Is Lumine Group’s (TSXV:LMN) Return to Profitability Shaping a New Investment Narrative?

Reviewed by Simply Wall St

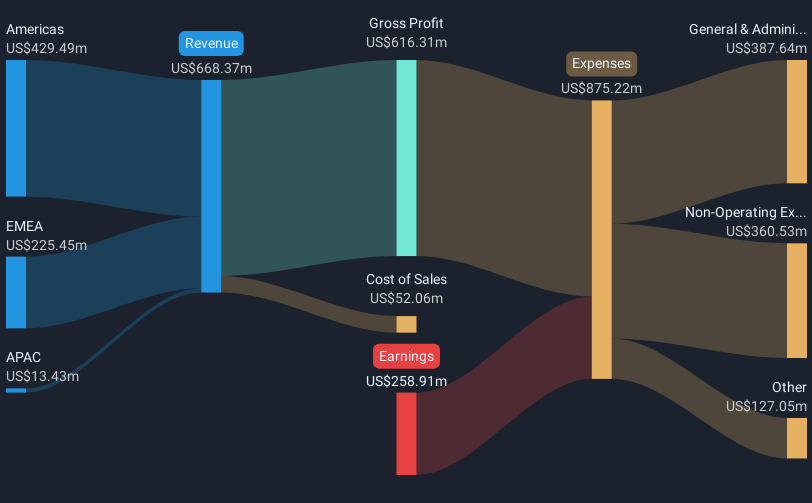

- Lumine Group Inc. recently reported its second quarter 2025 earnings, highlighting a rise in revenue to US$183.96 million and a shift from a net loss to a net income of US$23.55 million compared to the same quarter last year.

- The company's transition from a significant loss to profitability underscores substantial improvements in operational efficiency and financial strength within a single year.

- We’ll explore how Lumine Group’s move to positive net income frames its evolving investment narrative and future prospects.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Lumine Group's Investment Narrative?

To see Lumine Group as an attractive opportunity, investors need confidence in its ability to turn recent profitability into sustained growth, especially given the rapid turnaround in the latest results. The company’s strong second-quarter earnings, with revenue up and a shift to net income, could sharpen the focus on short-term catalysts like effective integration of new business lines, increased operational efficiency, and the impact of recent executive changes. These results suggest that the main risk, a track record of inconsistent profitability, may be easing, but not entirely gone. Valuation also continues to raise questions, with shares trading above some consensus price targets and a price-to-earnings ratio still high compared to peers. As a result, while Lumine’s latest news supports optimism around a newly profitable model, the biggest immediate risk is whether these gains can be repeated and maintained as the business matures. On the flip side, board inexperience remains an important risk for investors to keep in mind.

Lumine Group's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 9 other fair value estimates on Lumine Group - why the stock might be worth over 4x more than the current price!

Build Your Own Lumine Group Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lumine Group research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Lumine Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lumine Group's overall financial health at a glance.

Want Some Alternatives?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:LMN

Lumine Group

Offers develops, installs, and customizes of software worldwide.

Excellent balance sheet with moderate growth potential.

Market Insights

Community Narratives