As the Canadian market navigates a period of shifting business models, particularly in the tech sector with increased investment in data centers and AI infrastructure, investors are encouraged to consider diversification beyond mega-cap stocks. Penny stocks, despite their somewhat outdated name, remain relevant as they represent smaller or newer companies that can offer surprising value when backed by strong financials. In this article, we'll explore three penny stocks that stand out for their financial strength and potential for long-term success amidst these evolving market conditions.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.05 | CA$53.85M | ✅ 3 ⚠️ 4 View Analysis > |

| Canso Select Opportunities (TSXV:CSOC.A) | CA$4.50 | CA$21.61M | ✅ 2 ⚠️ 2 View Analysis > |

| Zoomd Technologies (TSXV:ZOMD) | CA$1.75 | CA$187.39M | ✅ 4 ⚠️ 1 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.39 | CA$3.34M | ✅ 2 ⚠️ 4 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.15 | CA$718.52M | ✅ 3 ⚠️ 1 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.12 | CA$22M | ✅ 2 ⚠️ 3 View Analysis > |

| Rio2 (TSX:RIO) | CA$2.18 | CA$945.72M | ✅ 4 ⚠️ 3 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$2.86 | CA$145.67M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$2.19 | CA$203.61M | ✅ 3 ⚠️ 2 View Analysis > |

| Matachewan Consolidated Mines (TSXV:MCM.A) | CA$0.75 | CA$10.23M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 410 stocks from our TSX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Alithya Group (TSX:ALYA)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Alithya Group Inc. offers information technology services and solutions through digital technologies across Canada, the United States, and internationally, with a market cap of CA$161.92 million.

Operations: Alithya Group Inc. has not reported any specific revenue segments.

Market Cap: CA$161.92M

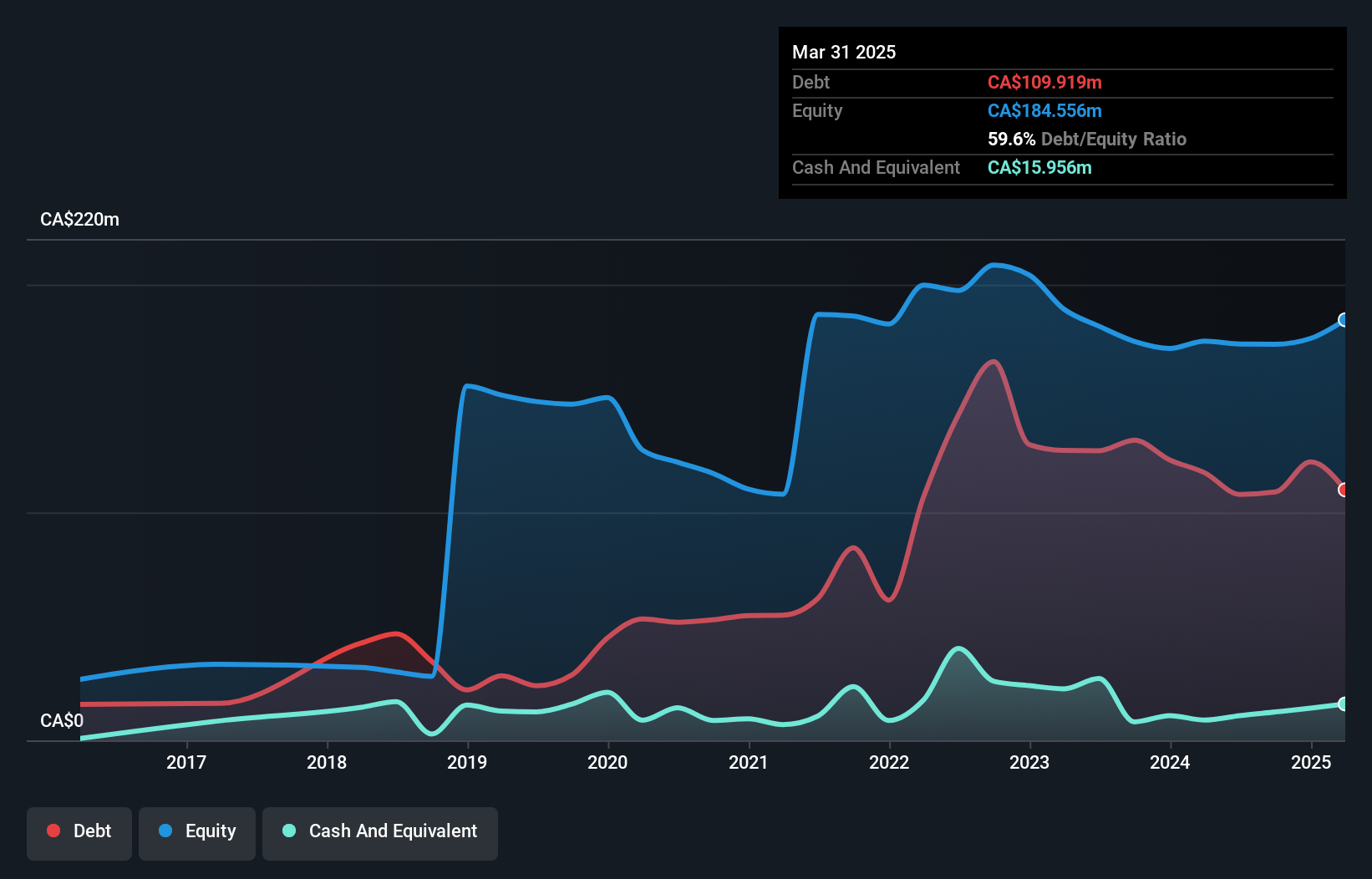

Alithya Group Inc. presents a mixed picture for penny stock investors. The company is unprofitable but has shown progress by reducing losses over the past five years and maintaining a positive cash flow, ensuring a cash runway of over three years. Recent earnings reports indicate revenue growth, with sales reaching CA$124.29 million in the latest quarter despite reporting significant impairment charges of $38 million and an increased net loss compared to last year. Alithya's debt levels have risen significantly, yet its short-term assets cover both short-term and long-term liabilities, suggesting some financial stability amidst challenges.

- Dive into the specifics of Alithya Group here with our thorough balance sheet health report.

- Gain insights into Alithya Group's outlook and expected performance with our report on the company's earnings estimates.

Grounded Lithium (TSXV:GRD)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Grounded Lithium Corp. is involved in the acquisition, exploration, and development of mineral properties in Canada, with a market cap of CA$3.98 million.

Operations: Currently, there are no reported revenue segments for the company.

Market Cap: CA$3.98M

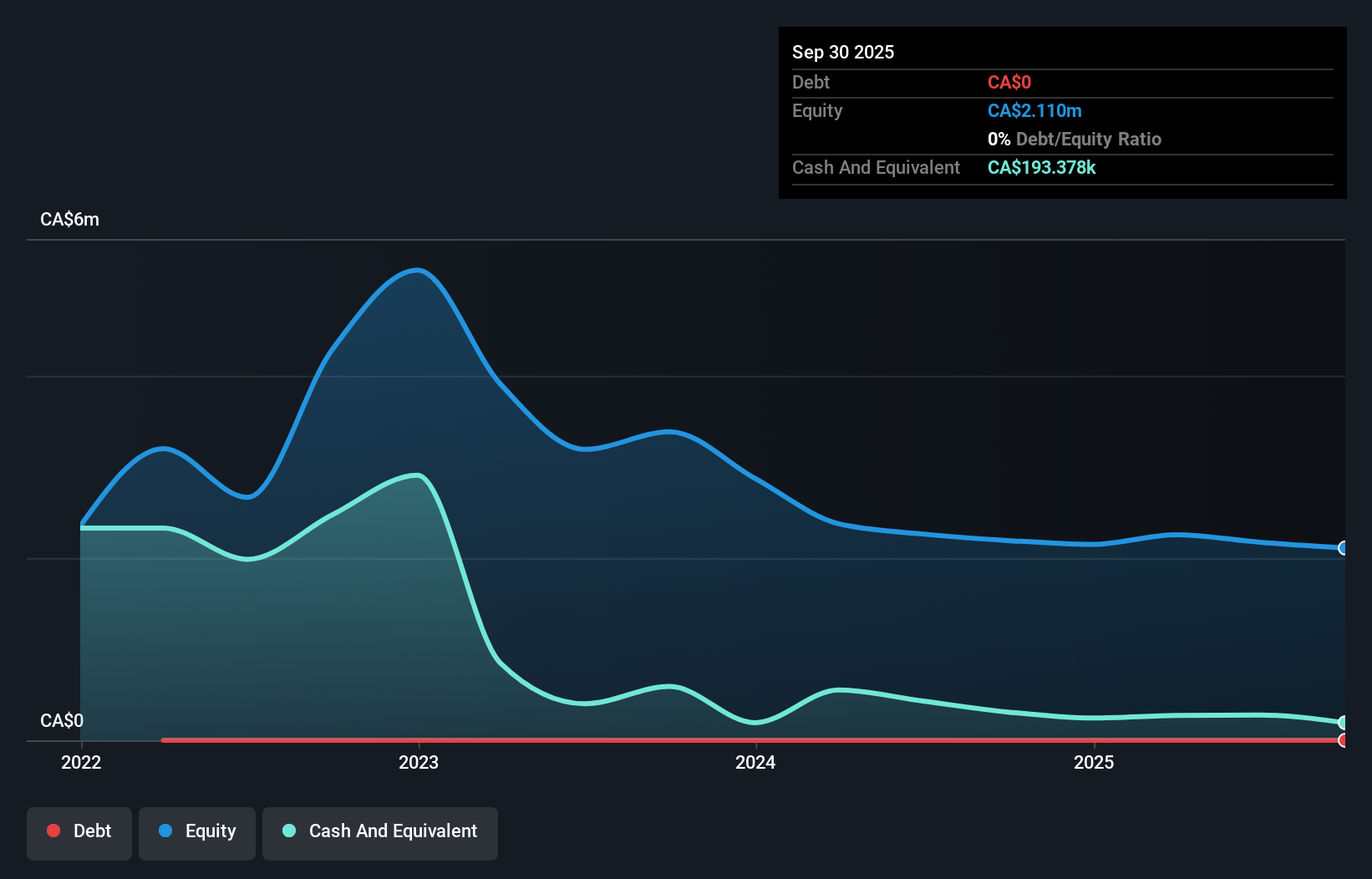

Grounded Lithium Corp. offers a speculative opportunity for penny stock investors, operating pre-revenue with minimal earnings reported. The company has reduced its losses over the past five years by 37.2% annually and remains debt-free, which can be appealing in volatile markets. Despite high volatility and a limited cash runway of less than a year if free cash flow grows at historical rates, Grounded Lithium's strategic partnerships and ongoing pre-feasibility study for its Kindersley Lithium Project could potentially enhance future prospects. Management's decision to receive equity compensation aligns interests with shareholders amidst these developmental phases.

- Click here to discover the nuances of Grounded Lithium with our detailed analytical financial health report.

- Explore historical data to track Grounded Lithium's performance over time in our past results report.

NeoTerrex Minerals (TSXV:NTX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: NeoTerrex Minerals Inc. focuses on evaluating, acquiring, and exploring mineral properties in Canada with a market cap of CA$23.04 million.

Operations: Currently, there are no reported revenue segments for this company.

Market Cap: CA$23.04M

NeoTerrex Minerals Inc. presents a speculative opportunity in the penny stock arena, operating pre-revenue with a market cap of CA$23.04 million. The company is debt-free and maintains sufficient cash runway for over a year, providing some financial stability amidst its exploration activities. Recent assays from NeoTerrex's Gravitas and Revolver projects in Quebec have revealed promising mineralization, including rare earth elements critical to modern technologies like electric vehicles and wind turbines. However, the company's high share price volatility may pose risks to investors seeking stability as it continues to explore its mineral properties without significant revenue streams yet established.

- Unlock comprehensive insights into our analysis of NeoTerrex Minerals stock in this financial health report.

- Gain insights into NeoTerrex Minerals' past trends and performance with our report on the company's historical track record.

Turning Ideas Into Actions

- Access the full spectrum of 410 TSX Penny Stocks by clicking on this link.

- Looking For Alternative Opportunities? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ALYA

Alithya Group

Provides information technology services and solutions through digital technologies in Canada, the United States, and internationally.

Very undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives