TSX Penny Stocks Spotlight: G2 Goldfields And Two More Promising Picks

Reviewed by Simply Wall St

The Canadian market has experienced a robust bull run, with the TSX gaining 67% since October 2022, supported by cooler inflation and potential interest rate cuts. In this context, investors are increasingly looking at smaller or newer companies that offer unique growth opportunities. While the term "penny stock" might seem outdated, these stocks can still provide significant value when backed by strong financials.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.60 | CA$67.75M | ✅ 3 ⚠️ 4 View Analysis > |

| Canso Select Opportunities (TSXV:CSOC.A) | CA$4.50 | CA$22.73M | ✅ 2 ⚠️ 2 View Analysis > |

| Zoomd Technologies (TSXV:ZOMD) | CA$2.31 | CA$233.74M | ✅ 3 ⚠️ 2 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.40 | CA$3.26M | ✅ 2 ⚠️ 4 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.08 | CA$725.17M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$0.97 | CA$19.22M | ✅ 2 ⚠️ 3 View Analysis > |

| Rio2 (TSX:RIO) | CA$2.29 | CA$915.49M | ✅ 4 ⚠️ 3 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$2.90 | CA$153.28M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$2.11 | CA$206.45M | ✅ 3 ⚠️ 2 View Analysis > |

| Matachewan Consolidated Mines (TSXV:MCM.A) | CA$0.75 | CA$9.08M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 412 stocks from our TSX Penny Stocks screener.

Let's review some notable picks from our screened stocks.

G2 Goldfields (TSX:GTWO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: G2 Goldfields Inc. is involved in the acquisition and exploration of mineral properties, with a market capitalization of CA$1.02 billion.

Operations: The company generates its revenue from mineral exploration, amounting to CA$0.68 million.

Market Cap: CA$1.02B

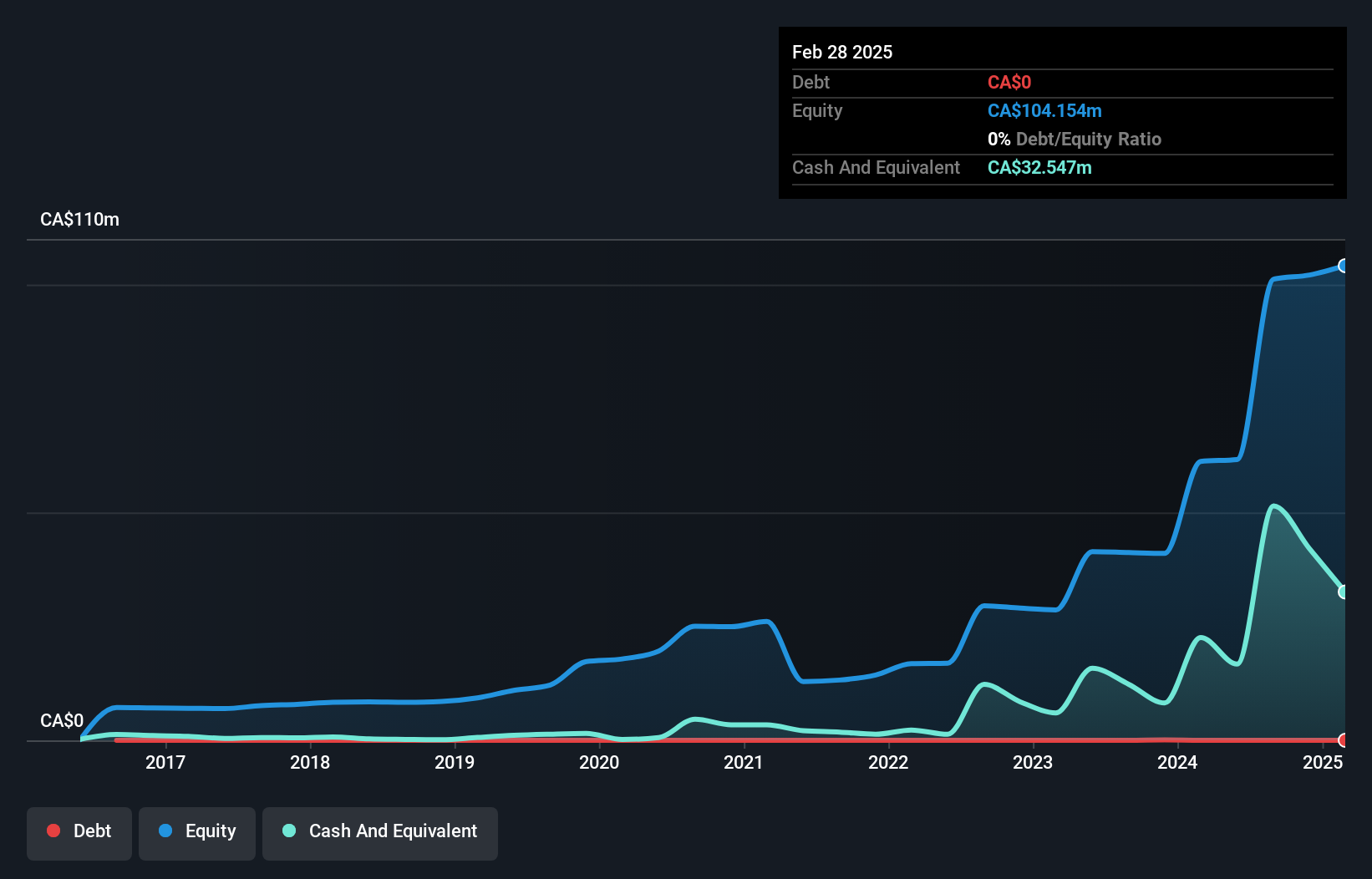

G2 Goldfields Inc., with a market cap of CA$1.02 billion, is currently pre-revenue and unprofitable, reporting a net loss of CA$2.17 million for the recent quarter. Despite this, the company is actively advancing its Oko Gold Project in Guyana, focusing on exploration and resource growth opportunities. Recent developments include an updated Mineral Resource Estimate and plans for a Preliminary Economic Assessment by November 2025. The company has no debt and recently raised capital through private placements to support its initiatives, including de-risking efforts and advancing permitting activities for future production decisions.

- Take a closer look at G2 Goldfields' potential here in our financial health report.

- Review our growth performance report to gain insights into G2 Goldfields' future.

BeWhere Holdings (TSXV:BEW)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: BeWhere Holdings Inc. is an industrial Internet of Things (IIoT) solutions company that designs, manufactures, and sells hardware with sensors and software applications for real-time tracking of equipment, tools, and inventory both in-transit and at facilities, with a market cap of CA$83.04 million.

Operations: The company generates revenue of CA$19.45 million from its Software & Programming segment.

Market Cap: CA$83.04M

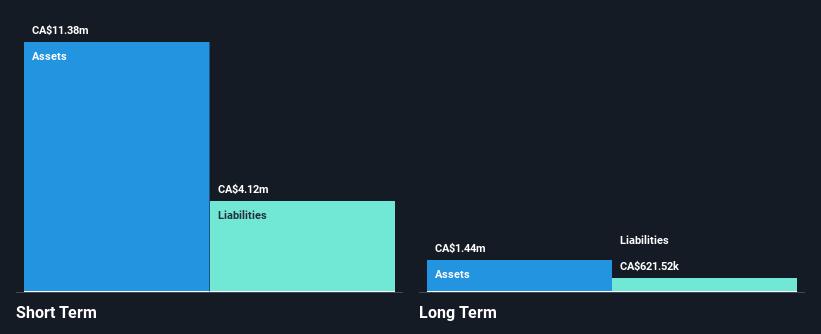

BeWhere Holdings Inc., with a market cap of CA$83.04 million, is gaining traction in the IoT sector through strategic deployments and partnerships. Recent collaborations, like those with Speedy Transport and FirstNet®, highlight its innovative solar-powered tracking solutions that enhance logistics and public safety operations. Despite stable weekly volatility and experienced management, BeWhere faces challenges such as declining profit margins (2.9% from 7.8% last year) and negative earnings growth over the past year (-49.1%). While cash exceeds debt levels, negative operating cash flow indicates financial pressure despite covering short-term liabilities comfortably with assets of CA$11.1 million.

- Navigate through the intricacies of BeWhere Holdings with our comprehensive balance sheet health report here.

- Gain insights into BeWhere Holdings' historical outcomes by reviewing our past performance report.

Sailfish Royalty (TSXV:FISH)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Sailfish Royalty Corp. focuses on acquiring precious metals royalty and streaming agreements, with a market cap of CA$199.76 million.

Operations: The company's revenue is primarily derived from royalties and stream interests, totaling $2.76 million.

Market Cap: CA$199.76M

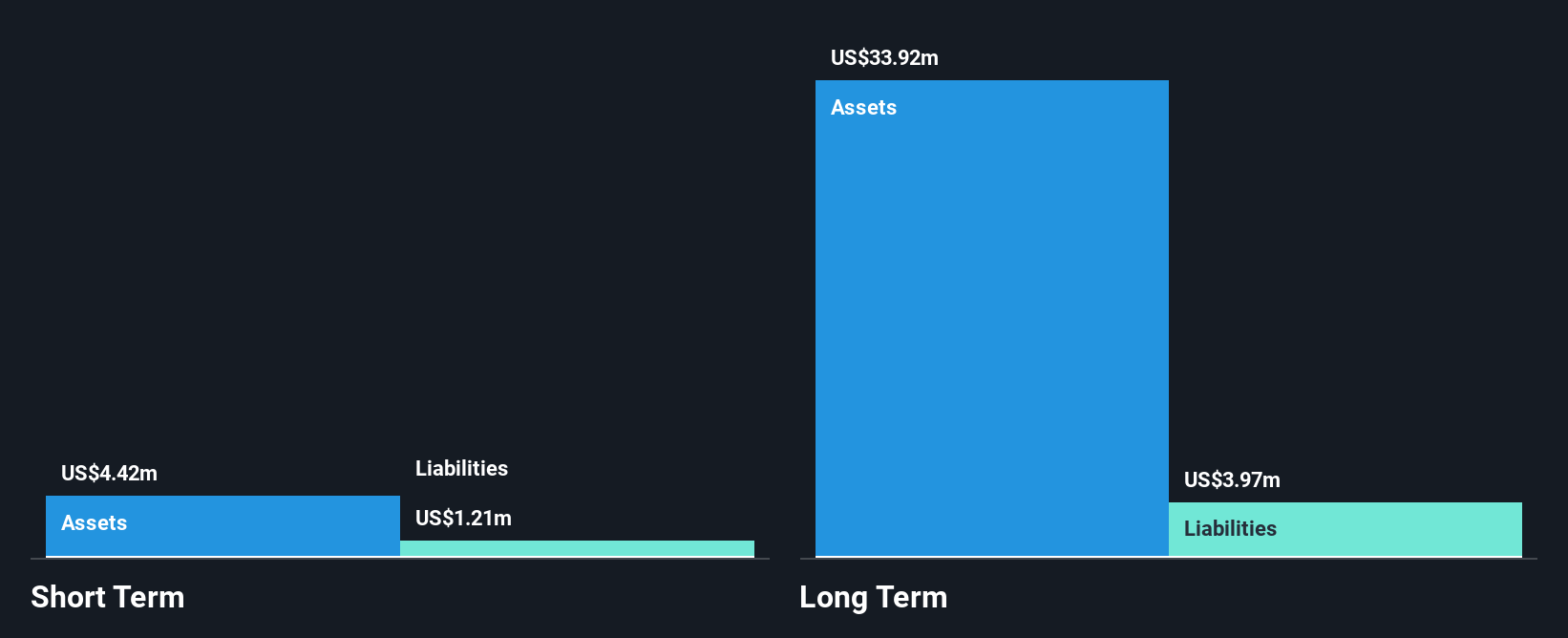

Sailfish Royalty Corp., with a market cap of CA$199.76 million, is navigating the penny stock landscape through strategic agreements like the recent acquisition of a gold stream and 2% NSR royalty from Mako Mining Corp. This move aligns with its focus on precious metals royalties, yet the company remains pre-revenue with earnings challenges. Despite being debt-free and having stable weekly volatility, Sailfish's dividend sustainability is questionable due to insufficient coverage by earnings or cash flow. The experienced management and board provide stability, while share buybacks reflect shareholder value efforts amidst unprofitability and limited revenue generation at US$1.3 million annually.

- Click here and access our complete financial health analysis report to understand the dynamics of Sailfish Royalty.

- Understand Sailfish Royalty's earnings outlook by examining our growth report.

Seize The Opportunity

- Access the full spectrum of 412 TSX Penny Stocks by clicking on this link.

- Looking For Alternative Opportunities? These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BeWhere Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:BEW

BeWhere Holdings

An industrial Internet of Things (IIoT) solutions company, designs, manufactures, and sells hardware with sensors and software applications to track real-time information on equipment, tools, and inventory in-transit and at facilities.

Adequate balance sheet with questionable track record.

Market Insights

Community Narratives