Even With A 38% Surge, Cautious Investors Are Not Rewarding EMERGE Commerce Ltd.'s (CVE:ECOM) Performance Completely

EMERGE Commerce Ltd. (CVE:ECOM) shareholders have had their patience rewarded with a 38% share price jump in the last month. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 8.3% in the last twelve months.

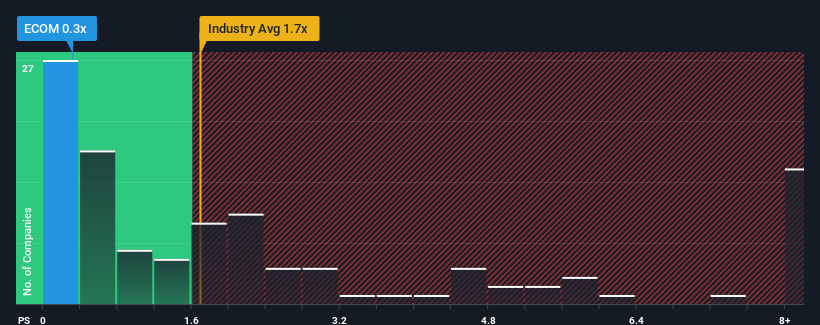

Although its price has surged higher, it's still not a stretch to say that EMERGE Commerce's price-to-sales (or "P/S") ratio of 0.3x right now seems quite "middle-of-the-road" compared to the IT industry in Canada, where the median P/S ratio is around 0.7x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for EMERGE Commerce

What Does EMERGE Commerce's Recent Performance Look Like?

For example, consider that EMERGE Commerce's financial performance has been poor lately as its revenue has been in decline. Perhaps investors believe the recent revenue performance is enough to keep in line with the industry, which is keeping the P/S from dropping off. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

Although there are no analyst estimates available for EMERGE Commerce, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Some Revenue Growth Forecasted For EMERGE Commerce?

In order to justify its P/S ratio, EMERGE Commerce would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a frustrating 14% decrease to the company's top line. Even so, admirably revenue has lifted 67% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Comparing that to the industry, which is only predicted to deliver 8.3% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

With this information, we find it interesting that EMERGE Commerce is trading at a fairly similar P/S compared to the industry. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

The Key Takeaway

EMERGE Commerce's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We didn't quite envision EMERGE Commerce's P/S sitting in line with the wider industry, considering the revenue growth over the last three-year is higher than the current industry outlook. It'd be fair to assume that potential risks the company faces could be the contributing factor to the lower than expected P/S. It appears some are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

You need to take note of risks, for example - EMERGE Commerce has 5 warning signs (and 4 which are concerning) we think you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if EMERGE Commerce might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:ECOM

EMERGE Commerce

Owns and operates a portfolio of e-commerce marketplaces in Canada and the United States.

Fair value with low risk.

Similar Companies

Market Insights

Community Narratives