How Investors Are Reacting To Descartes Systems Group (TSX:DSG) Securing Givaudan as a Compliance Automation Client

Reviewed by Sasha Jovanovic

- Descartes Systems Group recently announced that Givaudan has adopted its cloud-based denied party screening solution to automate and strengthen its international trade compliance across 163 locations in 52 countries, replacing manual processes with real-time automated screening.

- This client win emphasizes Descartes’ expanding presence among large multinational corporations seeking to enhance risk management and compliance in complex global trade environments.

- We’ll explore how Descartes’ role in automating compliance for a global leader like Givaudan could shape the company’s investment narrative.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Descartes Systems Group Investment Narrative Recap

To be a shareholder in Descartes Systems Group, you need to believe that the ongoing complexity of global trade and regulatory change will keep fueling demand for real-time, automated compliance solutions, an area where Descartes aims to remain essential to large multinationals. The Givaudan announcement strengthens Descartes' case as a trusted compliance partner, but does not materially change the immediate catalysts or the main risk, which remains tied to unpredictable global trade volumes and potential customer caution. A recent Descartes announcement that resonates directly with the Givaudan news is the introduction of Visual Compliance AI Assist, enhancing denied party screening with artificial intelligence. This product update highlights Descartes’ focus on automation and real-time compliance capabilities, features that could reinforce the company’s relevance as regulatory expectations evolve and transactional growth opportunities emerge. In contrast, investors should be aware that even as recurring revenue appears resilient, the unpredictability of global trade activity means that...

Read the full narrative on Descartes Systems Group (it's free!)

Descartes Systems Group's outlook anticipates $899.6 million in revenue and $240.4 million in earnings by 2028. Achieving these targets would require 10.4% annual revenue growth and a $95.6 million increase in earnings from the current $144.8 million.

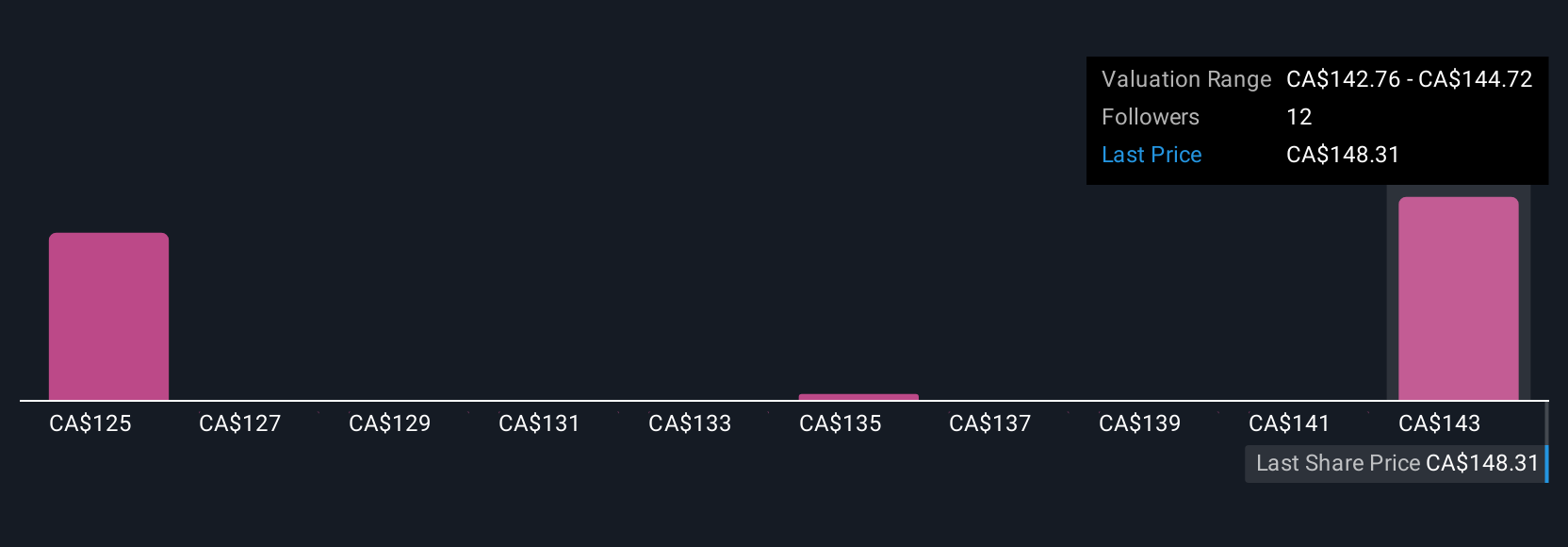

Uncover how Descartes Systems Group's forecasts yield a CA$131.93 fair value, in line with its current price.

Exploring Other Perspectives

Fair value opinions from four Simply Wall St Community members range from CA$123.65 to CA$135.41. While many see catalysts in new AI compliance offerings, shifting trade patterns could amplify volatility and impact performance outlooks, you’ll find a range of alternative views waiting to be explored.

Explore 4 other fair value estimates on Descartes Systems Group - why the stock might be worth 8% less than the current price!

Build Your Own Descartes Systems Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Descartes Systems Group research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Descartes Systems Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Descartes Systems Group's overall financial health at a glance.

Looking For Alternative Opportunities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:DSG

Descartes Systems Group

Provides global logistics technology solutions worldwide.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives