Investors Don't See Light At End Of Adcore Inc.'s (TSE:ADCO) Tunnel And Push Stock Down 27%

The Adcore Inc. (TSE:ADCO) share price has softened a substantial 27% over the previous 30 days, handing back much of the gains the stock has made lately. Longer-term, the stock has been solid despite a difficult 30 days, gaining 13% in the last year.

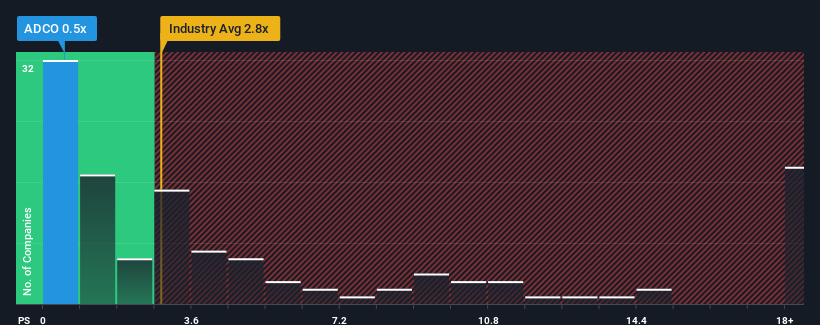

Since its price has dipped substantially, Adcore's price-to-sales (or "P/S") ratio of 0.5x might make it look like a strong buy right now compared to the wider Software industry in Canada, where around half of the companies have P/S ratios above 2.8x and even P/S above 7x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

View our latest analysis for Adcore

What Does Adcore's Recent Performance Look Like?

For example, consider that Adcore's financial performance has been poor lately as its revenue has been in decline. It might be that many expect the disappointing revenue performance to continue or accelerate, which has repressed the P/S. Those who are bullish on Adcore will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

Although there are no analyst estimates available for Adcore, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Adcore's Revenue Growth Trending?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Adcore's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 2.7%. As a result, revenue from three years ago have also fallen 28% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 18% shows it's an unpleasant look.

With this in mind, we understand why Adcore's P/S is lower than most of its industry peers. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. Even just maintaining these prices could be difficult to achieve as recent revenue trends are already weighing down the shares.

What Does Adcore's P/S Mean For Investors?

Adcore's P/S looks about as weak as its stock price lately. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

It's no surprise that Adcore maintains its low P/S off the back of its sliding revenue over the medium-term. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises either. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

There are also other vital risk factors to consider and we've discovered 3 warning signs for Adcore (1 is potentially serious!) that you should be aware of before investing here.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:ADCO

Adcore

An advertising technology company, provides smart algorithm-powered automation tools and reporting and analytics to digital advertisers worldwide.

Flawless balance sheet and good value.

Market Insights

Community Narratives