Over the last 7 days, the Canadian market has risen by 1.3%, and over the past year, it has climbed an impressive 23%, with earnings forecasted to grow by 15% annually. In this thriving environment, identifying high growth tech stocks involves looking for companies that demonstrate strong innovation and scalability potential to capitalize on these favorable conditions.

Top 10 High Growth Tech Companies In Canada

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Docebo | 14.54% | 34.05% | ★★★★★☆ |

| HIVE Digital Technologies | 49.31% | 94.00% | ★★★★★☆ |

| Constellation Software | 16.17% | 23.55% | ★★★★★☆ |

| GameSquare Holdings | 38.08% | 86.64% | ★★★★★☆ |

| Medicenna Therapeutics | 62.37% | 57.20% | ★★★★★☆ |

| Sabio Holdings | 12.97% | 122.50% | ★★★★☆☆ |

| Blackline Safety | 22.29% | 121.23% | ★★★★★☆ |

| BlackBerry | 24.17% | 79.50% | ★★★★★☆ |

| Alpha Cognition | 62.98% | 69.54% | ★★★★★☆ |

| Sernova | 76.56% | 74.04% | ★★★★★☆ |

Click here to see the full list of 22 stocks from our TSX High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Constellation Software (TSX:CSU)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Constellation Software Inc., along with its subsidiaries, focuses on acquiring, building, and managing vertical market software businesses across Canada, the United States, Europe, and internationally with a market cap of CA$93.59 billion.

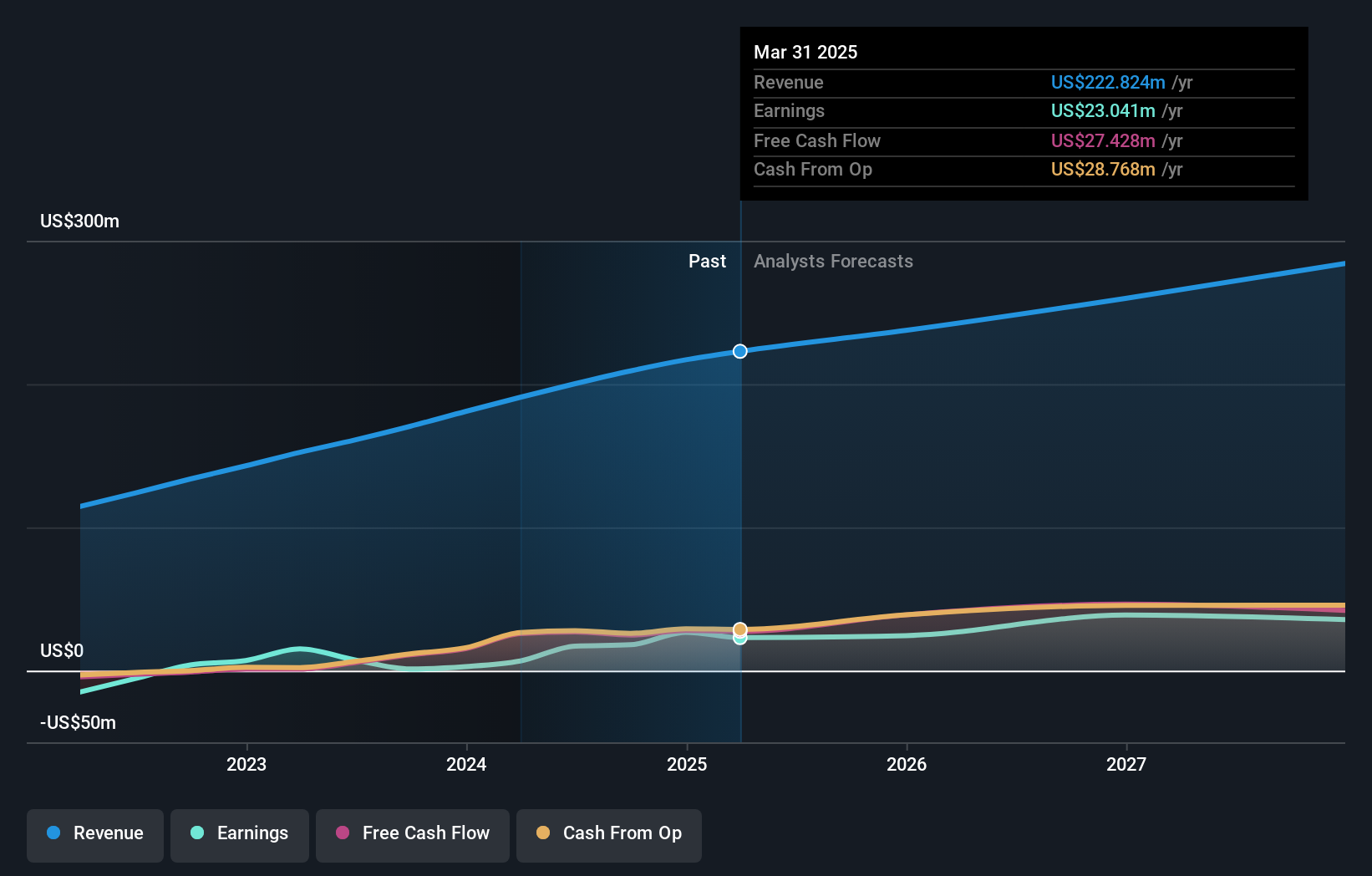

Operations: The company generates revenue primarily from its software and programming segment, amounting to $9.27 billion. Its business model centers on the acquisition, development, and management of vertical market software businesses globally.

Constellation Software, a standout in the Canadian tech landscape, is demonstrating robust growth with earnings projected to surge by 23.6% annually, outpacing the local market's 14.7%. This growth is underpinned by a significant revenue increase of 16.2% per year, which also exceeds the broader Canadian market average of 7%. The company's commitment to innovation is evident from its R&D spending trends; however, specific figures were not disclosed in the provided data. Recent financial results reflect this positive trajectory: for Q2 2024 alone, revenue soared to USD 2.468 billion from USD 2.039 billion year-over-year, with net income rising sharply to USD 177 million from USD 103 million. Despite these strong indicators, Constellation Software faces challenges such as high debt levels and substantial insider selling over the past quarter that could signal caution among investors about its future prospects. Nonetheless, with earnings growing at an impressive rate and recent affirmations of quarterly dividends suggesting confidence in ongoing profitability, Constellation remains a critical player in shaping technological advancements within Canada’s software sector.

- Click to explore a detailed breakdown of our findings in Constellation Software's health report.

Understand Constellation Software's track record by examining our Past report.

Docebo (TSX:DCBO)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Docebo Inc. is a company that offers an AI-powered learning management software platform across North America and internationally, with a market capitalization of CA$1.85 billion.

Operations: The company generates revenue primarily through its educational software, which brought in $200.24 million. It operates within the learning management software industry, leveraging AI technology to enhance its platform offerings across various regions.

Docebo's recent pivot to intensify its R&D spending, now at 34.0% of revenue, underscores a strategic thrust towards enhancing its AI-driven learning platforms. This investment aligns with the firm's 14.5% annual revenue growth and positions it well within the competitive tech landscape of Canada. The company's role as the business learning partner for TEDAI Vienna highlights its commitment to integrating AI in corporate training, further evidenced by a robust earnings jump from last year’s loss to this quarter’s $4.7 million net income. These moves not only reflect Docebo’s resilience but also its ability to capitalize on emerging tech trends, setting a strong foundation for future growth amidst evolving educational needs.

Vitalhub (TSX:VHI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Vitalhub Corp. offers technology solutions for health and human service providers across various regions, including Canada, the United States, the United Kingdom, Australia, and Western Asia, with a market cap of CA$487.36 million.

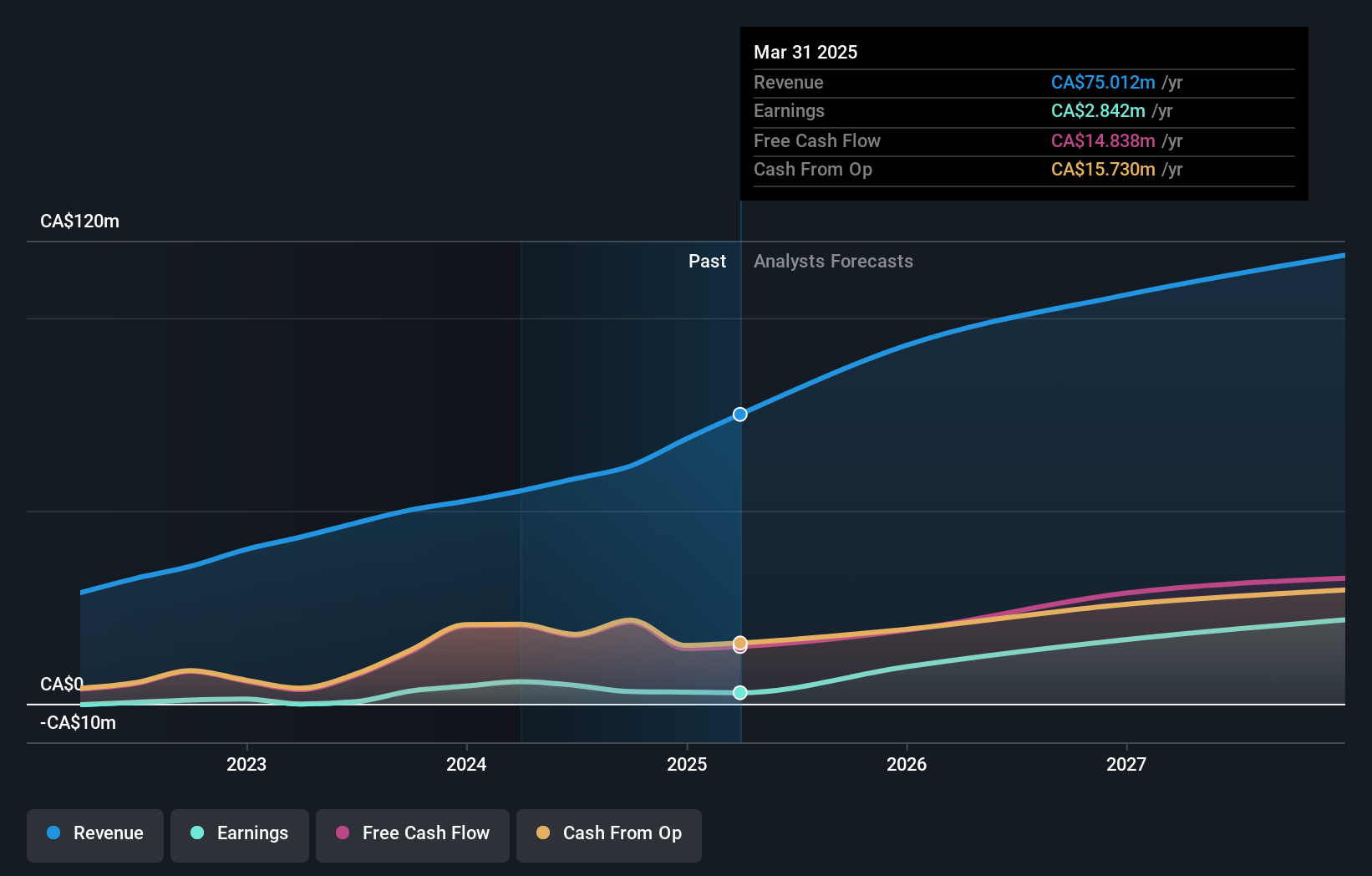

Operations: Vitalhub Corp., along with its subsidiaries, generates revenue primarily from its healthcare software segment, amounting to CA$58.32 million. The company operates across multiple international markets, providing specialized technology solutions for health and human service sectors.

Vitalhub, recently spotlighted at the Cantech Letter Investment Conference, is navigating a transformative period marked by its addition to the S&P Global BMI Index and a notable pivot in its financial trajectory. Despite a dip in net income to CAD 0.34 million this quarter from CAD 0.62 million last year, the company's revenue surged by 24% to CAD 16.24 million, reflecting robust market demand. This growth is underpinned by an aggressive R&D strategy that consumes 13.5% of its revenue, aligning with industry trends towards enhanced software solutions in healthcare—a sector where Vitalhub is poised to expand its influence given its projected annual earnings growth of 65.9%.

- Click here and access our complete health analysis report to understand the dynamics of Vitalhub.

Explore historical data to track Vitalhub's performance over time in our Past section.

Summing It All Up

- Reveal the 22 hidden gems among our TSX High Growth Tech and AI Stocks screener with a single click here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CSU

Constellation Software

Acquires, builds, and manages vertical market software businesses in Canada, the United States, Europe, and internationally.

High growth potential with questionable track record.