- Canada

- /

- Telecom Services and Carriers

- /

- TSX:BCE

BCE (TSX:BCE): Assessing Valuation After Recent Share Price Weakness

Reviewed by Simply Wall St

BCE (TSX:BCE) shares have moved slightly over the past month, sparking questions among investors about what is next for this major Canadian telecom. With a steady revenue stream and evolving industry dynamics, some are reevaluating BCE's positioning.

See our latest analysis for BCE.

BCE’s share price has drifted lower this year, trimming another 4% since January after a one-year total shareholder return of -22%. Despite the company’s scale and recent efforts to streamline operations, momentum remains subdued as investors weigh long-term challenges and potential catalysts.

If recent telecom moves have you rethinking your portfolio, now could be the perfect moment to discover fast growing stocks with high insider ownership.

With its shares lagging and the stock trading below analyst price targets, investors are left wondering whether BCE is now undervalued or if the market has already factored in all future growth prospects into the current price.

Most Popular Narrative: 11.3% Undervalued

BCE’s last close of CA$32.06 sits noticeably below the most widely followed fair value estimate, capturing attention as investors weigh recent upgrades and outlook shifts. This difference is fueling debate among market watchers about whether the current level represents an opportunity or if continued caution is warranted.

Momentum in BCE's AI-powered enterprise solutions (Ateko, cybersecurity, and Bell AI Fabric) is opening up new high-margin business lines. These initiatives are benefiting from the proliferation of AI workloads and digital transformation among Canadian enterprises, which could have positive implications for consolidated revenues and long-term EBITDA growth.

Want to know what’s powering this optimistic fair value? The big story is a bet on ongoing transformation, higher earnings, and a margin overhaul by 2028. Which bold profit and revenue assumptions set this narrative apart from the market? Dive in to uncover the projections behind that number.

Result: Fair Value of $36.15 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, regulatory constraints and persistent competition could still challenge BCE's fiber expansion and profit margins. This situation may put the optimistic outlook to the test.

Find out about the key risks to this BCE narrative.

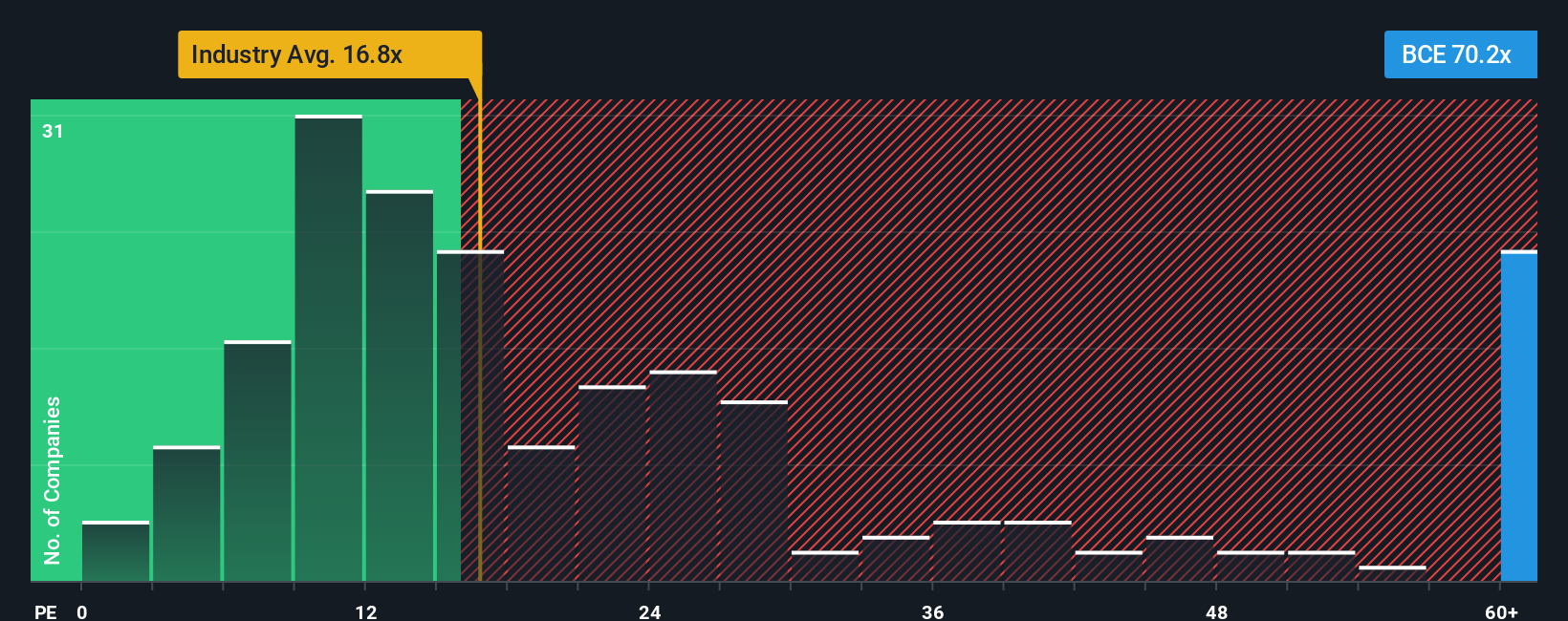

Another View: Price-to-Earnings Suggests Risk

Looking at BCE from the perspective of its actual price-to-earnings ratio, the stock trades at 69x earnings. This is much higher than both the global telecom industry average of 16.4x and its fair ratio of 20x. This gap implies BCE could face valuation risk if the market reverts toward industry norms. Does this steep premium reflect untapped growth or a warning sign?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own BCE Narrative

If you want to dig deeper or take a different view on BCE, the data is here for you to explore and shape your own story in just a few minutes. Do it your way.

A great starting point for your BCE research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Give yourself the edge by expanding your horizons beyond BCE. There are standout opportunities waiting if you know where to look. Here are three powerful ways to level up your portfolio now:

- Pinpoint high-potential bargains by checking out these 832 undervalued stocks based on cash flows and spot stocks most overlooked by the broader market.

- Accelerate your growth strategy and tap into booming innovation with these 26 AI penny stocks loaded with companies transforming industries through artificial intelligence.

- Boost your cash flow and financial stability when you browse these 22 dividend stocks with yields > 3% for yield-friendly investments that keep your returns coming in.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BCE might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BCE

BCE

A communications company, provides wireless, wireline, internet, streaming services, and television (TV) services to residential, business, and wholesale customers in Canada.

Slight risk with moderate growth potential.

Similar Companies

Market Insights

Community Narratives