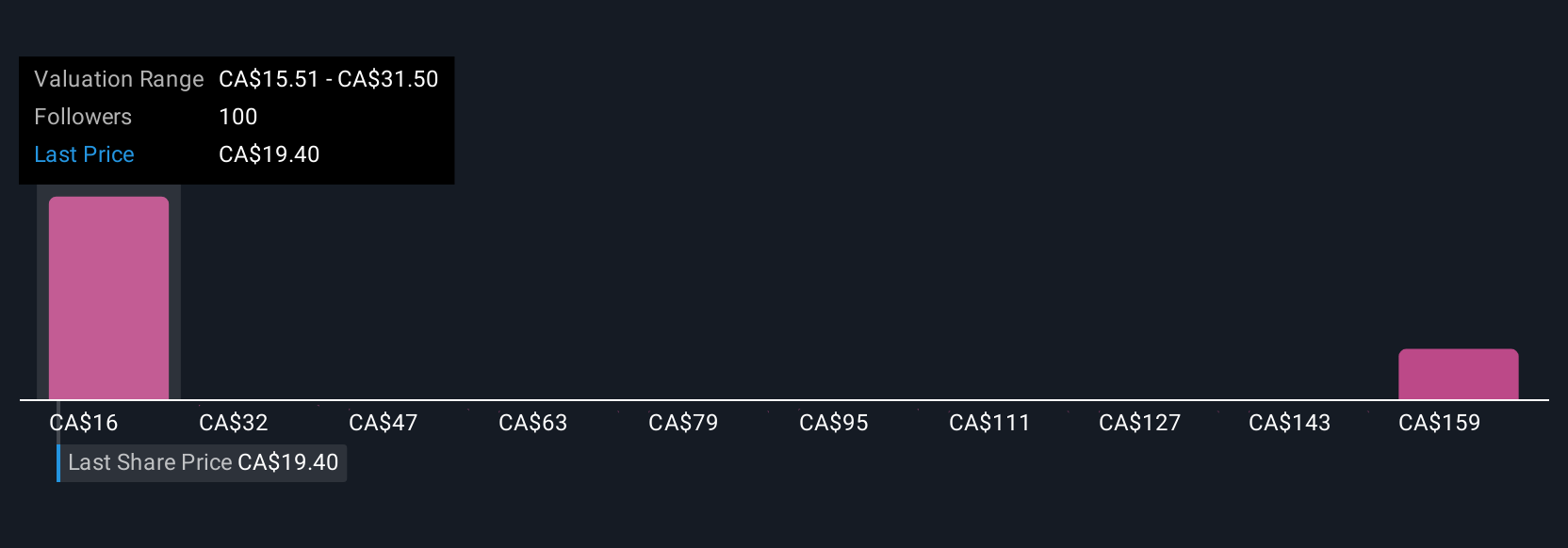

Simply Wall St Community members estimate Air Canada’s fair value between C$19.00 and C$52.82, offering eight distinct perspectives. With labor cost risks still prominent, consider how this diversity might shape your expectations.

Explore 8 other fair value estimates on Air Canada - why the stock might be worth over 2x more than the current price!

Build Your Own Air Canada Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Air Canada research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Air Canada research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Air Canada's overall financial health at a glance.

Ready For A Different Approach?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 38 best rare earth metal stocks of the very few that mine this essential strategic resource.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:AC

Air Canada

Provides domestic, U.S. transborder, and international airline services.

Very undervalued with low risk.

Similar Companies

Market Insights

Community Narratives