Stock Analysis

Exploring High Growth Tech Stocks Including Three Prominent Picks

Reviewed by Simply Wall St

As global markets show resilience with U.S. indexes approaching record highs and smaller-cap indexes outperforming large-caps, investor sentiment is buoyed by positive economic indicators such as falling jobless claims and rising home sales. In this context of broad-based gains, exploring high growth tech stocks becomes particularly pertinent, as these companies often thrive on innovation and market adaptability—key attributes for navigating the current economic landscape.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Seojin SystemLtd | 32.56% | 43.21% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| eWeLLLtd | 27.24% | 28.74% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Mental Health TechnologiesLtd | 24.68% | 97.53% | ★★★★★★ |

| Pharma Mar | 25.97% | 56.89% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| JNTC | 20.52% | 57.26% | ★★★★★★ |

| Elliptic Laboratories | 65.73% | 103.55% | ★★★★★★ |

Click here to see the full list of 1288 stocks from our High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

Shaanxi Fenghuo Electronics (SZSE:000561)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shaanxi Fenghuo Electronics Co., Ltd. focuses on developing and producing military communications equipment and electroacoustic products in China, with a market capitalization of CN¥5.57 billion.

Operations: Fenghuo Electronics specializes in military communications equipment and electroacoustic products. The company operates primarily in China, leveraging its expertise to cater to defense-related needs.

Shaanxi Fenghuo Electronics, navigating a challenging period with a reported net loss of CNY 58.65 million for the nine months ending September 2024, contrasts starkly against its revenue growth projection of 24.5% per year. Despite recent setbacks, including a significant one-off gain of CN¥22.0M skewing past earnings quality, the company's strategic R&D investments are poised to harness long-term benefits, reflected in an ambitious forecasted annual earnings growth of 44%. This focus on innovation could potentially recalibrate its market position amidst ongoing share repurchases totaling CNY 3.84 million this year, signaling a commitment to enhancing shareholder value through calculated financial maneuvers and robust technological advancements.

NSFOCUS Technologies Group (SZSE:300369)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: NSFOCUS Technologies Group Co., Ltd. offers Internet and application security services globally, with a market capitalization of CN¥6.71 billion.

Operations: The company generates revenue primarily from the Information Security Industry, amounting to CN¥1.75 billion.

NSFOCUS Technologies Group has demonstrated a robust commitment to growth, with its revenue forecast to expand by 18.1% annually, outpacing the broader Chinese market's 13.8% growth rate. This aggressive expansion is supported by substantial R&D investments, which are not just a financial commitment but a strategic one, as evidenced by the company's R&D spending aimed at fostering innovation and securing competitive advantages in the tech sector. Despite current unprofitability, these efforts are expected to yield significant returns, with earnings projected to surge by an impressive 127.3% per year. Moreover, recent developments reveal that while NSFOCUS faced a net loss of CN¥326.02 million in the first nine months of 2024—a marked improvement from last year's CN¥524.28 million loss during the same period—their strategic focus remains unwaveringly on technological advancements and market recalibration.

- Navigate through the intricacies of NSFOCUS Technologies Group with our comprehensive health report here.

Understand NSFOCUS Technologies Group's track record by examining our Past report.

Kraken Robotics (TSXV:PNG)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Kraken Robotics Inc. is a marine technology company that designs, manufactures, and sells sonar and optical sensors, batteries, and underwater robotic equipment for unmanned underwater vehicles used in military and commercial applications worldwide, with a market cap of CA$543.48 million.

Operations: Specializing in marine technology, Kraken Robotics Inc. generates revenue through the design and sale of advanced sonar and optical sensors, batteries, and underwater robotic equipment for unmanned vehicles across military and commercial sectors globally. The company operates in diverse regions including Canada, Asia Pacific, Europe, the Middle East, Africa, and North America.

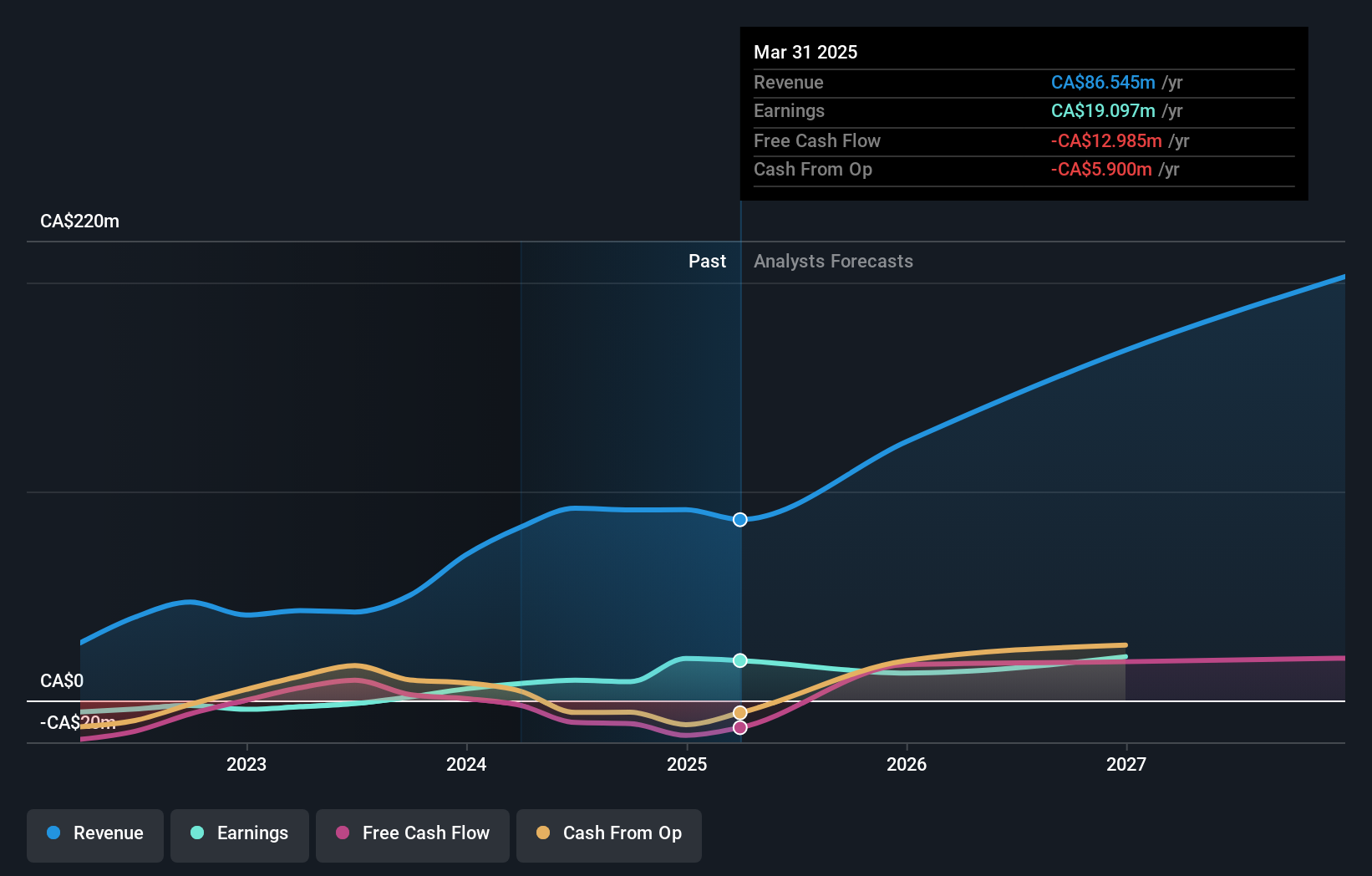

Kraken Robotics has marked a notable trajectory in the tech sector, particularly with its recent advancements and strategic initiatives. The company's R&D expenditure, vital for maintaining its competitive edge in maritime technology, aligns with its growth metrics; notably, earnings are expected to surge by 30.9% annually. Recent demonstrations of their Autonomous Launch and Recovery System (ALARS) for the KATFISH™ towed synthetic aperture sonar underscore their innovative capabilities, enhancing naval interoperability and operational flexibility. Moreover, Kraken's financial performance reflects robust health with a revenue jump to CAD 63.18 million from CAD 41.58 million year-over-year for the first nine months of 2024, alongside a net income increase to CAD 6.42 million from CAD 2.96 million in the same period last year—indicative of effective scaling and market penetration efforts that could set a precedent within high-tech maritime solutions.

- Unlock comprehensive insights into our analysis of Kraken Robotics stock in this health report.

Gain insights into Kraken Robotics' past trends and performance with our Past report.

Summing It All Up

- Click here to access our complete index of 1288 High Growth Tech and AI Stocks.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kraken Robotics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:PNG

Kraken Robotics

A marine technology company, engages in the design, manufacture, and sale of sonar and optical sensors, batteries, and underwater robotic equipment for unmanned underwater vehicles used in military and commercial applications in Canada, the Asia Pacific, Europe, the Middle East, Africa, North America, and internationally.