Will Aduro Clean Technologies' (CNSX:ACT) Netherlands Site Deal Accelerate Its European Expansion Strategy?

Reviewed by Sasha Jovanovic

- On November 10, 2025, Aduro Clean Technologies announced its European subsidiary signed a non-binding Letter of Intent to purchase a brownfield industrial site in the Netherlands for EUR 2 million, aiming to advance its Hydrochemolytic technology demonstration plant.

- This potential acquisition positions Aduro to capitalize on evolving European regulations and industrial demand for certified circular feedstocks within a robust chemical sector.

- We’ll explore how progressing towards a demonstration-scale facility in Europe could shape Aduro’s investment narrative and long-term growth prospects.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Aduro Clean Technologies' Investment Narrative?

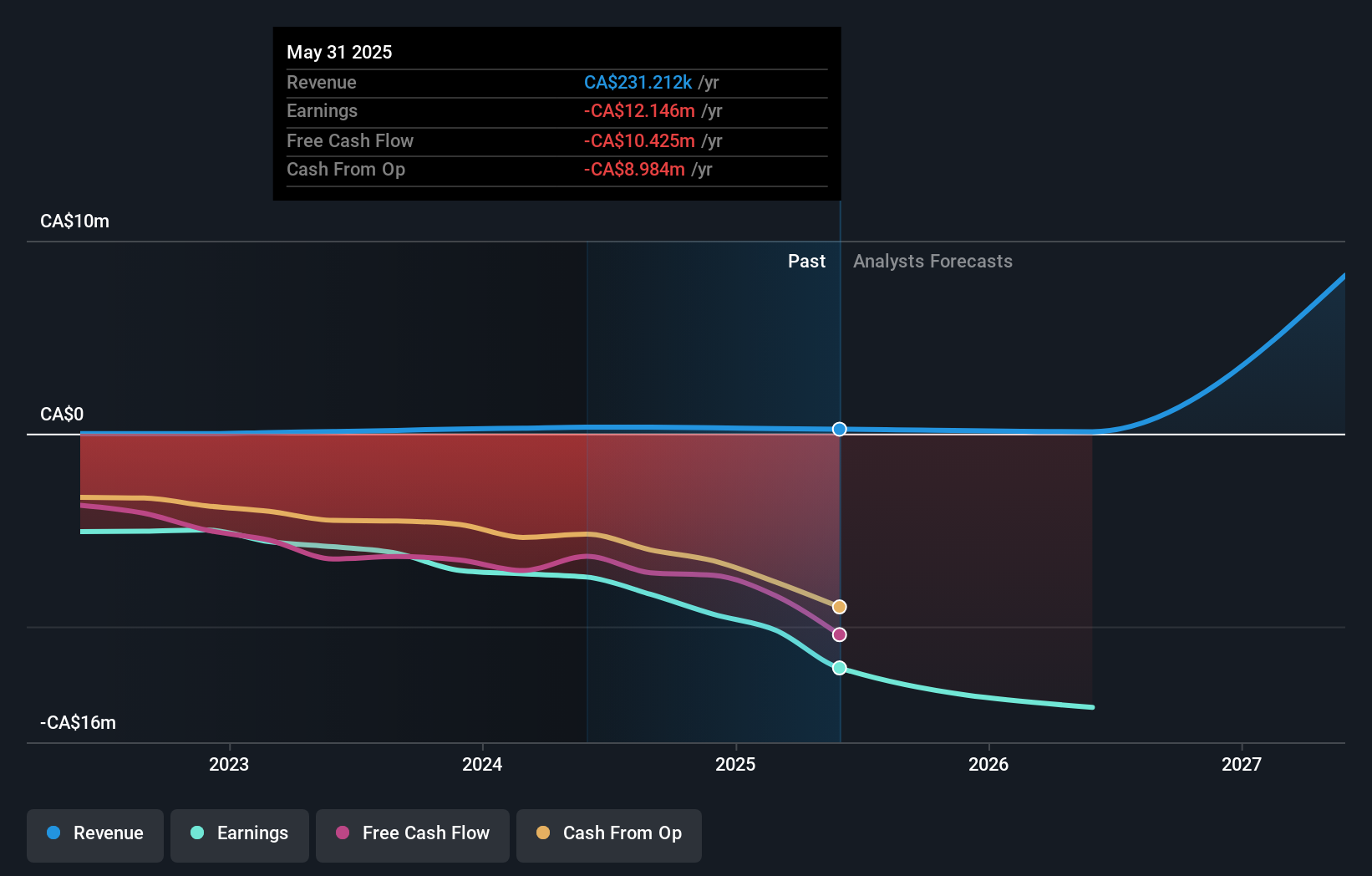

For shareholders, the big picture at Aduro Clean Technologies centers on faith in its ability to convert proprietary recycling technology into meaningful commercial outcomes, despite ongoing operational losses and the absence of near-term profitability. The recent announcement of a non-binding LOI to acquire a brownfield site in the Netherlands could be material to Aduro's story, as it accelerates progress toward a demonstration-scale plant in Europe, potentially boosting credibility and positioning the company to benefit from tightening regulations on recycled materials. This development addresses a key short-term catalyst, validation at commercial scale, and may shift investor attention away from lagging sales and persistent cash burn, at least temporarily. Yet, the cost and risk of scaling up, especially with less than a year of cash runway and continued unprofitability, remain front and center, offering little margin for delays or setbacks. The site selection may well raise hopes, but the execution risk continues to loom large.

In contrast, cash runway risk is something investors must still keep carefully in mind.

Exploring Other Perspectives

Explore 3 other fair value estimates on Aduro Clean Technologies - why the stock might be worth less than half the current price!

Build Your Own Aduro Clean Technologies Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Aduro Clean Technologies research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Aduro Clean Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Aduro Clean Technologies' overall financial health at a glance.

Contemplating Other Strategies?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CNSX:ACT

Aduro Clean Technologies

Engages in developing water-based chemical recycling technologies.

Excellent balance sheet with slight risk.

Market Insights

Community Narratives