A Fresh Look at Descartes Systems Group (TSX:DSG) Valuation After Givaudan Partnership Highlights Product Strength

Reviewed by Kshitija Bhandaru

Descartes Systems Group (TSX:DSG) just announced that Givaudan, a powerhouse in the flavors and fragrances industry, is now using its denied party screening technology to automate and strengthen compliance with international trade regulations.

See our latest analysis for Descartes Systems Group.

After a strong run in recent years, Descartes Systems Group’s stock has seen some pullback in 2024, with a 1-year total shareholder return of -8.4%. However, its technology-driven partnerships and resilient long-term growth, highlighted by an impressive 48% total return over three years, suggest investors are still confident in its competitive edge, even as near-term momentum has faded.

If you’re interested in what else is gaining traction in the tech and automation space, check out the possibilities with our curated list by exploring See the full list for free..

That leaves investors facing a key question: after recent gains and high-profile partnerships, is Descartes undervalued or has the market already factored in all its future growth potential?

Price-to-Earnings of 55.8x: Is it justified?

Descartes Systems Group is trading at a price-to-earnings ratio of 55.8x, which places the stock firmly in expensive territory compared to several benchmarks. The last close price was CA$134.79, reflecting this high valuation level.

The price-to-earnings (P/E) ratio measures how much investors are willing to pay per dollar of earnings. For a technology company like Descartes, this ratio is closely watched as a signal of growth expectations and market sentiment about profitability.

Despite the company’s rapid earnings growth over the past five years, the current P/E is almost identical to the Canadian Software industry average (54.9x). It remains well above our estimated fair P/E of 34.1x. This suggests the market may be pricing in elevated expectations that are higher than longer-term trends or industry standards. If sentiment shifts, there could be significant reversion toward the fair ratio level the market could move towards.

Explore the SWS fair ratio for Descartes Systems Group

Result: Price-to-Earnings of 55.8x (OVERVALUED)

However, slowing annual revenue growth and a current share price above analyst targets present clear risks. These factors could temper further upside for Descartes.

Find out about the key risks to this Descartes Systems Group narrative.

Another View: What Does Our DCF Model Say?

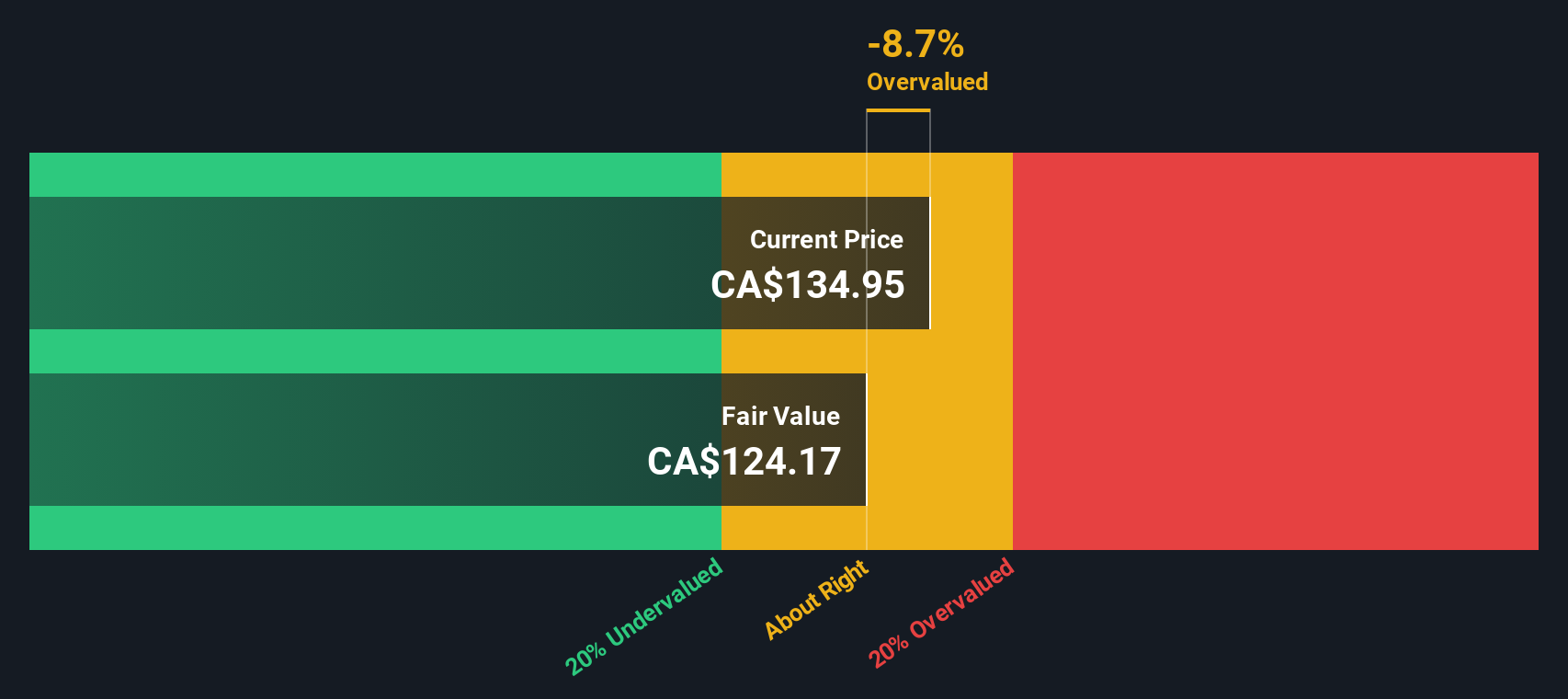

To balance out the high price-to-earnings discussion, let's look at the SWS DCF model, which estimates Descartes' fair value at CA$123.87. This is noticeably below the current share price of CA$134.79. This implies the stock is trading above what our cash flow estimate suggests is reasonable. Does this mean the growth story is already priced in, or is the market seeing something our model is not?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Descartes Systems Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Descartes Systems Group Narrative

If you want to follow your own insights or dig deeper into the numbers, you can easily build your personal view of Descartes in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Descartes Systems Group.

Ready for Even More Investment Opportunities?

Great investors keep their eyes open for fresh potential. Don’t let the next big trend pass you by when there are exciting sectors to tap into right now.

- Tap into the momentum of artificial intelligence by searching for companies positioned for rapid growth and innovation among these 100+ AI penny stocks.

- Benefit from untapped bargains hiding in plain sight by reviewing these 100+ undervalued stocks based on cash flows, which have strong fundamentals backed by solid cash flows.

- Secure reliable returns even in uncertain markets by checking out these 100+ dividend stocks with yields > 3%, as these offer attractive yields over 3% to boost your portfolio’s income potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:DSG

Descartes Systems Group

Provides global logistics technology solutions worldwide.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives