- Canada

- /

- Semiconductors

- /

- TSXV:QNC

Why Quantum eMotion (TSXV:QNC) Is Up 36.0% After Launching Quantum-Secured Energy Storage Partnership

Reviewed by Sasha Jovanovic

- Quantum eMotion Corp., Energy Plug Technologies Corp., and Malahat Battery Technology Corp. recently announced a joint development agreement to co-develop and commercialize quantum-secured energy storage and defence systems for critical infrastructure, integrating advanced quantum-safe cybersecurity with Battery Energy Storage Systems and Energy Management Platforms.

- An Indigenous-led partnership and focus on Arctic, defence, and utility-scale smart grids position Quantum eMotion as a key player in quantum-enhanced, cyber-resilient power solutions targeting sensitive government and industrial applications.

- We'll explore how these alliances and the adoption of quantum-grade cybersecurity could reshape Quantum eMotion's long-term investment narrative.

These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Quantum eMotion's Investment Narrative?

For investors considering Quantum eMotion, the story has always hinged on high-stakes innovation and partnerships in quantum-driven cybersecurity, with little current revenue and persistent net losses (CA$1.52 million for Q2). The newly announced alliance with Energy Plug and Malahat Battery stands out as a true pivot in the company’s short-term narrative: for the first time, Quantum eMotion’s core quantum security technologies are being targeted at massive infrastructure and defense applications, and the involvement of an Indigenous-led partner is unique in Canada’s cleantech sector. This could raise the stakes for upcoming catalysts, especially if pilot deployments materialize with major international defense and utility clients. However, the company’s lack of revenue, ongoing dilution, volatile share price, and very high valuation metrics all remain front-and-center risks. While this alliance could help shift perception, investors still face rapid increases in losses and significant uncertainty about commercial impact or sustainable revenue in the short term.

By contrast, recurring losses and share dilution are risks no investor should ignore.

Exploring Other Perspectives

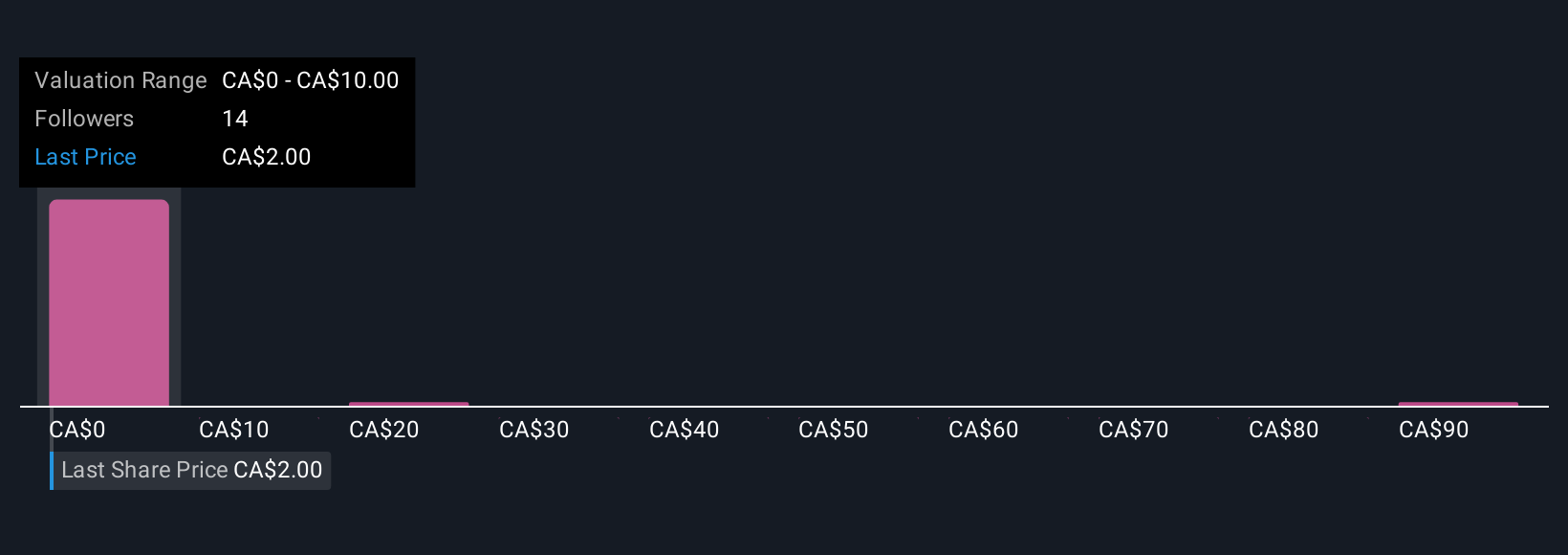

Explore 16 other fair value estimates on Quantum eMotion - why the stock might be a potential multi-bagger!

Build Your Own Quantum eMotion Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Quantum eMotion research is our analysis highlighting 5 important warning signs that could impact your investment decision.

- Our free Quantum eMotion research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Quantum eMotion's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Quantum eMotion might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:QNC

Quantum eMotion

Engages in the development of quantum-based cryptographic solutions in Canada.

Flawless balance sheet with moderate risk.

Market Insights

Community Narratives