- Canada

- /

- Metals and Mining

- /

- TSX:JAG

TSX Penny Stocks: BTQ Technologies And 2 More To Watch

Reviewed by Simply Wall St

The Canadian market has been navigating a period of heightened volatility, influenced by global trade tensions and fluctuating tariffs, which have kept investors on edge. Despite this uncertainty, the concept of penny stocks remains intriguing for those looking to explore smaller or newer companies with potential growth opportunities. While the term "penny stocks" might seem outdated, these investments can offer significant returns when supported by strong financials. In this article, we will examine three such stocks that stand out for their financial health and growth potential in today's market climate.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.61 | CA$61.7M | ✅ 4 ⚠️ 4 View Analysis > |

| NTG Clarity Networks (TSXV:NCI) | CA$1.63 | CA$68.71M | ✅ 4 ⚠️ 2 View Analysis > |

| Orezone Gold (TSX:ORE) | CA$1.09 | CA$562M | ✅ 4 ⚠️ 1 View Analysis > |

| Amerigo Resources (TSX:ARG) | CA$1.70 | CA$280.75M | ✅ 2 ⚠️ 2 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.73 | CA$167.33M | ✅ 3 ⚠️ 1 View Analysis > |

| Alvopetro Energy (TSXV:ALV) | CA$4.57 | CA$166.42M | ✅ 3 ⚠️ 1 View Analysis > |

| PetroTal (TSX:TAL) | CA$0.60 | CA$549.3M | ✅ 4 ⚠️ 3 View Analysis > |

| McCoy Global (TSX:MCB) | CA$2.58 | CA$70.12M | ✅ 3 ⚠️ 2 View Analysis > |

| Findev (TSXV:FDI) | CA$0.46 | CA$13.18M | ✅ 2 ⚠️ 3 View Analysis > |

| BluMetric Environmental (TSXV:BLM) | CA$1.14 | CA$42.09M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 931 stocks from our TSX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

BTQ Technologies (NEOE:BTQ)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: BTQ Technologies Corp. focuses on developing computer-based technology for post-quantum cryptography in blockchain applications, with a market cap of CA$277.92 million.

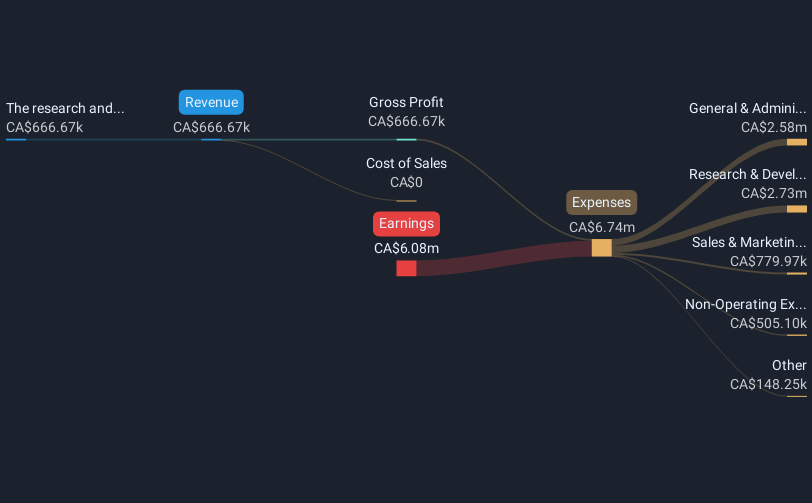

Operations: The company's revenue segment is derived entirely from its research and development activities in computer-based technology related to post-quantum cryptography, amounting to CA$0.67 million.

Market Cap: CA$277.92M

BTQ Technologies, a pre-revenue company with a market cap of CA$277.92 million, is focused on post-quantum cryptography for blockchain applications. Despite reporting sales of only CA$0.67 million and a net loss reduction to CA$6.08 million in 2024, the company's volatility remains high compared to most Canadian stocks. BTQ's short-term assets significantly exceed its liabilities, providing some financial stability without debt concerns. Recent strategic initiatives include appointing Dr. Gavin Brennen as Chief Quantum Officer and partnering with Coxwave for AI-driven quantum education solutions, which may bolster its technological roadmap and industry presence despite management's limited experience.

- Get an in-depth perspective on BTQ Technologies' performance by reading our balance sheet health report here.

- Learn about BTQ Technologies' historical performance here.

Jaguar Mining (TSX:JAG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Jaguar Mining Inc. is a junior gold mining company focused on acquiring, exploring, developing, and operating gold mineral properties in Brazil with a market cap of CA$231.58 million.

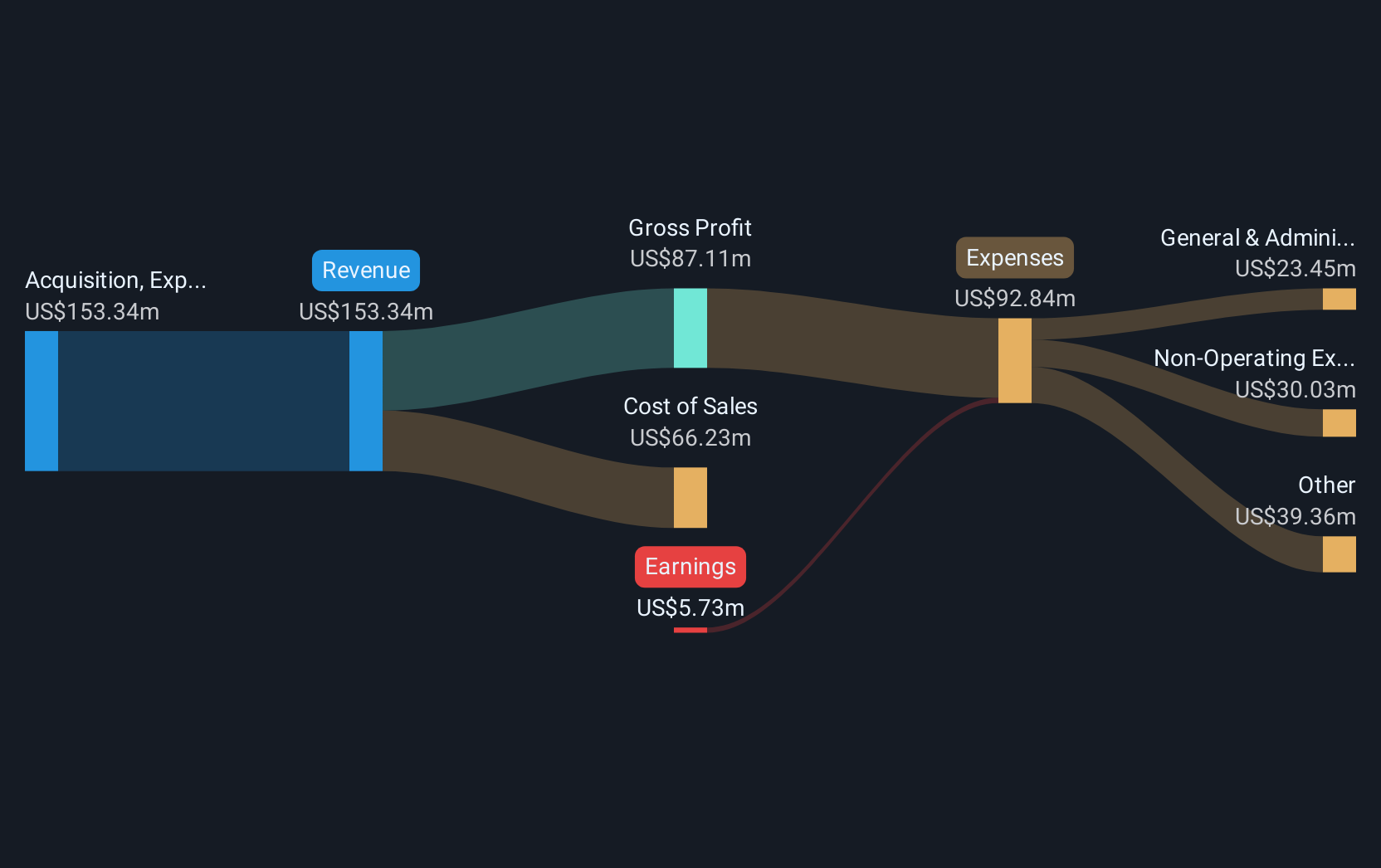

Operations: The company generates its revenue of $158.63 million through the acquisition, exploration, development, and operation of gold-producing properties.

Market Cap: CA$231.58M

Jaguar Mining Inc., with a market cap of CA$231.58 million, faces challenges as its gold production dropped significantly in Q1 2025 due to operational issues at the Turmalina mine. Despite generating US$158.63 million in sales for 2024, the company reported a net loss of US$1.29 million, reflecting profitability struggles amidst declining earnings over five years. Positively, Jaguar's financial health is bolstered by more cash than debt and strong asset coverage for liabilities. While trading below estimated fair value and maintaining stable volatility, its unprofitability and negative return on equity remain concerns for investors considering penny stocks in Canada.

- Click here and access our complete financial health analysis report to understand the dynamics of Jaguar Mining.

- Review our growth performance report to gain insights into Jaguar Mining's future.

Aldebaran Resources (TSXV:ALDE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Aldebaran Resources Inc. focuses on the acquisition, exploration, and evaluation of mineral properties in Canada and Argentina, with a market cap of CA$312.64 million.

Operations: Aldebaran Resources Inc. does not report any revenue segments.

Market Cap: CA$312.64M

Aldebaran Resources Inc., with a market cap of CA$312.64 million, is pre-revenue and recently became profitable, yet its Return on Equity remains low at 3%. The company has no debt, providing financial stability, and its short-term assets of CA$14.3 million cover both short- and long-term liabilities comfortably. Despite a net loss reduction to CA$0.71 million in the latest quarter compared to the previous year, Aldebaran's earnings growth prospects are challenging to gauge against industry standards due to recent profitability. Trading below analyst price targets suggests potential upside in valuation amidst stable volatility over the past year.

- Jump into the full analysis health report here for a deeper understanding of Aldebaran Resources.

- Assess Aldebaran Resources' previous results with our detailed historical performance reports.

Summing It All Up

- Reveal the 931 hidden gems among our TSX Penny Stocks screener with a single click here.

- Seeking Other Investments? AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:JAG

Jaguar Mining

A junior gold mining company, engages in the acquisition, exploration, development, and operation of gold mineral properties in Brazil.

Undervalued with high growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success