Air Canada (TSX:AC) Margin Miss Challenges Bullish Narrative Despite Strong Growth Forecasts

Reviewed by Simply Wall St

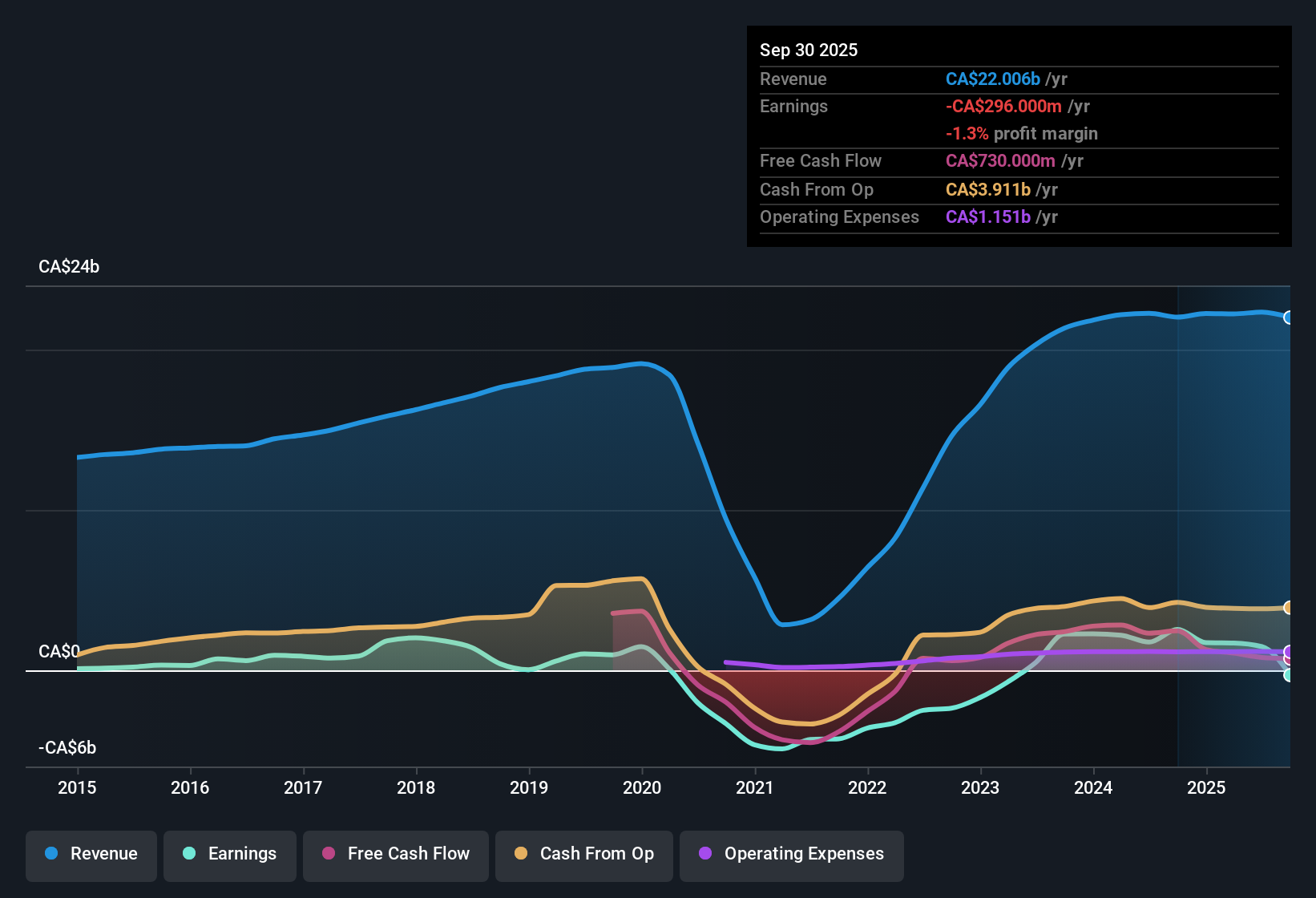

Air Canada (TSX:AC) is projecting earnings growth of 13.9% per year and revenue growth of 6.2% per year, both coming in ahead of the broader Canadian market averages. The company’s current net profit margin stands at 6.6%, down from last year's 7.9%, with recent trailing results aided by a CA$63.0 million one-off gain. With its stock trading at just 3.8 times earnings and well below some analyst fair value estimates (CA$18.75 share price vs. CA$52.82 fair value), investors are weighing attractive valuation metrics against the impact of non-recurring items and signs of a less robust financial position.

See our full analysis for Air Canada.The key question now is how these headline figures stack up with the mainstream narratives. This is where expectations might be confirmed or challenged as we dig deeper into the story.

See what the community is saying about Air Canada

Labor Costs Up 16% on Flat Headcount

- Labor expenses grew by 16% year over year, even though headcount increased by less than 1%. This highlights a significant spike in workforce costs relative to staffing changes.

- Analysts' consensus view points out that higher pilot and flight attendant costs, already locked in via ratified and ongoing agreements, are expected to squeeze net margins and earnings more than some bulls had hoped.

- Rising labor costs risk outweighing the benefit from corporate and premium cabin demand, putting pressure on profit margins, which are projected to fall from 6.6% to 3.3% in three years.

- The consensus narrative notes that cost escalation, not just demand, is a key swing factor for Air Canada’s future earnings quality.

- Curious how numbers become stories that shape markets? Explore Community Narratives📊 Read the full Air Canada Consensus Narrative.

Fleet Modernization Drives Efficiency Bets

- Fleet spending remains high, with major capital outlays for new A220s, 737 MAX, A321XLRs, and 787s designed to reduce per-seat costs and increase operational efficiency across longer-haul routes.

- Analysts' consensus view gives credit to these investments, expecting their pay-off will anchor Air Canada’s ability to fund recurring, high-margin revenue streams and offset margin risk.

- The consensus narrative notes that digital initiatives and expanded loyalty programs, including Aeroplan and free Wi-Fi perks, should diversify revenue and support steadier free cash flow.

- However, ongoing capital expenditures and volatile fuel prices mean that if efficiency gains disappoint, pressure on cash flow and net margin could increase.

Trading at 3.8x PE, Well Below Peers and DCF Fair Value

- Shares currently trade at 3.8 times earnings, compared to 8.8x for the global airline sector and 17.5x for immediate peers, and are well below the DCF fair value of CA$52.82 per share.

- Analysts' consensus view frames this low multiple as a potential value opportunity, but notes that to support the CA$24.29 analyst target, investors must believe future margins and profits (CA$869.3 million earnings by 2028) will be sustained, despite cost and competition challenges.

- This disconnect between a discounted PE and the consensus price target, which is 23.9% above the current market price, shows that even with muted earnings forecasts, analysts see more upside than the stock price reflects.

- Yet, consensus cautions that substantial disagreement among analysts about future profit and margin levels makes this valuation gap a risk, not just an opportunity.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Air Canada on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a fresh take on these figures? Share your viewpoint and craft a personal narrative in just a few minutes: Do it your way.

A great starting point for your Air Canada research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Air Canada faces narrowing profit margins and higher costs, raising concerns about the sustainability of its earnings and overall financial resilience.

If you prefer companies with safer financial foundations and less earnings volatility, see what you can uncover with solid balance sheet and fundamentals stocks screener (1979 results) built to handle challenging environments.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:AC

Air Canada

Provides domestic, U.S. transborder, and international airline services.

Very undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives