Could ARTEX Partnership Reveal Abaxx Technologies’ (NEOE:ABXX) True Edge in Digital Asset Infrastructure?

Reviewed by Sasha Jovanovic

- Earlier this month, ARTEX AG announced a strategic partnership with Abaxx Technologies to modernize the trading, financing, and management of alternative and real-world assets across regulated markets in Europe, North America, and Asia.

- This collaboration aims to advance market infrastructure technology and achieve cross-platform integration, positioning both firms to capitalize on growing trends in the digitization of financial markets.

- We'll explore how the ARTEX partnership and shared vision for digital market modernization influences Abaxx Technologies' broader investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Abaxx Technologies' Investment Narrative?

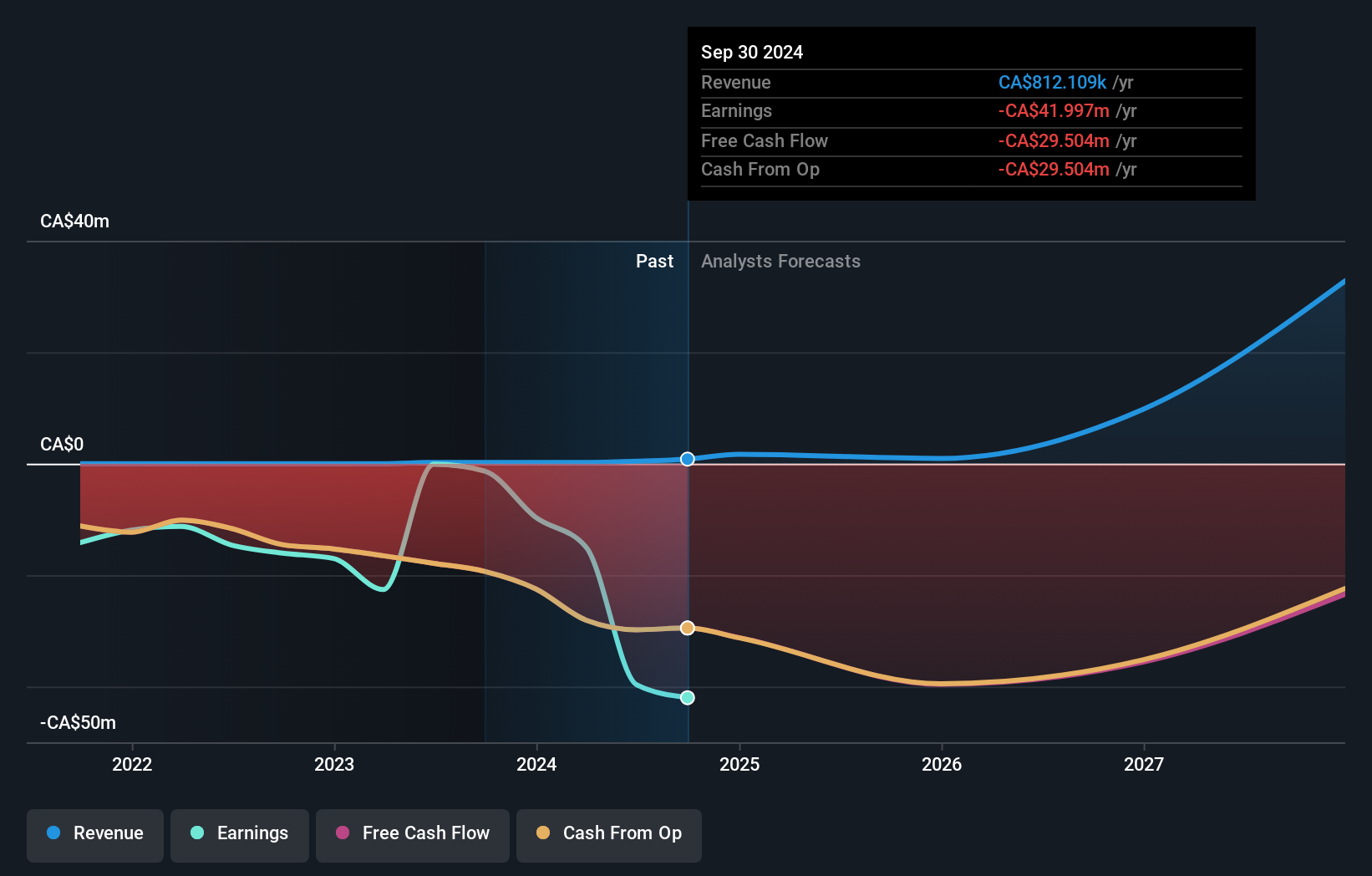

To be a shareholder in Abaxx Technologies right now, you need to believe in the company's ability to successfully commercialize its infrastructure solutions for digitizing and modernizing financial markets, even while it remains unprofitable and reports limited revenue (just under CA$1 million for the year). The recent surge in partnerships, particularly the deal with ARTEX AG, could represent a real shift in momentum for Abaxx by expanding its reach into European, North American, and Asian regulated markets. This integration has the potential to accelerate product adoption and address one of the main short-term catalysts: converting innovation and industry collaborations into meaningful, recurring revenue. However, the core challenges remain visible, with continued losses (CA$10.07 million net loss in Q3 alone) and a premium price-to-book multiple highlighting high market expectations. If the ARTEX partnership delivers tangible revenue or customer traction sooner than expected, some near-term risks could ease, though the need to show steady execution and revenue growth is still critical for investor confidence. Yet, there's a big question about how much this partnership can move the needle on Abaxx’s bottom line and cash needs.

Abaxx Technologies' shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 2 other fair value estimates on Abaxx Technologies - why the stock might be worth over 3x more than the current price!

Build Your Own Abaxx Technologies Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Abaxx Technologies research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Abaxx Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Abaxx Technologies' overall financial health at a glance.

Seeking Other Investments?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NEOE:ABXX

Abaxx Technologies

Engages in developing software tools which enable commodity traders and finance professionals to communicate, trade, and transact in Canada.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives