- Canada

- /

- Specialty Stores

- /

- TSX:KITS

With Kits Eyecare Ltd. (TSE:KITS) It Looks Like You'll Get What You Pay For

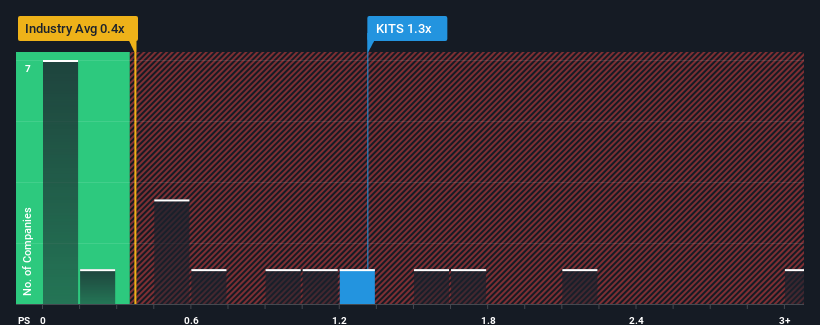

Kits Eyecare Ltd.'s (TSE:KITS) price-to-sales (or "P/S") ratio of 1.3x may not look like an appealing investment opportunity when you consider close to half the companies in the Specialty Retail industry in Canada have P/S ratios below 0.5x. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Kits Eyecare

What Does Kits Eyecare's P/S Mean For Shareholders?

Recent times haven't been great for Kits Eyecare as its revenue has been rising slower than most other companies. Perhaps the market is expecting future revenue performance to undergo a reversal of fortunes, which has elevated the P/S ratio. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Kits Eyecare's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Kits Eyecare's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 21% last year. Pleasingly, revenue has also lifted 169% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 20% each year as estimated by the three analysts watching the company. That's shaping up to be materially higher than the 13% each year growth forecast for the broader industry.

With this information, we can see why Kits Eyecare is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Kits Eyecare's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

You always need to take note of risks, for example - Kits Eyecare has 2 warning signs we think you should be aware of.

If you're unsure about the strength of Kits Eyecare's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Kits Eyecare might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:KITS

Kits Eyecare

Operates a digital eyecare platform in the United States and Canada.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives