- Canada

- /

- Energy Services

- /

- TSX:CFW

3 TSX Penny Stocks With Market Caps Under CA$400M

Reviewed by Simply Wall St

Over the last 7 days, the Canadian market has remained flat, but it is up 23% over the past year with earnings expected to grow by 16% per annum over the next few years. In light of these conditions, identifying stocks that combine affordability with growth potential can be particularly appealing. Penny stocks, though a term from a bygone era, continue to offer intriguing opportunities for investors interested in smaller or newer companies with strong financials.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.83 | CA$176.58M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.16 | CA$390.75M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.16 | CA$109.91M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.43 | CA$12.32M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.60 | CA$547.51M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.28 | CA$224.43M | ★★★★★☆ |

| NamSys (TSXV:CTZ) | CA$1.09 | CA$29.28M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.45 | CA$968.15M | ★★★★★★ |

| Winshear Gold (TSXV:WINS) | CA$0.16 | CA$5.03M | ★★★★★★ |

Click here to see the full list of 920 stocks from our TSX Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Calfrac Well Services (TSX:CFW)

Simply Wall St Financial Health Rating: ★★★★☆☆

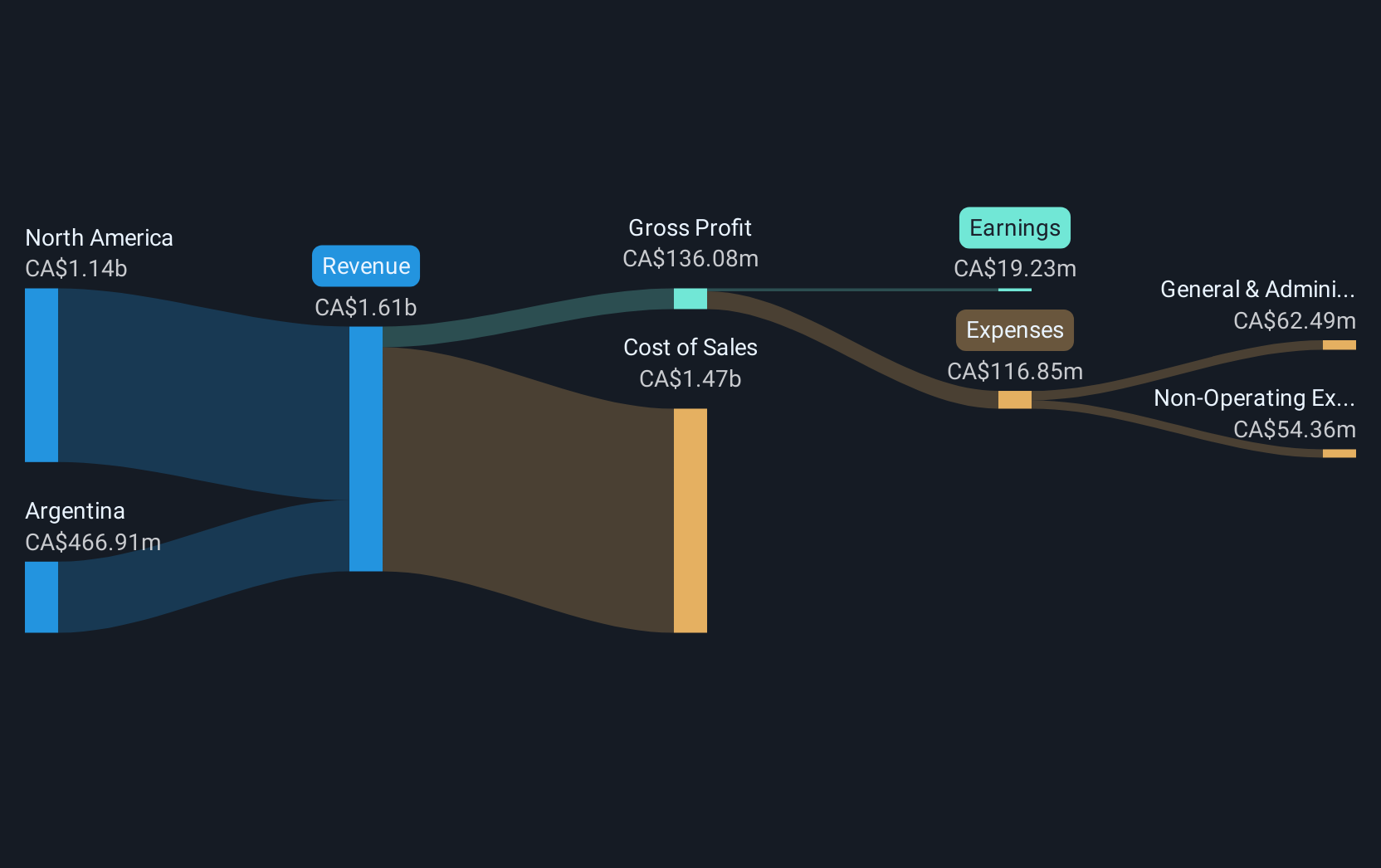

Overview: Calfrac Well Services Ltd., operating in Canada, the United States, and Argentina, offers specialized oilfield services and has a market cap of CA$329.46 million.

Operations: The company generates CA$1.61 billion in revenue from its oil well equipment and services segment.

Market Cap: CA$329.46M

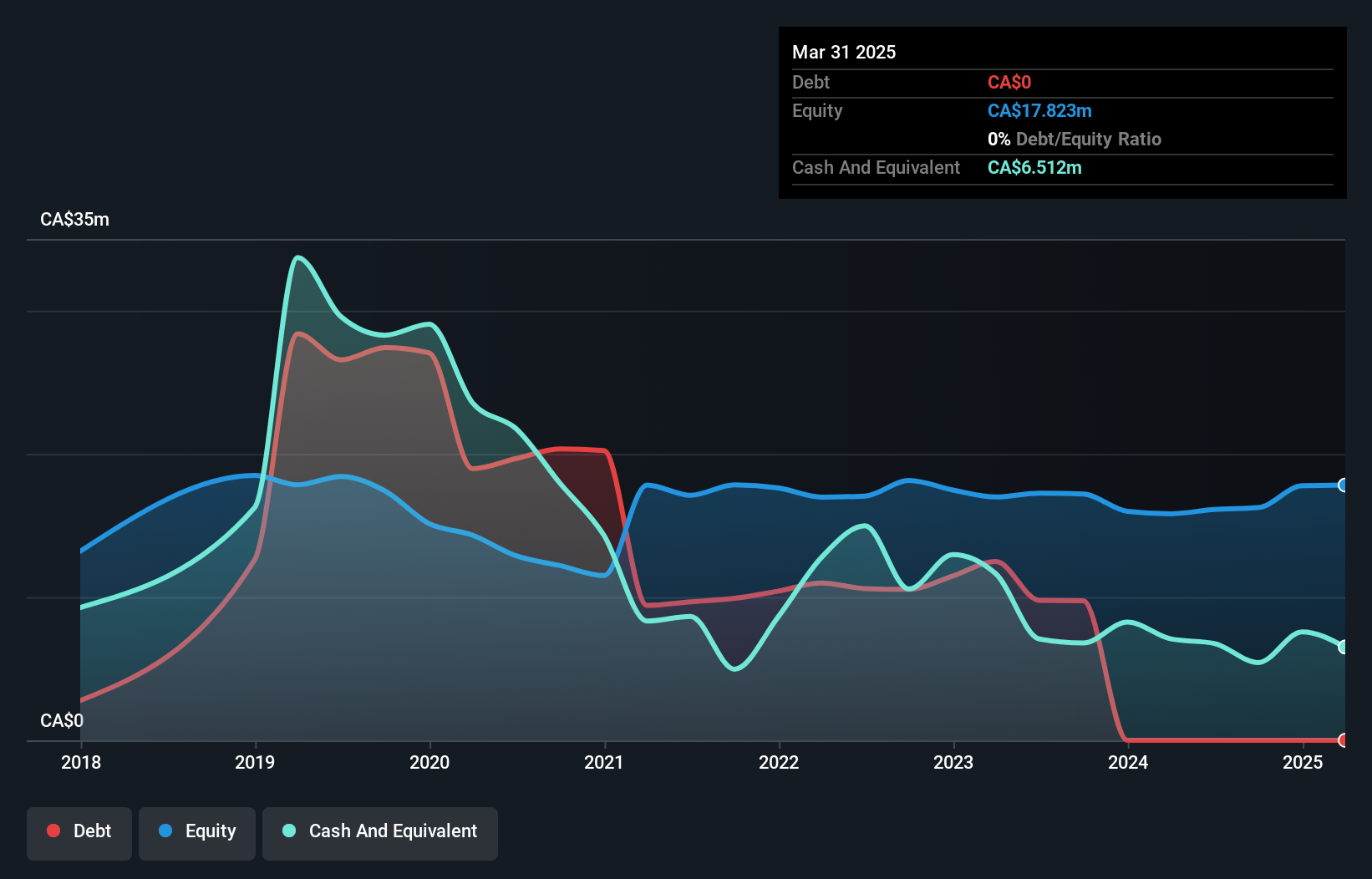

Calfrac Well Services Ltd. recently reported a net loss of CA$5.43 million for Q3 2024, contrasting with a net income of CA$86.57 million the previous year, highlighting challenges in profitability and earnings growth. Despite this setback, the company has reduced its debt to equity ratio significantly from 234% to 54.4% over five years, indicating improved financial management. However, interest payments are not well covered by earnings, posing potential risks. The management team is experienced and recent executive changes might bring fresh perspectives to address operational issues and enhance financial performance moving forward.

- Get an in-depth perspective on Calfrac Well Services' performance by reading our balance sheet health report here.

- Explore Calfrac Well Services' analyst forecasts in our growth report.

Mene (TSXV:MENE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Mene Inc. designs, manufactures, and markets 24 karat gold and platinum jewelry worldwide, with a market cap of CA$31.24 million.

Operations: The company generates revenue of CA$23.54 million from its Jewelry & Watches segment.

Market Cap: CA$31.24M

Mene Inc. has shown improvement by reporting a net income of CA$1.32 million for Q3 2024, reversing a previous net loss, and increasing sales to CA$5.39 million from CA$4.29 million year-over-year. Despite being unprofitable overall, Mene has reduced losses over five years at 36.9% annually and maintains a strong cash runway exceeding three years due to positive free cash flow growth of 43% per year. The recent appointment of Sean Ty as CFO may bring valuable financial expertise to the company, which benefits from no debt and sufficient short-term assets covering liabilities effectively amidst high share price volatility.

- Take a closer look at Mene's potential here in our financial health report.

- Evaluate Mene's historical performance by accessing our past performance report.

SATO Technologies (TSXV:SATO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: SATO Technologies Corp. is a Canadian blockchain company focused on cryptocurrency mining, with a market cap of CA$17.95 million.

Operations: The company generates revenue primarily from its Compute Power for Bitcoin Mining segment, which amounted to CA$18.17 million.

Market Cap: CA$17.95M

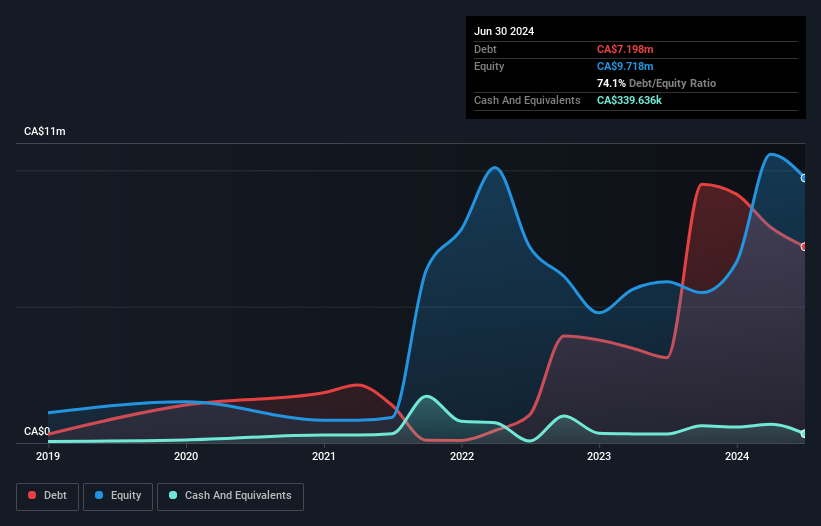

SATO Technologies Corp., with a market cap of CA$17.95 million, has transitioned to profitability over the past year, reporting net income of CA$1.27 million for the first nine months of 2024. Despite a volatile share price and a high net debt to equity ratio of 82.6%, SATO's operating cash flow covers its debt well at 37.3%. The company's strategic expansion into AI and high-performance computing leverages its expertise in energy-efficient Bitcoin mining and Quebec's renewable energy resources, positioning it for future growth in diverse computational sectors despite recent quarterly revenue declines and losses.

- Navigate through the intricacies of SATO Technologies with our comprehensive balance sheet health report here.

- Evaluate SATO Technologies' prospects by accessing our earnings growth report.

Seize The Opportunity

- Take a closer look at our TSX Penny Stocks list of 920 companies by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CFW

Calfrac Well Services

Provides specialized oilfield services in Canada, the United States, and Argentina.

Undervalued with adequate balance sheet.