Even With A 64% Surge, Cautious Investors Are Not Rewarding Bitfarms Ltd.'s (TSE:BITF) Performance Completely

Bitfarms Ltd. (TSE:BITF) shares have had a really impressive month, gaining 64% after a shaky period beforehand. But the last month did very little to improve the 52% share price decline over the last year.

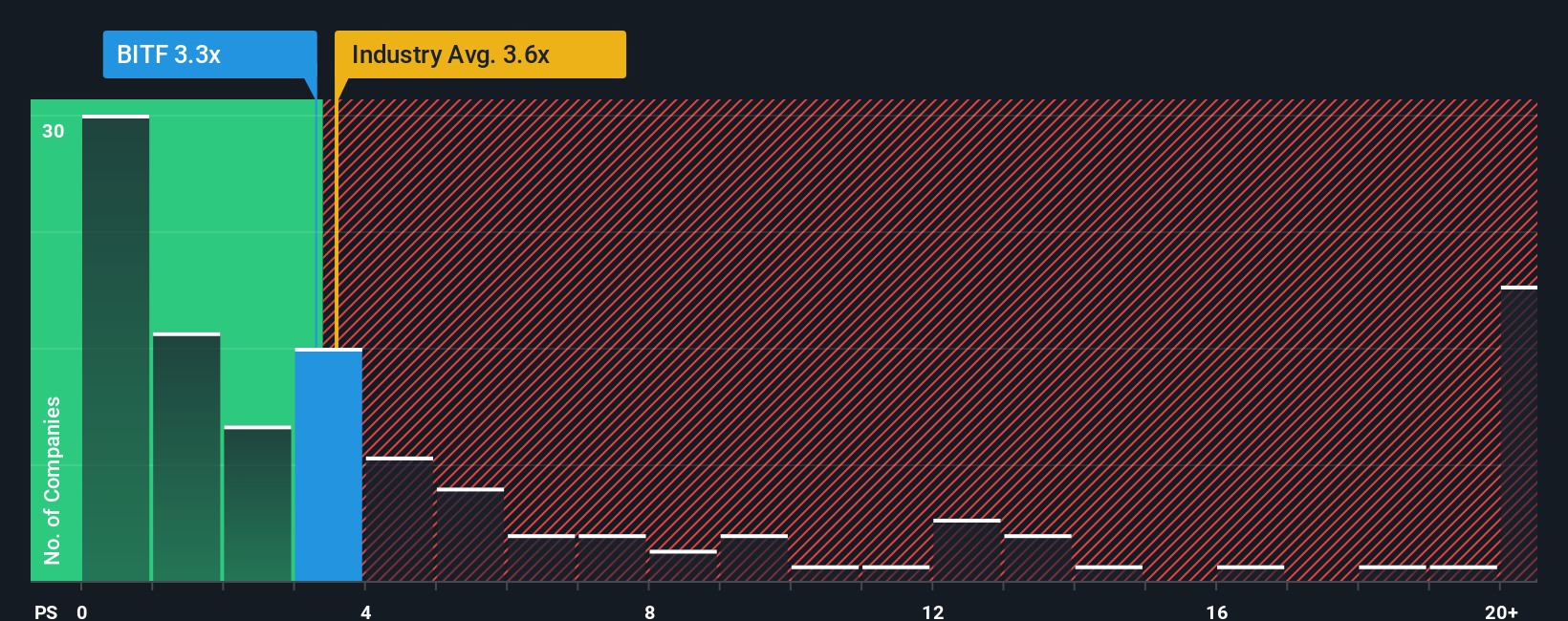

In spite of the firm bounce in price, it's still not a stretch to say that Bitfarms' price-to-sales (or "P/S") ratio of 3.3x right now seems quite "middle-of-the-road" compared to the Software industry in Canada, where the median P/S ratio is around 3.6x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Bitfarms

What Does Bitfarms' P/S Mean For Shareholders?

Recent times have been advantageous for Bitfarms as its revenues have been rising faster than most other companies. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Bitfarms.What Are Revenue Growth Metrics Telling Us About The P/S?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Bitfarms' to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 26%. As a result, it also grew revenue by 15% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Turning to the outlook, the next year should generate growth of 57% as estimated by the seven analysts watching the company. That's shaping up to be materially higher than the 19% growth forecast for the broader industry.

With this in consideration, we find it intriguing that Bitfarms' P/S is closely matching its industry peers. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Bottom Line On Bitfarms' P/S

Bitfarms appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Despite enticing revenue growth figures that outpace the industry, Bitfarms' P/S isn't quite what we'd expect. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

It is also worth noting that we have found 3 warning signs for Bitfarms (1 is a bit unpleasant!) that you need to take into consideration.

If you're unsure about the strength of Bitfarms' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Bitfarms might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:BITF

Bitfarms

Operates integrated bitcoin data centers in Canada, the United States, Paraguay, and Argentina.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives