The Canadian market has been experiencing significant shifts following the decisive U.S. election outcome, which removed a layer of uncertainty and sparked a robust rally in stocks. Amid these broader market dynamics, investors are turning their focus to long-term fundamentals and exploring diverse opportunities across various sectors. Penny stocks, while often seen as relics of past eras, continue to offer potential for growth and value when backed by strong financials; they represent an intriguing option for those looking beyond well-known names.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| PetroTal (TSX:TAL) | CA$0.68 | CA$611.57M | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | CA$1.82 | CA$285.18M | ★★★★★☆ |

| Alvopetro Energy (TSXV:ALV) | CA$4.98 | CA$183.06M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.30 | CA$116.54M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.425 | CA$11.75M | ★★★★★☆ |

| Vox Royalty (TSX:VOXR) | CA$3.90 | CA$190.72M | ★★★★★★ |

| Winshear Gold (TSXV:WINS) | CA$0.14 | CA$4.87M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.39 | CA$237.5M | ★★★★★☆ |

| Mandalay Resources (TSX:MND) | CA$3.35 | CA$317.69M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.09 | CA$29.28M | ★★★★★★ |

Click here to see the full list of 954 stocks from our TSX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

AI Artificial Intelligence Ventures (TSXV:AIVC)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: AI Artificial Intelligence Ventures Inc., previously ESG Global Impact Capital Inc., is a venture capital and private equity firm focusing on seed, early-stage, and growth investments in both debt and equity, with a market cap of CA$17.61 million.

Operations: AI Artificial Intelligence Ventures Inc. currently reports no revenue from its classified segments.

Market Cap: CA$17.61M

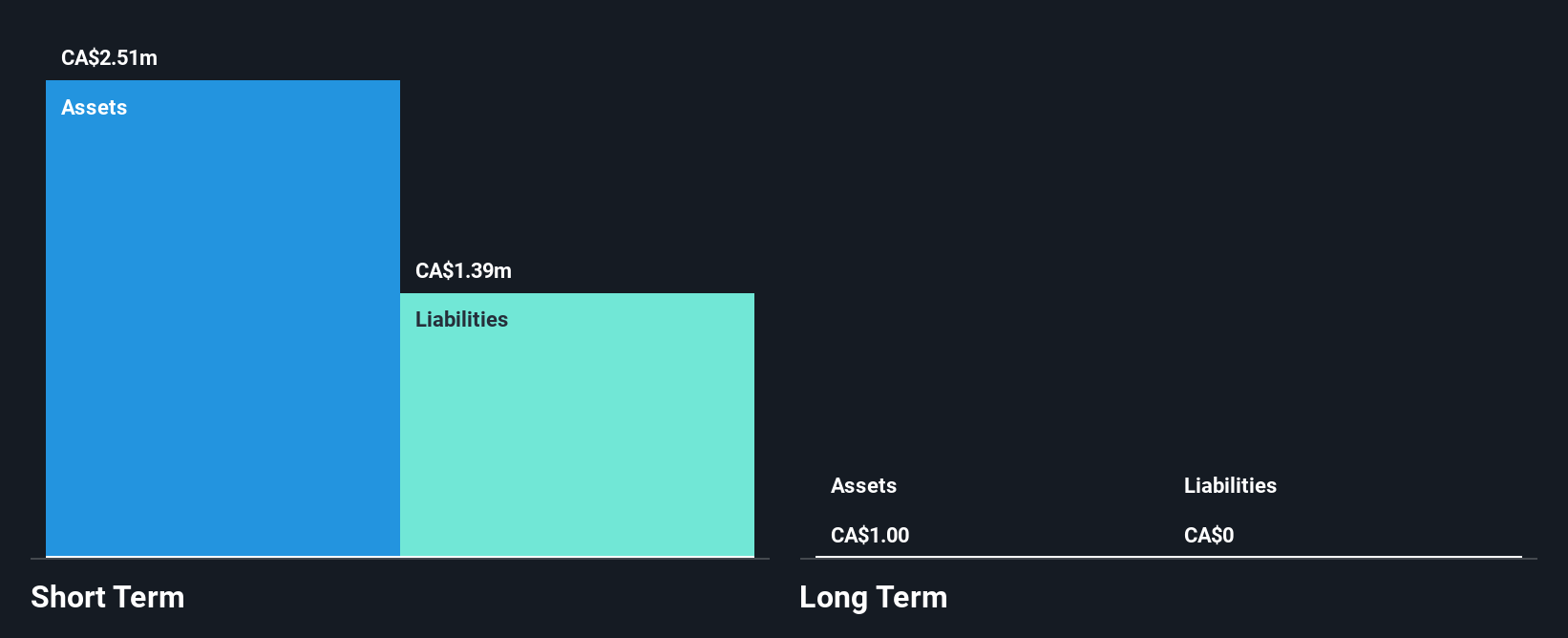

AI Artificial Intelligence Ventures Inc., with a market cap of CA$17.61 million, is pre-revenue and unprofitable but maintains a positive cash flow, providing it with a cash runway exceeding three years. Despite its negative return on equity and increased debt-to-equity ratio over the past five years, the company has more cash than total debt and no long-term liabilities. Its share price remains highly volatile compared to most Canadian stocks. The management team is experienced, with an average tenure of five years, and short-term assets exceed short-term liabilities by CA$1.2 million, indicating financial stability in the near term.

- Click here to discover the nuances of AI Artificial Intelligence Ventures with our detailed analytical financial health report.

- Explore historical data to track AI Artificial Intelligence Ventures' performance over time in our past results report.

Morien Resources (TSXV:MOX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Morien Resources Corp. is a mining development company focused on acquiring mineral interests and projects in Canada, with a market capitalization of CA$14.62 million.

Operations: The company's revenue is derived from the identification, purchase, exploration, and development of mineral properties totaling CA$0.19 million.

Market Cap: CA$14.62M

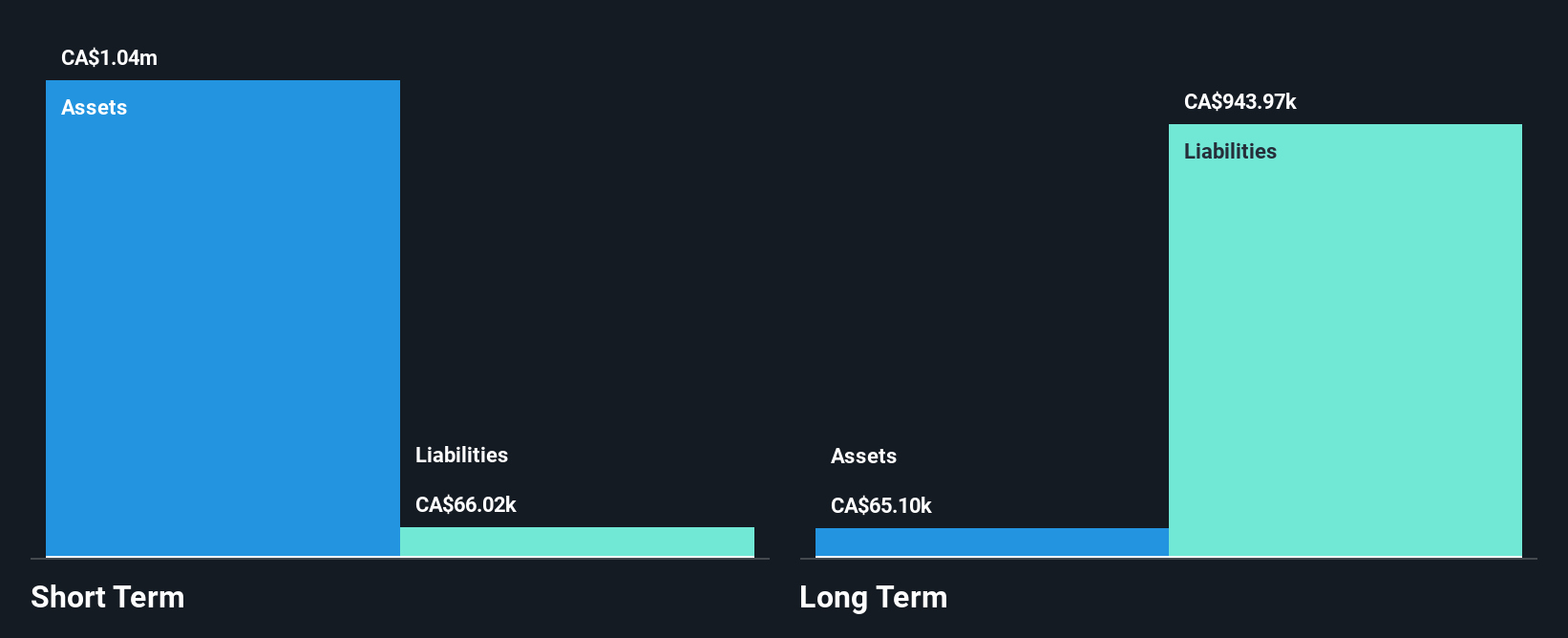

Morien Resources Corp., with a market cap of CA$14.62 million, is pre-revenue and unprofitable, reporting increased losses in recent quarters. Despite this, the company maintains financial stability as short-term assets of CA$1.3 million cover both short and long-term liabilities comfortably. The seasoned management team has an average tenure of 6.5 years, contributing to strategic continuity. Morien's cash runway exceeds three years due to positive free cash flow trends, although its share price remains highly volatile compared to most Canadian stocks. Recent buyback announcements have not resulted in any actual share repurchases during the specified period.

- Navigate through the intricacies of Morien Resources with our comprehensive balance sheet health report here.

- Gain insights into Morien Resources' historical outcomes by reviewing our past performance report.

Pivotree (TSXV:PVT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Pivotree Inc. is a company that focuses on designing, integrating, deploying, and managing digital platforms for commerce, data management, and supply chain solutions for retail and branded manufacturers both in Canada and internationally, with a market cap of CA$28.48 million.

Operations: Pivotree's revenue is derived from two primary segments: Professional Services, generating CA$42.78 million, and Managed & IP Solutions (MIPS) & Legacy Managed Services (LMS), contributing CA$40.50 million.

Market Cap: CA$28.48M

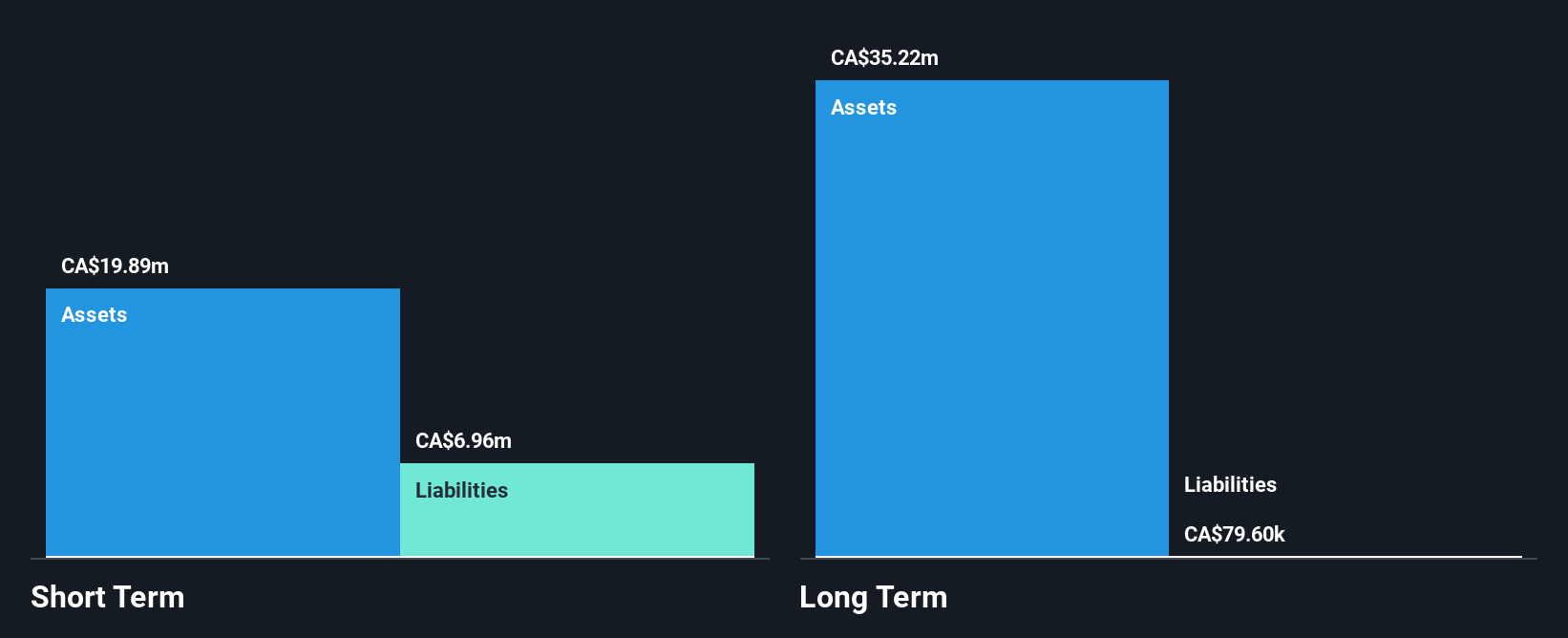

Pivotree Inc., with a market cap of CA$28.48 million, is a penny stock in the Canadian market that has shown potential through strategic partnerships and technological advancements. The company's recent collaboration with Sonepar Canada highlights its capability in automating data processes, achieving significant cost savings and operational efficiency. Despite being unprofitable, Pivotree maintains financial stability with short-term assets exceeding liabilities and no debt burden. Its experienced management team supports strategic initiatives like the Shopify partnership to enhance eCommerce solutions for enterprise clients. However, ongoing losses emphasize challenges in achieving profitability amidst competitive industry dynamics.

- Jump into the full analysis health report here for a deeper understanding of Pivotree.

- Examine Pivotree's earnings growth report to understand how analysts expect it to perform.

Taking Advantage

- Take a closer look at our TSX Penny Stocks list of 954 companies by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:PVT

Pivotree

Designs, integrates, deploys, and manages digital platforms in commerce, data management, and supply chain for retail and branded manufacturers worldwide.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives