Digihost Technology Inc.'s (CVE:DGHI) Shares Bounce 59% But Its Business Still Trails The Industry

Digihost Technology Inc. (CVE:DGHI) shareholders would be excited to see that the share price has had a great month, posting a 59% gain and recovering from prior weakness. Looking back a bit further, it's encouraging to see the stock is up 45% in the last year.

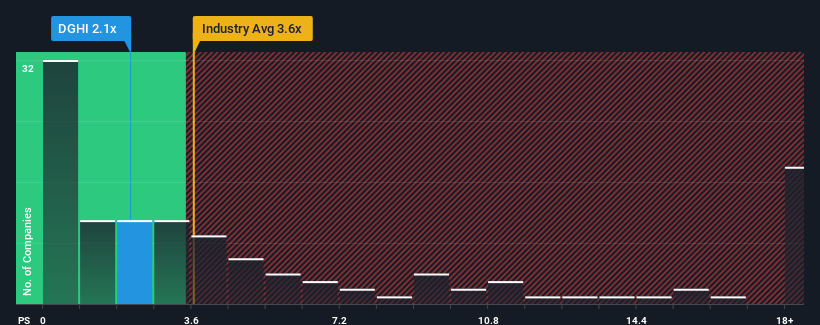

Although its price has surged higher, Digihost Technology's price-to-sales (or "P/S") ratio of 2.1x might still make it look like a buy right now compared to the Software industry in Canada, where around half of the companies have P/S ratios above 3.6x and even P/S above 10x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Digihost Technology

How Has Digihost Technology Performed Recently?

Digihost Technology certainly has been doing a good job lately as it's been growing revenue more than most other companies. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Want the full picture on analyst estimates for the company? Then our free report on Digihost Technology will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Digihost Technology?

Digihost Technology's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 101%. The latest three year period has also seen an excellent 155% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the lone analyst covering the company suggest revenue should grow by 4.8% over the next year. With the industry predicted to deliver 18% growth, the company is positioned for a weaker revenue result.

With this in consideration, its clear as to why Digihost Technology's P/S is falling short industry peers. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What We Can Learn From Digihost Technology's P/S?

Digihost Technology's stock price has surged recently, but its but its P/S still remains modest. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Digihost Technology maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. The company will need a change of fortune to justify the P/S rising higher in the future.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with Digihost Technology (at least 2 which don't sit too well with us), and understanding these should be part of your investment process.

If these risks are making you reconsider your opinion on Digihost Technology, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:DGX

Digi Power X

An energy infrastructure company, develops data centers to drive the expansion of energy assets in the United States.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success