Insiders sold CA$2.7m worth of CGI Inc. (TSE:GIB.A) stock last year, could be a warning sign to watch out for

While it’s been a great week for CGI Inc. (TSE:GIB.A) shareholders after stock gained 6.5%, they should consider it with a grain of salt. In spite of the relatively cheap prices, insiders made the decision to sell CA$2.7m worth of stock in the last 12 months. This could be a warning indicator of vulnerabilities in the future.

Although we don't think shareholders should simply follow insider transactions, we would consider it foolish to ignore insider transactions altogether.

See our latest analysis for CGI

CGI Insider Transactions Over The Last Year

The Independent Director, Gilles Labbé, made the biggest insider sale in the last 12 months. That single transaction was for CA$1.6m worth of shares at a price of CA$109 each. So it's clear an insider wanted to take some cash off the table, even below the current price of CA$117. When an insider sells below the current price, it suggests that they considered that lower price to be fair. That makes us wonder what they think of the (higher) recent valuation. However, while insider selling is sometimes discouraging, it's only a weak signal. It is worth noting that this sale was 100% of Gilles Labbé's holding.

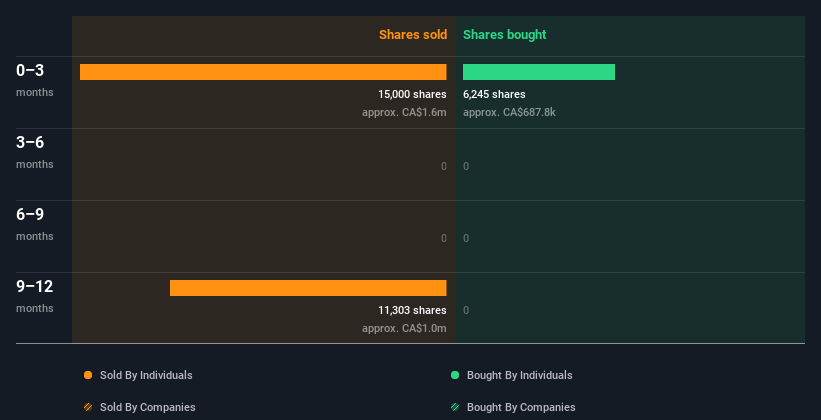

In total, CGI insiders sold more than they bought over the last year. The chart below shows insider transactions (by companies and individuals) over the last year. By clicking on the graph below, you can see the precise details of each insider transaction!

I will like CGI better if I see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Insiders at CGI Have Sold Stock Recently

We've seen more insider selling than insider buying at CGI recently. In that time, Independent Director Gilles Labbé dumped CA$1.6m worth of shares. On the flip side, Independent Director Joakim Westh spent CA$688k on purchasing shares (as mentioned above) . Generally this level of net selling might be considered a bit bearish.

Insider Ownership of CGI

Another way to test the alignment between the leaders of a company and other shareholders is to look at how many shares they own. I reckon it's a good sign if insiders own a significant number of shares in the company. CGI insiders own about CA$3.2b worth of shares (which is 11% of the company). Most shareholders would be happy to see this sort of insider ownership, since it suggests that management incentives are well aligned with other shareholders.

What Might The Insider Transactions At CGI Tell Us?

The insider sales have outweighed the insider buying, at CGI, in the last three months. And our longer term analysis of insider transactions didn't bring confidence, either. On the plus side, CGI makes money, and is growing profits. It is good to see high insider ownership, but the insider selling leaves us cautious. So these insider transactions can help us build a thesis about the stock, but it's also worthwhile knowing the risks facing this company. You'd be interested to know, that we found 2 warning signs for CGI and we suggest you have a look.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of interesting companies, that have HIGH return on equity and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:GIB.A

CGI

Provides information technology and business process services in Western and Southern Europe, the United States, Canada, Scandinavia, Northwest and Central-East Europe, the United Kingdom, Australia, Germany, Finland, Poland, Baltics, and the Asia Pacific.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026