Exploring TSX Stocks With Estimated Discounts Ranging From 12.9% To 23.6%

Reviewed by Simply Wall St

The Canadian market has shown resilience with a steady performance over the last week and an impressive 11% increase over the past year, coupled with expectations of a 15% annual earnings growth. In this environment, identifying stocks that appear undervalued could present opportunities for investors looking for potential growth at a discounted price.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| goeasy (TSX:GSY) | CA$192.21 | CA$312.71 | 38.5% |

| Decisive Dividend (TSXV:DE) | CA$7.11 | CA$11.76 | 39.5% |

| B2Gold (TSX:BTO) | CA$4.11 | CA$8.12 | 49.4% |

| Trisura Group (TSX:TSU) | CA$43.83 | CA$80.07 | 45.3% |

| Kraken Robotics (TSXV:PNG) | CA$1.13 | CA$2.24 | 49.6% |

| Viemed Healthcare (TSX:VMD) | CA$10.45 | CA$20.08 | 48% |

| Amerigo Resources (TSX:ARG) | CA$1.59 | CA$2.74 | 41.9% |

| Hamilton Thorne (TSX:HTL) | CA$2.17 | CA$3.95 | 45% |

| Green Thumb Industries (CNSX:GTII) | CA$15.99 | CA$28.46 | 43.8% |

| Kits Eyecare (TSX:KITS) | CA$8.98 | CA$16.82 | 46.6% |

Let's uncover some gems from our specialized screener.

Brookfield Asset Management (TSX:BAM)

Overview: Brookfield Asset Management Ltd. is a real estate investment firm specializing in alternative asset management services, with a market capitalization of CA$23.69 billion.

Operations: The company specializes in alternative asset management, primarily focusing on real estate investments.

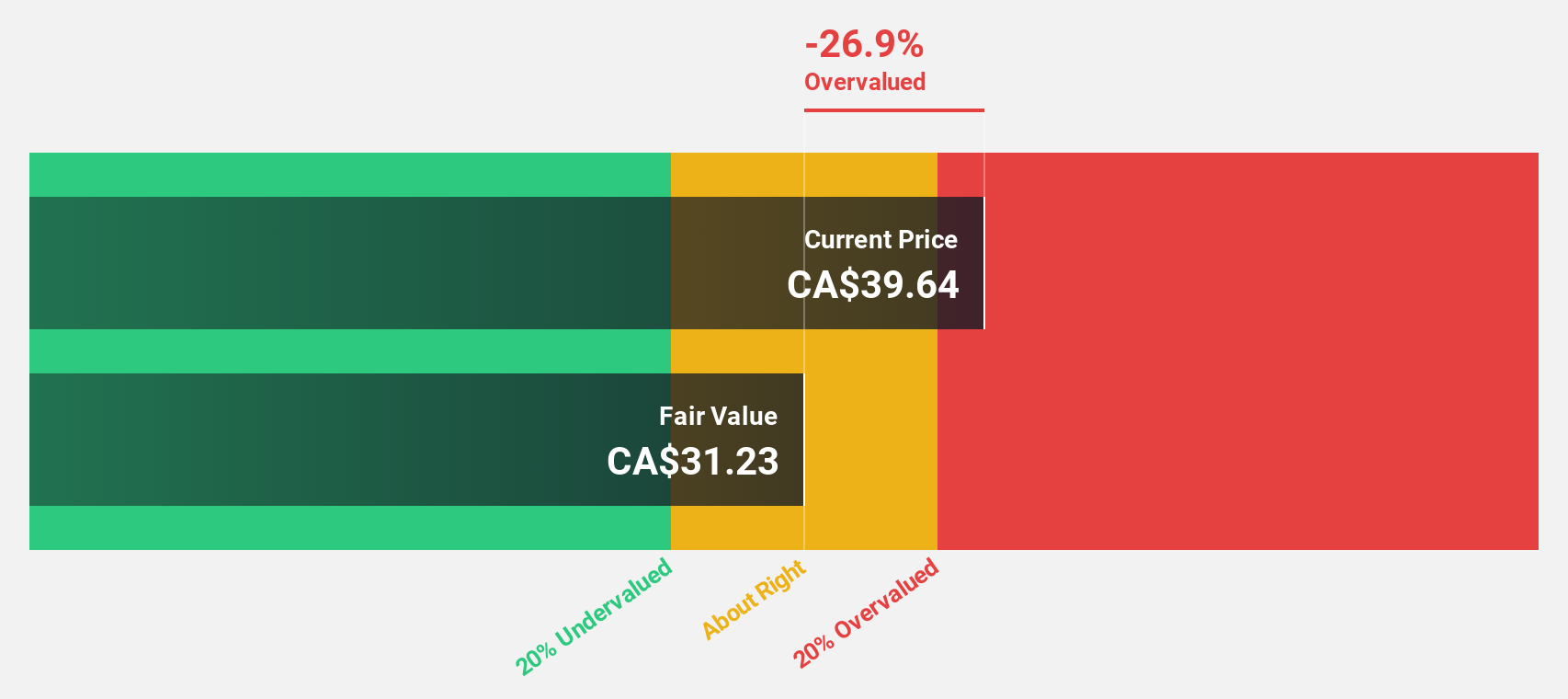

Estimated Discount To Fair Value: 13.2%

Brookfield Asset Management is trading 13.2% below its estimated fair value of CA$67.02, with a current price of CA$58.16, reflecting potential undervaluation based on discounted cash flow analysis. Despite this, its dividend coverage by earnings and free cash flows is weak. However, the company's revenue and earnings growth are projected to significantly outpace the Canadian market average at 61.8% and 74.4% per year respectively, suggesting robust future financial performance amidst ongoing M&A activities which could influence its market position and valuation further.

- Our earnings growth report unveils the potential for significant increases in Brookfield Asset Management's future results.

- Click to explore a detailed breakdown of our findings in Brookfield Asset Management's balance sheet health report.

Constellation Software (TSX:CSU)

Overview: Constellation Software Inc. operates globally, focusing on acquiring, building, and managing vertical market software businesses primarily in Canada, the U.S., and Europe, with a market capitalization of approximately CA$89.32 billion.

Operations: The company's revenue from software and programming amounts to CA$8.84 billion.

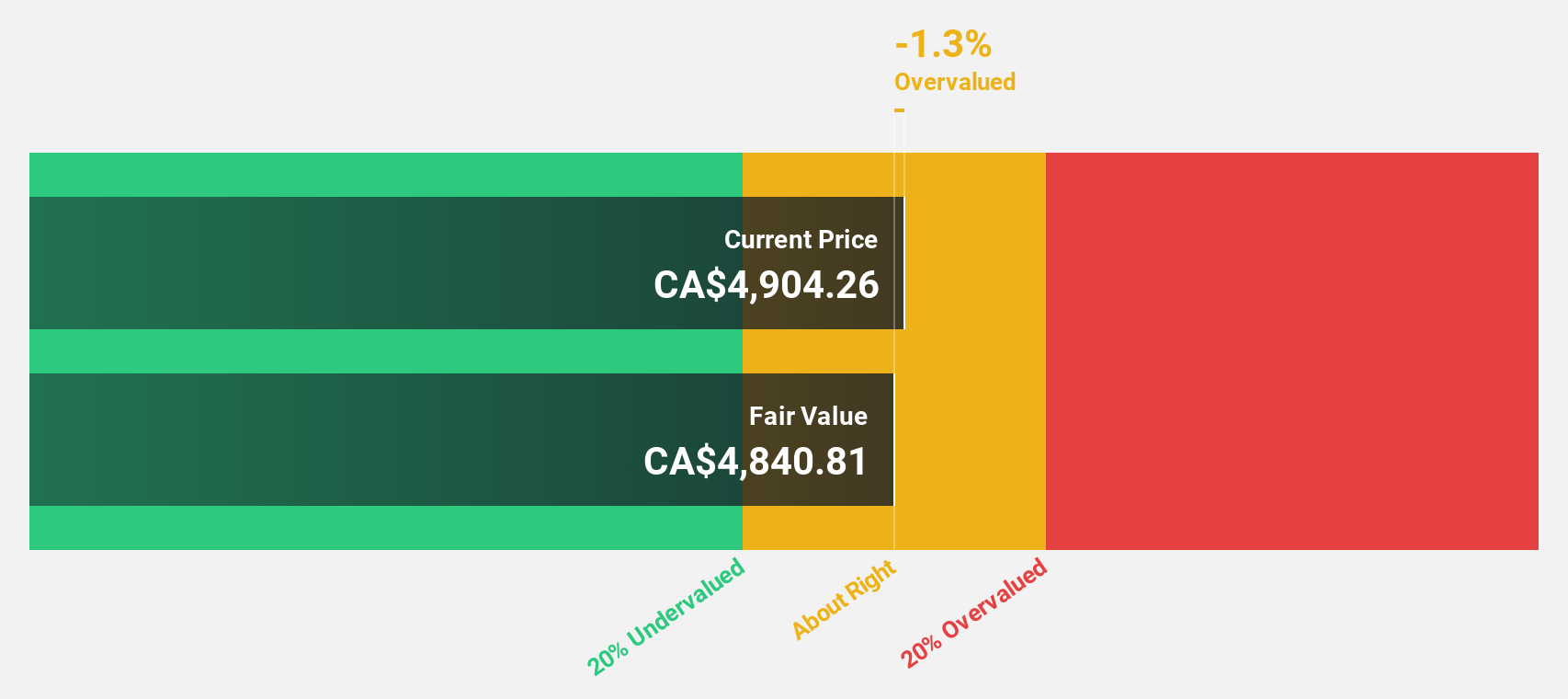

Estimated Discount To Fair Value: 23.6%

Constellation Software, priced at CA$4288.99, is significantly undervalued by over 20% against a fair value of CA$5612.62 based on discounted cash flow analysis. Despite high debt levels and considerable insider selling recently, its earnings and revenue growth projections outstrip the Canadian market averages at 24.43% and 16.1% per year respectively. Recent strategic expansions include launching Omegro, enhancing global software operations which could bolster long-term growth despite current financial leverage concerns.

- Our expertly prepared growth report on Constellation Software implies its future financial outlook may be stronger than recent results.

- Take a closer look at Constellation Software's balance sheet health here in our report.

Docebo (TSX:DCBO)

Overview: Docebo Inc. is a learning management software company offering an AI-powered learning platform across North America and internationally, with a market cap of approximately CA$1.56 billion.

Operations: The company generates its revenue primarily from its educational software segment, amounting to CA$190.78 million.

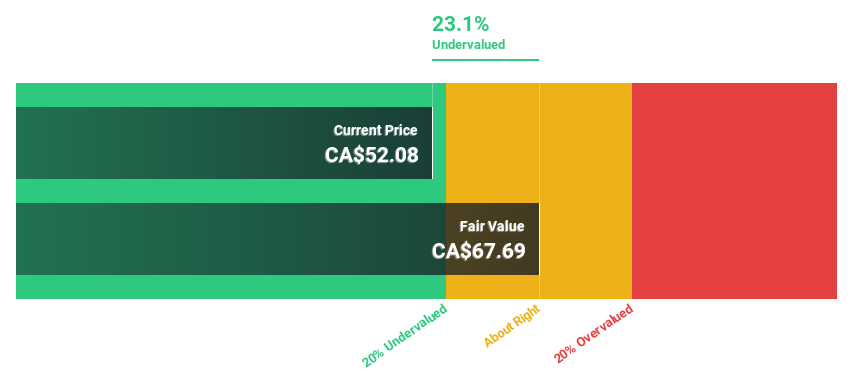

Estimated Discount To Fair Value: 12.9%

Docebo Inc., trading at CA$52.16, is positioned below its estimated fair value of CA$59.88, reflecting a modest undervaluation based on discounted cash flow analysis. The company's recent financial performance shows robust growth, with a significant increase in quarterly sales and net income compared to the previous year. Additionally, Docebo has initiated a share repurchase program, enhancing shareholder value by reducing equity dilution. Despite lower profit margins than last year, its earnings are expected to grow substantially over the next three years, outpacing average market projections.

- Upon reviewing our latest growth report, Docebo's projected financial performance appears quite optimistic.

- Dive into the specifics of Docebo here with our thorough financial health report.

Key Takeaways

- Gain an insight into the universe of 22 Undervalued TSX Stocks Based On Cash Flows by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:DCBO

Docebo

Operates as a learning management software company that provides artificial intelligence (AI)-powered learning platform in North America and internationally.

Outstanding track record with flawless balance sheet.