In recent weeks, global markets have experienced a mix of cautious optimism and volatility, with U.S. stocks declining amid hawkish Federal Reserve commentary and inflation concerns persisting. As major indices like the Russell 2000 registered losses, the focus on small-cap stocks has intensified, particularly those perceived as undervalued in light of insider buying trends. In this context, identifying promising small-cap stocks requires careful consideration of market sentiment and economic indicators that may impact their growth potential.

Top 10 Undervalued Small Caps With Insider Buying Globally

Let's dive into some prime choices out of from the screener.

Sparebanken Norge (OB:SBNOR)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Sparebanken Norge operates as a financial services provider, offering banking and estate agency services, with a market capitalization of NOK 15.5 billion.

Operations: Sparebanken Norge generates revenue primarily from its Banking Operations in the Retail and Corporate Markets, with additional contributions from Bulder Bank and its Estate Agency Business. The company has experienced fluctuations in net income margin, ranging from -15.58% to 24.52% over the periods analyzed. Operating expenses have consistently been a significant component of the financial structure, with General & Administrative Expenses being a major part of these costs.

PE: 9.1x

Sparebanken Norge, a small cap bank, showcases potential value with its impressive earnings growth—net income surged to NOK 1.7 billion in Q2 2025 from NOK 1.1 billion the previous year. Insider confidence is evident as insiders have been actively purchasing shares throughout the past six months. Despite primarily relying on higher-risk external borrowing for funding, the bank's earnings are projected to grow by 25.83% annually, suggesting promising prospects ahead.

- Navigate through the intricacies of Sparebanken Norge with our comprehensive valuation report here.

Examine Sparebanken Norge's past performance report to understand how it has performed in the past.

Security Bank (PSE:SECB)

Simply Wall St Value Rating: ★★★★★★

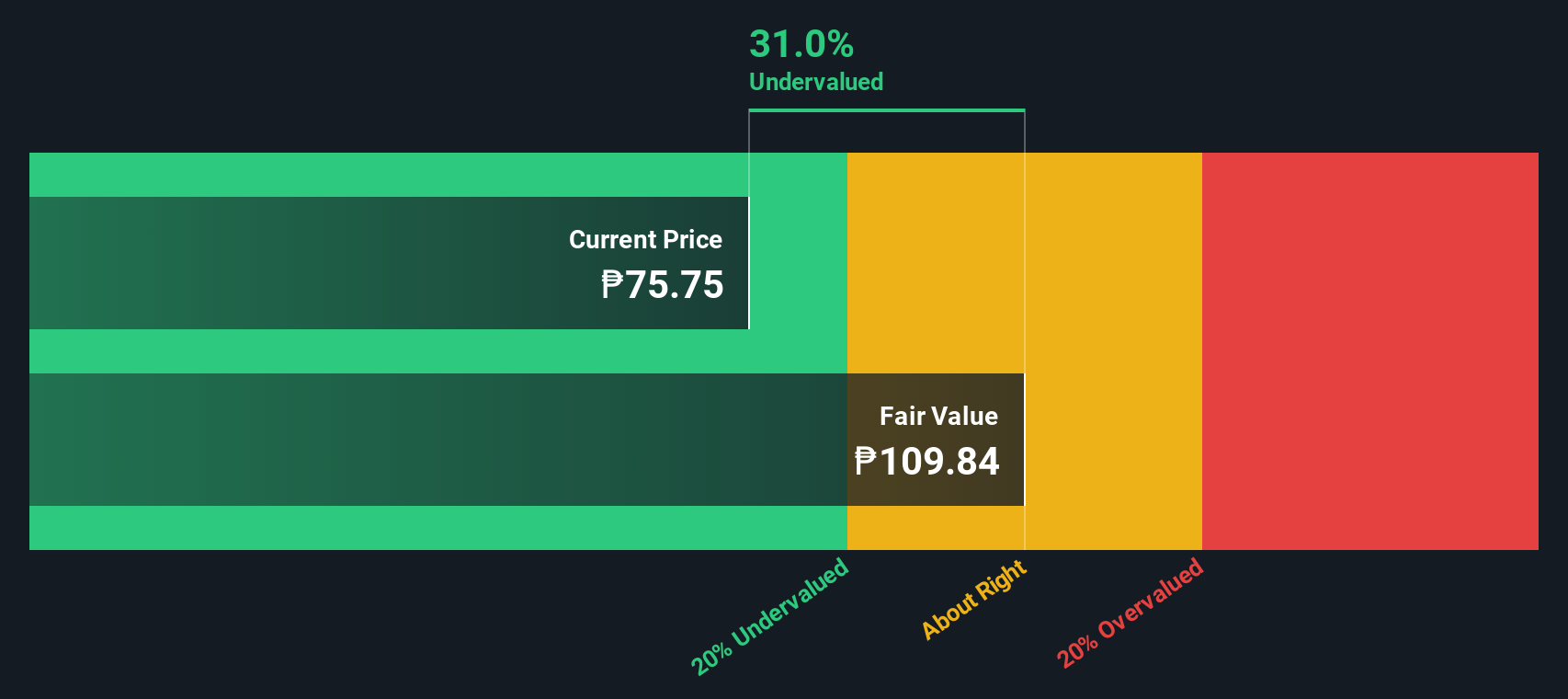

Overview: Security Bank is a financial institution engaged in retail banking, business banking, financial markets, and wholesale banking operations with a market capitalization of ₱1.13 billion.

Operations: Retail banking is the largest revenue contributor, generating ₱27.53 billion, followed by wholesale banking at ₱16.02 billion. The net income margin has shown variability, with a notable decrease from 44.89% in December 2014 to 22.22% in June 2025. Operating expenses have consistently increased over time, impacting the overall profitability of the business operations significantly.

PE: 4.7x

Security Bank, a smaller player in the financial sector, has shown promising earnings growth with net income for Q2 2025 rising to PHP 3.04 billion from PHP 2.82 billion a year earlier. While facing challenges like high bad loans at 2.9% and a low allowance of 81%, insider confidence is evident through recent share purchases by executives, indicating belief in potential growth despite leadership changes and retirements affecting stability.

- Click here to discover the nuances of Security Bank with our detailed analytical valuation report.

Explore historical data to track Security Bank's performance over time in our Past section.

Tiny (TSXV:TINY)

Simply Wall St Value Rating: ☆☆☆☆☆☆

Overview: Tiny operates in digital services, creative platforms, software and apps, and other segments with a market cap of CA$1.2 billion.

Operations: The company's revenue streams are primarily derived from Digital Services, Creative Platform, and Software and Apps. Over the observed periods, there is a noticeable decline in net income margin from 24.19% in December 2020 to -15.80% by September 2025. Gross profit margin also shows a downward trend from 57.92% at the end of 2020 to around 35.19% by mid-2025, indicating an increase in cost of goods sold relative to revenue growth over time.

PE: -66.9x

Tiny Ltd. recently showcased insider confidence with significant share purchases over the past quarter, indicating potential undervaluation. Despite a slight dip in sales to C$50 million for Q2 2025 compared to last year, net income improved dramatically from a loss of C$2.07 million to a gain of C$10.71 million. The company executed a 1:8 stock split on October 1, 2025, which may enhance liquidity and attract new investors. Although reliant on higher-risk external borrowing for funding, Tiny's projected revenue growth of 14% annually suggests promising future prospects amidst its small-cap peers.

Make It Happen

- Access the full spectrum of 109 Undervalued Global Small Caps With Insider Buying by clicking on this link.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tiny might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:TINY

Tiny

A venture capital and private equity firm specializing in buyouts.

Good value with low risk.

Market Insights

Weekly Picks

The Future of Social Sharing Is Private and People Are Ready

EU#3 - From Philips Management Buyout to Europe’s Biggest Company

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

A fully integrated LNG business seems to be ignored by the market.

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

The Green Consolidator

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion