Can BTQ Technologies (NEOE:BTQ) Leverage Quantum Blockchain Partnerships to Redefine Its Competitive Edge?

Reviewed by Sasha Jovanovic

- BTQ Technologies announced a partnership to integrate its Quantum Compute-in-Memory hardware with Solana’s core infrastructure, enabling post-quantum secure computations and commercialization opportunities on Bonsol’s verifiable computation network.

- This collaboration positions BTQ at the forefront of quantum-secure blockchain solutions while its inclusion in the SamsungActive KoAct Global Quantum Computing Active ETF raises its visibility among Asia-Pacific investors.

- We’ll explore how BTQ’s enhanced global exposure and quantum blockchain focus may reshape its overall investment narrative.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is BTQ Technologies' Investment Narrative?

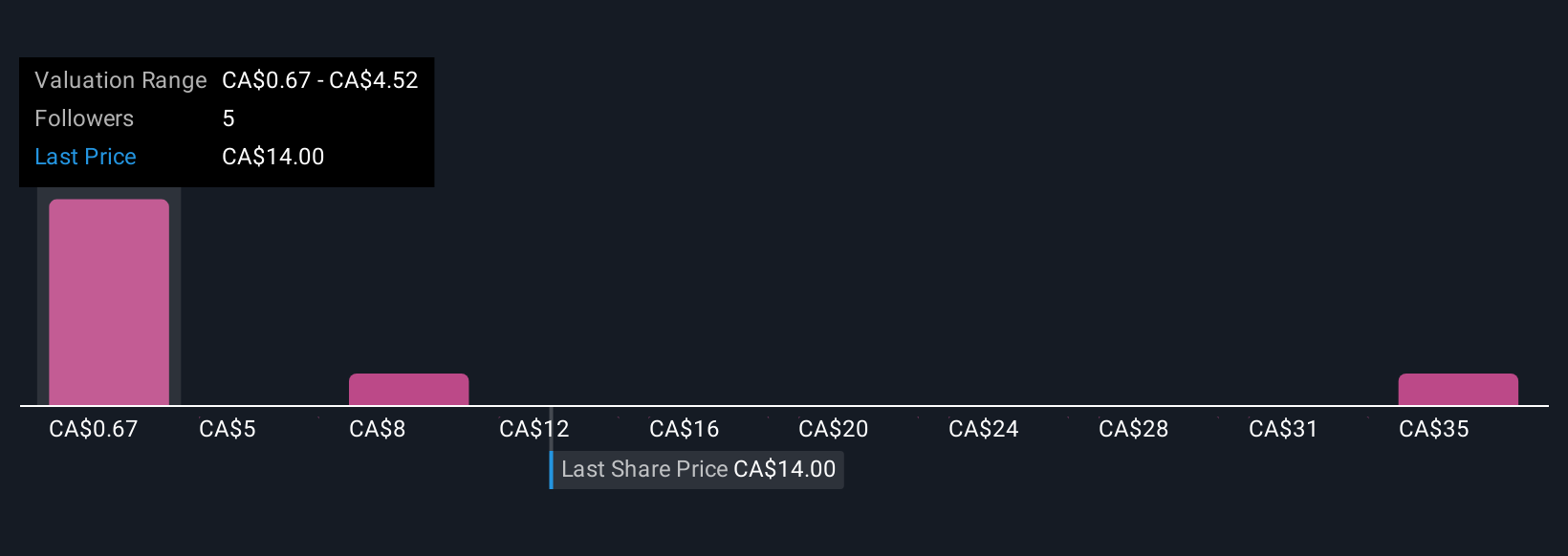

For BTQ Technologies, the investment thesis now hinges on the company’s push to commercialize quantum-secure blockchain infrastructure, an ambition amplified by the Bonsol-Solana partnership and the recent addition to SamsungActive’s KoAct ETF. These developments offer BTQ greater industry exposure and potentially new revenue channels, especially if post-quantum security gains traction in blockchain. Short term, these factors could shift market perception and drive speculative interest, but BTQ’s most pressing risks remain: limited sales (just under CA$900,000), ongoing losses, and a high Price-To-Book Ratio compared to peers. Prior concerns about expensive valuation and financial sustainability may be somewhat offset by improved credibility and global attention, but significant uncertainty remains until commercialization translates into material revenue. This news moves BTQ’s story forward, but key financial and execution risks still loom large.

But there’s also the challenge of turning innovation into real, sustainable revenue. Our valuation report unveils the possibility BTQ Technologies' shares may be trading at a premium.Exploring Other Perspectives

Explore 8 other fair value estimates on BTQ Technologies - why the stock might be worth over 3x more than the current price!

Build Your Own BTQ Technologies Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BTQ Technologies research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free BTQ Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BTQ Technologies' overall financial health at a glance.

Interested In Other Possibilities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BTQ Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NEOE:BTQ

BTQ Technologies

Engages in the development of computer-based technology related to post-quantum cryptography for applications in blockchain and related technologies.

Flawless balance sheet with limited growth.

Market Insights

Community Narratives