BeWhere Holdings Inc. (CVE:BEW) Looks Just Right With A 33% Price Jump

Despite an already strong run, BeWhere Holdings Inc. (CVE:BEW) shares have been powering on, with a gain of 33% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 100% in the last year.

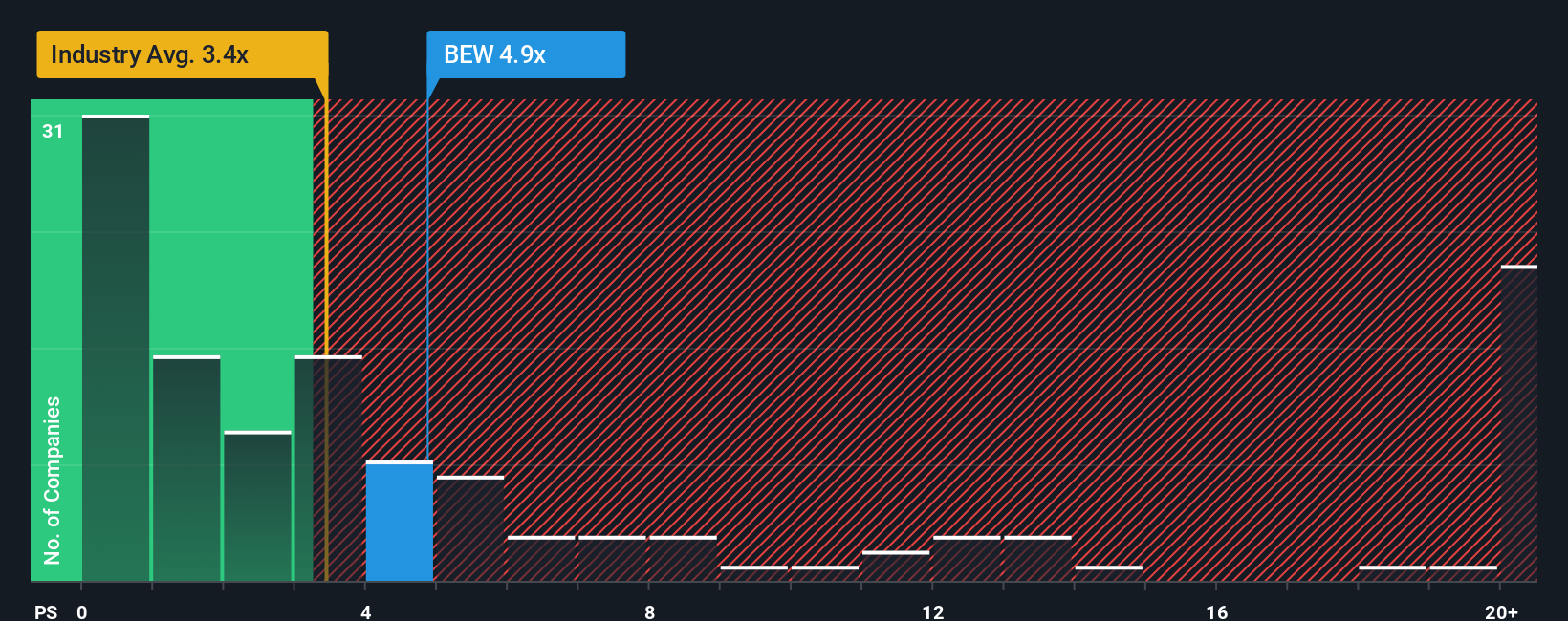

Since its price has surged higher, you could be forgiven for thinking BeWhere Holdings is a stock not worth researching with a price-to-sales ratios (or "P/S") of 4.9x, considering almost half the companies in Canada's Software industry have P/S ratios below 3.4x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

See our latest analysis for BeWhere Holdings

What Does BeWhere Holdings' Recent Performance Look Like?

With revenue growth that's exceedingly strong of late, BeWhere Holdings has been doing very well. Perhaps the market is expecting future revenue performance to outperform the wider market, which has seemingly got people interested in the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

Although there are no analyst estimates available for BeWhere Holdings, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The High P/S Ratio?

BeWhere Holdings' P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Retrospectively, the last year delivered an exceptional 42% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 99% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 19% shows it's noticeably more attractive.

In light of this, it's understandable that BeWhere Holdings' P/S sits above the majority of other companies. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

What Does BeWhere Holdings' P/S Mean For Investors?

BeWhere Holdings shares have taken a big step in a northerly direction, but its P/S is elevated as a result. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that BeWhere Holdings maintains its high P/S on the strength of its recent three-year growth being higher than the wider industry forecast, as expected. At this stage investors feel the potential continued revenue growth in the future is great enough to warrant an inflated P/S. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for BeWhere Holdings that you should be aware of.

If these risks are making you reconsider your opinion on BeWhere Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if BeWhere Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:BEW

BeWhere Holdings

An industrial Internet of Things (IIoT) solutions company, designs, manufactures, and sells hardware with sensors and software applications to track real-time information on equipment, tools, and inventory in-transit and at facilities.

Adequate balance sheet with questionable track record.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success