Should Air Canada’s (TSX:AC) Cabin Upgrades and Free Wi-Fi Prompt a Rethink by Investors?

Reviewed by Sasha Jovanovic

- Air Canada recently announced its most comprehensive cabin renewal program, introducing upgraded interiors, next-generation technology, and enhanced amenities including fast, free Wi-Fi and complimentary snacks across its North American fleet.

- Beyond comfort, the initiative features significant fleet realignment and a new Rouge crew base in Vancouver, aiming to improve operational consistency and better serve key regional markets.

- We'll examine how Air Canada's investment in upgraded interiors and free Wi-Fi could influence its long-term investment outlook.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Air Canada Investment Narrative Recap

To be a shareholder in Air Canada, you need to see value in large capital investments driving customer loyalty, operational efficiency, and market share gains, offsetting current earnings volatility. While the recent cabin renewal program strengthens Air Canada’s brand and product, it does not materially change the immediate pressure from rising labor expenses, which remain the most important near-term catalyst and risk for the business.

Among recent announcements, the launch of all-new North American routes out of Billy Bishop Toronto City Airport stands out. This expansion could support future revenue growth, but its impact must be weighed against persistent cost headwinds and constrained free cash flow from ongoing labor negotiations.

But investors should be mindful that, despite upgrades and network expansion, wage arbitration outcomes could impact near-term margins if...

Read the full narrative on Air Canada (it's free!)

Air Canada's outlook anticipates CA$26.3 billion in revenue and CA$869.3 million in earnings by 2028. This is based on analysts’ expectations for a 5.6% annual revenue growth, but a decrease in earnings of CA$630.7 million from the current CA$1.5 billion.

Uncover how Air Canada's forecasts yield a CA$24.24 fair value, a 33% upside to its current price.

Exploring Other Perspectives

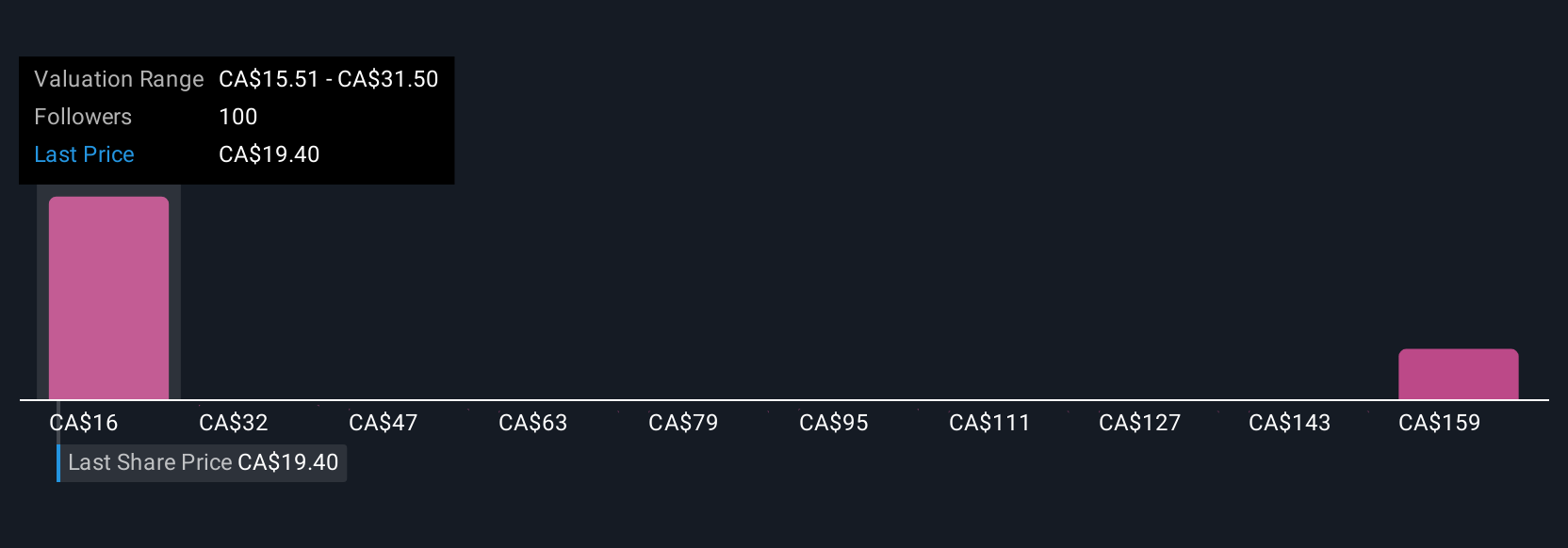

Eight fair value estimates from the Simply Wall St Community show targets between CA$19.00 and CA$85.08 per share. Facing rising labor costs, these divergent views highlight how opinions on Air Canada's recovery and profitability can differ, inviting you to compare various forecasts for a fuller picture.

Explore 8 other fair value estimates on Air Canada - why the stock might be worth just CA$19.00!

Build Your Own Air Canada Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Air Canada research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Air Canada research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Air Canada's overall financial health at a glance.

Ready For A Different Approach?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:AC

Air Canada

Provides domestic, U.S. transborder, and international airline services.

Very undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives