- Canada

- /

- Commercial Services

- /

- TSX:KBL

3 TSX Dividend Stocks With Yields Ranging From 3.5% To 9%

Reviewed by Simply Wall St

As central banks, including the Bank of Canada, adjust interest rates in response to shifting economic indicators such as inflation and employment, investors might look for stable income opportunities amidst market fluctuations. In this context, dividend stocks can be particularly appealing, offering potential regular income streams and a degree of insulation against market volatility.

Top 10 Dividend Stocks In Canada

| Name | Dividend Yield | Dividend Rating |

| Bank of Nova Scotia (TSX:BNS) | 6.88% | ★★★★★★ |

| Whitecap Resources (TSX:WCP) | 7.19% | ★★★★★★ |

| Secure Energy Services (TSX:SES) | 3.35% | ★★★★★☆ |

| Boston Pizza Royalties Income Fund (TSX:BPF.UN) | 8.48% | ★★★★★☆ |

| Enghouse Systems (TSX:ENGH) | 3.39% | ★★★★★☆ |

| Royal Bank of Canada (TSX:RY) | 3.83% | ★★★★★☆ |

| Firm Capital Mortgage Investment (TSX:FC) | 9.02% | ★★★★★☆ |

| Canadian Western Bank (TSX:CWB) | 3.20% | ★★★★★☆ |

| Russel Metals (TSX:RUS) | 4.67% | ★★★★★☆ |

| Canadian Natural Resources (TSX:CNQ) | 4.28% | ★★★★★☆ |

Click here to see the full list of 33 stocks from our Top TSX Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Evertz Technologies (TSX:ET)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Evertz Technologies Limited specializes in designing, manufacturing, and distributing video and audio infrastructure solutions for the production, post-production, broadcast, and telecommunications sectors globally, with a market cap of approximately CA$951.29 million.

Operations: Evertz Technologies Limited generates CA$514.62 million in revenue from its television broadcast equipment market.

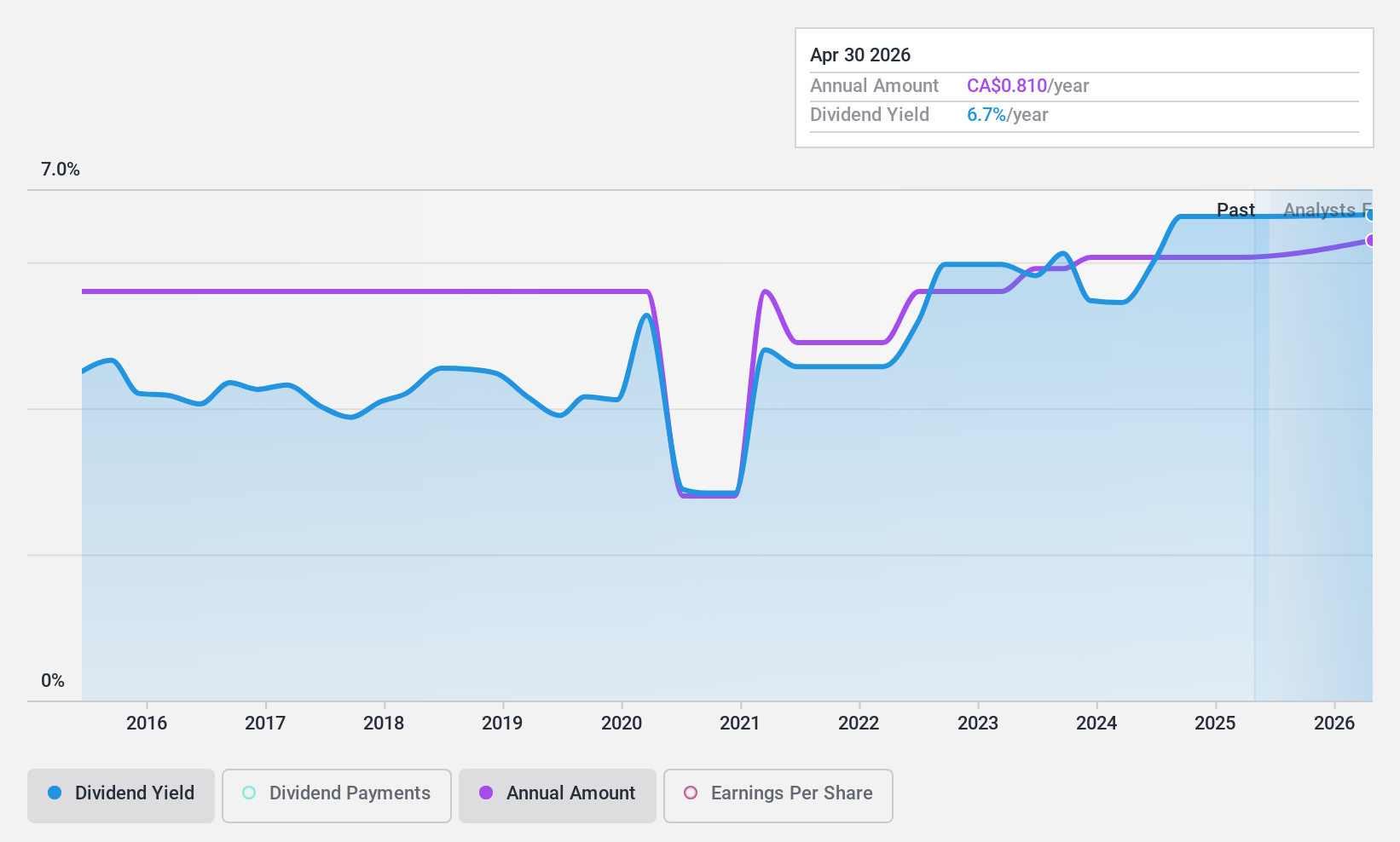

Dividend Yield: 6.2%

Evertz Technologies recently declared a quarterly dividend of CA$0.195, consistent with previous quarters, despite a decrease in Q4 sales to CA$122.77 million and net income to CA$13.76 million from the prior year. Annually, sales rose to CA$514.62 million with net income at CA$70.17 million, reflecting some earnings growth. However, the company's dividend history shows volatility and its yield of 6.25% is below the top Canadian payers' average of 6.57%. Trading at 49.5% below estimated fair value suggests potential undervaluation relative to peers.

- Navigate through the intricacies of Evertz Technologies with our comprehensive dividend report here.

- The valuation report we've compiled suggests that Evertz Technologies' current price could be quite moderate.

K-Bro Linen (TSX:KBL)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: K-Bro Linen Inc. operates in Canada and the United Kingdom, offering laundry and linen services to healthcare institutions, hotels, and other commercial organizations, with a market capitalization of approximately CA$349.49 million.

Operations: K-Bro Linen Inc. generates CA$330.33 million in revenue primarily from its laundry and linen services catering to the healthcare and hospitality sectors.

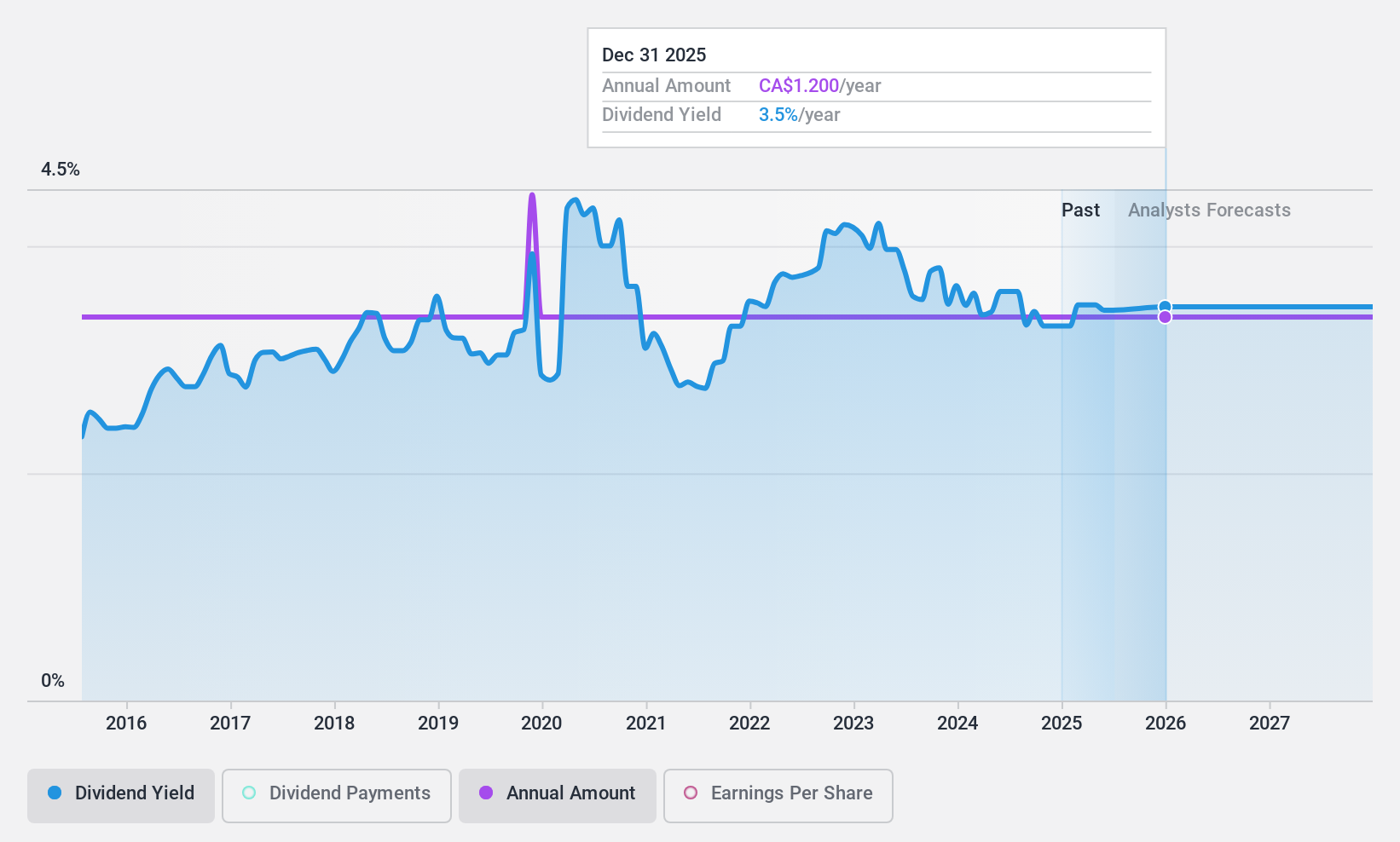

Dividend Yield: 3.6%

K-Bro Linen maintains a consistent dividend payout with a 3.59% yield, slightly lower than the top Canadian dividend payers. The company's dividends are well-supported by earnings and cash flow, with payout ratios of 73.2% and 38.5%, respectively, indicating sustainability. Recent activities include regular dividend affirmations and a share buyback program, signaling confidence in financial stability despite modest recent earnings growth of 18.06% per year forecasted and actual earnings growth of 174.1% last year.

- Click here and access our complete dividend analysis report to understand the dynamics of K-Bro Linen.

- Our valuation report here indicates K-Bro Linen may be undervalued.

Peyto Exploration & Development (TSX:PEY)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Peyto Exploration & Development Corp. is an energy company focused on the exploration, development, and production of natural gas, oil, and natural gas liquids in Alberta's Deep Basin, with a market capitalization of CA$2.83 billion.

Operations: Peyto Exploration & Development Corp. primarily generates its revenue from the exploration and production of oil and gas, which amounted to CA$876.26 million.

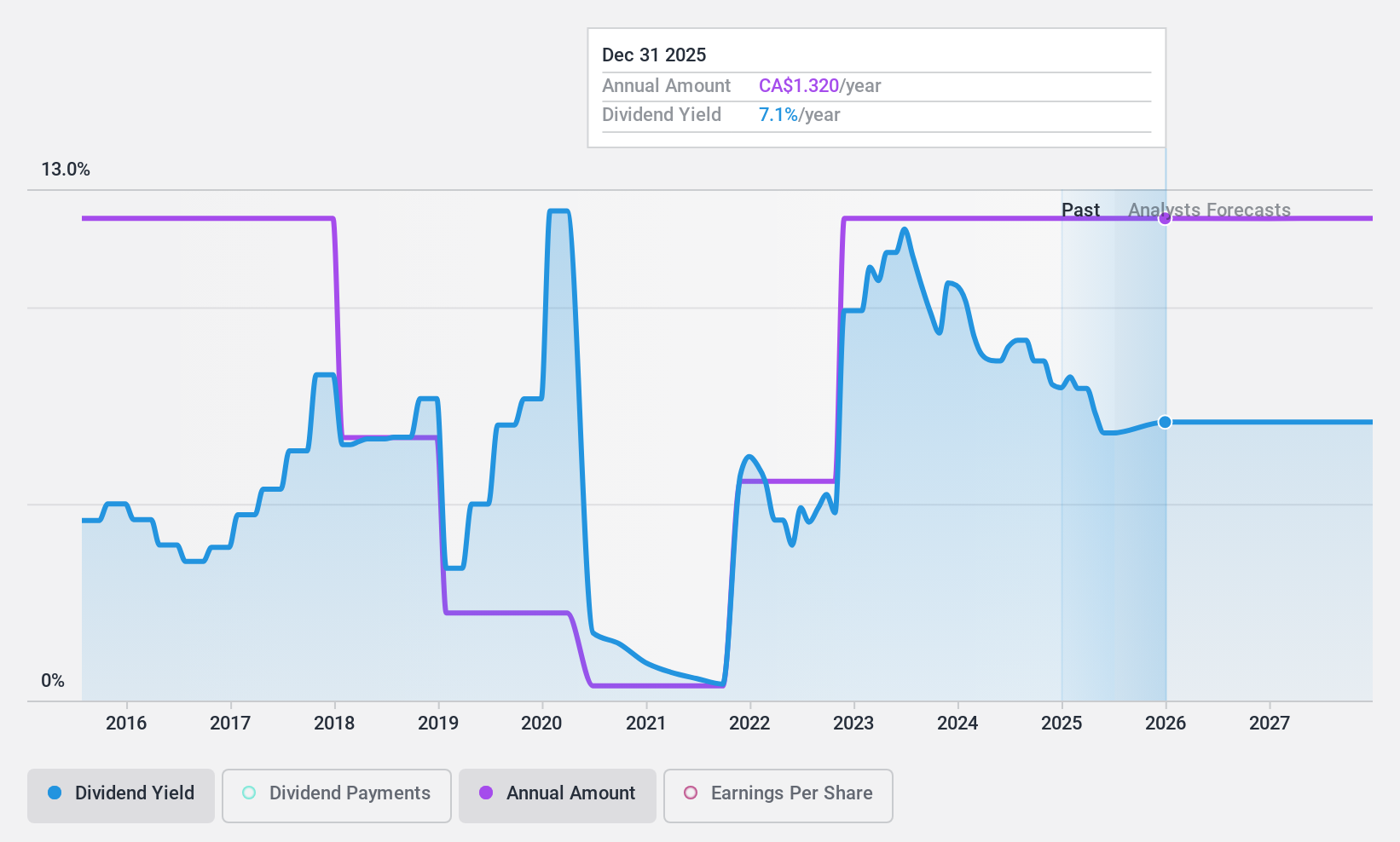

Dividend Yield: 9.1%

Peyto Exploration & Development's recent extension of its $1 billion credit facilities underscores a solid liquidity position, crucial for sustaining its dividends amidst a challenging cash flow environment. However, the company's dividend sustainability is questionable with a high cash payout ratio of 102.7% and coverage issues indicated by both earnings and free cash flows. Despite this, Peyto maintains a competitive 9.09% yield, attractive in the Canadian market but paired with historical volatility in payouts.

- Click to explore a detailed breakdown of our findings in Peyto Exploration & Development's dividend report.

- Our valuation report unveils the possibility Peyto Exploration & Development's shares may be trading at a discount.

Summing It All Up

- Navigate through the entire inventory of 33 Top TSX Dividend Stocks here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if K-Bro Linen might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:KBL

K-Bro Linen

Provides laundry and linen services to healthcare institutions, hotels, and other commercial organizations in Canada and the United Kingdom.

Very undervalued with solid track record and pays a dividend.