NTG Clarity Networks Inc. (CVE:NCI) Stock's 30% Dive Might Signal An Opportunity But It Requires Some Scrutiny

The NTG Clarity Networks Inc. (CVE:NCI) share price has softened a substantial 30% over the previous 30 days, handing back much of the gains the stock has made lately. Regardless, last month's decline is barely a blip on the stock's price chart as it has gained a monstrous 654% in the last year.

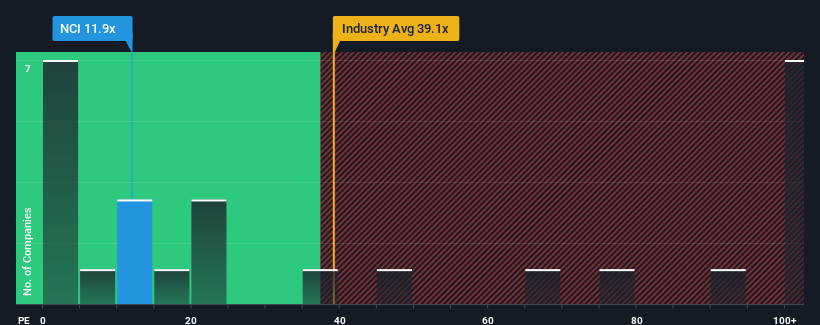

Since its price has dipped substantially, given about half the companies in Canada have price-to-earnings ratios (or "P/E's") above 16x, you may consider NTG Clarity Networks as an attractive investment with its 11.9x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

NTG Clarity Networks has been doing a good job lately as it's been growing earnings at a solid pace. It might be that many expect the respectable earnings performance to degrade substantially, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for NTG Clarity Networks

What Are Growth Metrics Telling Us About The Low P/E?

In order to justify its P/E ratio, NTG Clarity Networks would need to produce sluggish growth that's trailing the market.

Retrospectively, the last year delivered an exceptional 19% gain to the company's bottom line. Pleasingly, EPS has also lifted 317% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing earnings over that time.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 26% shows it's noticeably more attractive on an annualised basis.

With this information, we find it odd that NTG Clarity Networks is trading at a P/E lower than the market. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Key Takeaway

NTG Clarity Networks' P/E has taken a tumble along with its share price. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that NTG Clarity Networks currently trades on a much lower than expected P/E since its recent three-year growth is higher than the wider market forecast. There could be some major unobserved threats to earnings preventing the P/E ratio from matching this positive performance. It appears many are indeed anticipating earnings instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

Before you take the next step, you should know about the 6 warning signs for NTG Clarity Networks (2 are significant!) that we have uncovered.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're here to simplify it.

Discover if NTG Clarity Networks might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:NCI

NTG Clarity Networks

Provides network, telecom, IT, and infrastructure solutions to medium and large network service providers in Canada, North America, Iraq, Saudi Arabia, Egypt, and Oman.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success