A Look at Digi Power X (TSXV:DGX) Valuation Following AI Data Center Expansion News

Reviewed by Simply Wall St

Digi Power X (TSXV:DGX) just announced an expansion of its AI data center capacity, adding five new ARMS-200 GPU modules at its Alabama facility. This move highlights the company’s effort to keep pace with growing industry demand.

See our latest analysis for Digi Power X.

Digi Power X’s recent leap in AI infrastructure seems to have caught investor attention, with share price returns soaring 138.75% over the past month and an impressive 235.09% year-to-date. Longer-term holders have seen even bigger wins, with the one-year total shareholder return hitting 241.07% and a remarkable 1,142% five-year total return. Momentum is clearly building as the company expands its data center footprint and brings experienced leadership on board, which strengthens the case for ongoing growth.

If Digi Power X’s rapid ascent has you curious about where else fast-paced momentum might be building, it could be the perfect moment to explore fast growing stocks with high insider ownership.

With such explosive returns and ambitious growth plans, the big question is whether Digi Power X stock still has room to run or if future gains are already reflected in the current price.

Price-to-Sales Ratio of 7.7x: Is it justified?

Digi Power X’s current share price values the company at a price-to-sales ratio (P/S) of 7.7x. This ratio is considerably higher than both the Canadian Software industry average of 5x and the peer group’s average of 1.9x. This indicates the market is attaching a premium to Digi Power X’s recent growth story and future potential.

The price-to-sales ratio compares the company’s market capitalization to its total sales over the last year. For firms focused on rapid revenue expansion rather than profitability, especially early-stage tech companies, P/S can offer a window into how the market perceives top-line momentum, since earnings multiples may not be relevant when profits are negative.

Such a high multiple shows investors are extremely optimistic about Digi Power X, but it also means expectations are already high. Compared to the industry and its peers, Digi Power X is trading at a significant premium. This suggests some investors expect outsized growth to justify that valuation. However, our analysis indicates that the fair price-to-sales ratio, based on quantitative models, would be 10.3x, so there could still be room for further re-rating if aggressive growth forecasts play out.

Explore the SWS fair ratio for Digi Power X

Result: Price-to-Sales Ratio of 7.7x (OVERVALUED)

However, sustained losses and reliance on aggressive growth forecasts could challenge investor confidence if targets are missed or if industry conditions shift unexpectedly.

Find out about the key risks to this Digi Power X narrative.

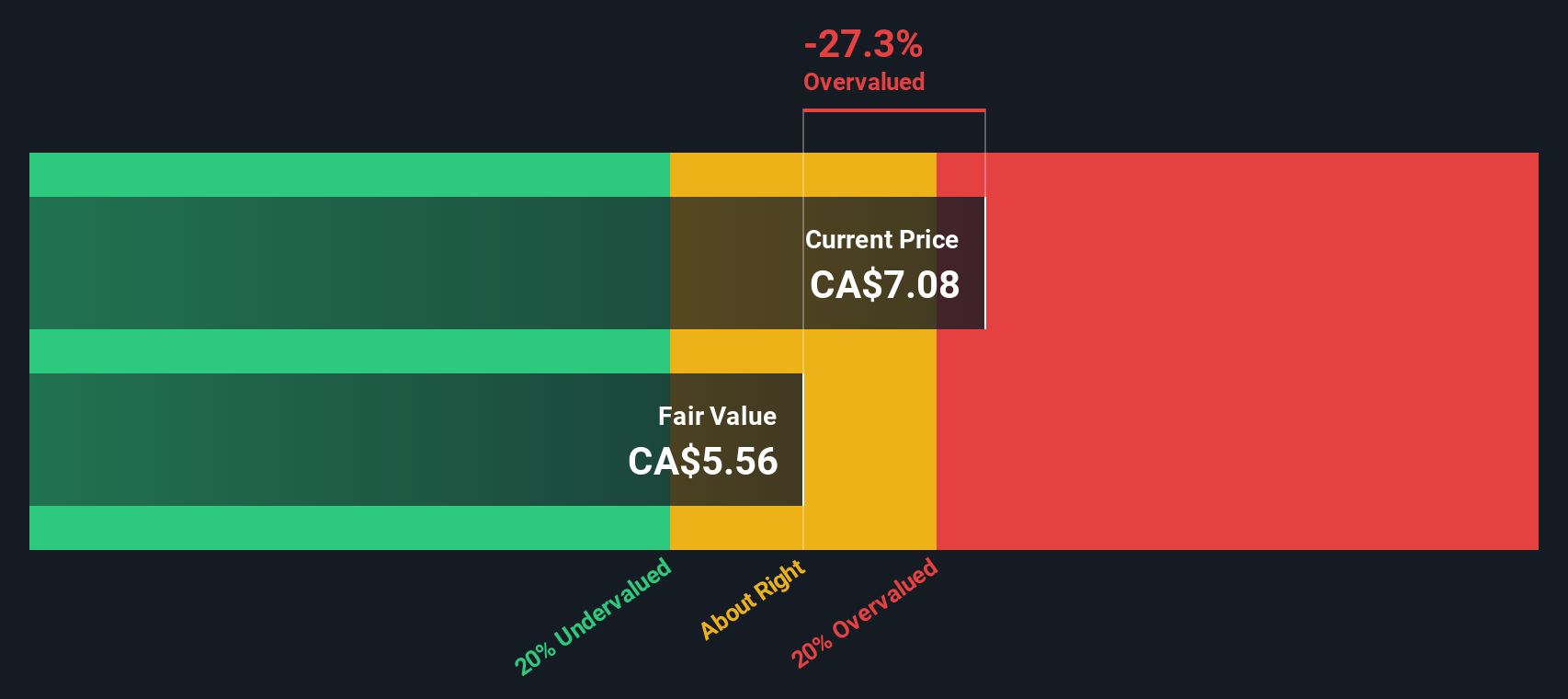

Another View: Discounted Cash Flow Signals Overvaluation

While the high price-to-sales ratio hints at future potential, our DCF model provides a different perspective. According to the SWS DCF model, Digi Power X shares are currently trading above their estimated fair value of CA$5.5. This suggests the stock may be overvalued at present. Could market optimism be moving too far ahead of the fundamentals?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Digi Power X for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 848 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Digi Power X Narrative

If you want to dive deeper and reach your own conclusions, you can analyze the numbers yourself and shape a narrative in just a few minutes with Do it your way.

A great starting point for your Digi Power X research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Take your next step with confidence. The right opportunities are out there. Don’t let them pass by while others seize the advantage.

- Capture emerging AI breakthroughs by tracking market leaders with these 26 AI penny stocks poised for rapid, tech-driven growth.

- Tap into future dividend income streams by scanning these 24 dividend stocks with yields > 3% that offer yields above 3% for strong portfolio cash flow.

- Ride the momentum in digital finance by targeting these 81 cryptocurrency and blockchain stocks on the cutting edge of blockchain and cryptocurrency innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:DGX

Digi Power X

An energy infrastructure company, develops data centers to drive the expansion of energy assets in the United States.

Excellent balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives