- Canada

- /

- Specialty Stores

- /

- TSX:GRGD

Groupe Dynamite (TSX:GRGD): Assessing Valuation After Strong Profits and Upgraded Sales Outlook

Reviewed by Simply Wall St

If you have been watching Groupe Dynamite (TSX:GRGD) lately, you know the stock just grabbed the spotlight. The company reported sharply higher quarterly profits and revenue, with net income jumping from CA$40.36 million to CA$63.89 million compared to a year ago. Alongside these results, management bumped up its full-year comparable store sales outlook by nearly double. They now expect growth in the 17% to 19% range. That kind of move signals real conviction about momentum and clearly caught investors’ attention.

Shares of Groupe Dynamite surged 16% after these numbers came out, reflecting a swift change in how the market is viewing its growth trajectory and risk profile. The stock hasn’t just moved in the past week. Looking over the past three months, returns have stacked up to more than double, indicating a surge in confidence. When you add in recent updates like the ongoing share buyback, it is clear there’s a narrative shift underway around this retailer’s prospects.

But after such strong gains over the year, is there still value for investors or has all that future growth already been priced in?

Price-to-Earnings of 34.5x: Is it justified?

Based on its price-to-earnings (P/E) ratio, Groupe Dynamite is trading at 34.5 times earnings. This makes it appear expensive compared to both the North American Specialty Retail industry average of 19.5x and its peer average of 24.3x.

The price-to-earnings ratio is a key measure of how much investors are willing to pay for each dollar of a company's earnings. It is particularly relevant for evaluating growth expectations within the retail sector. A higher P/E may reflect market confidence in stronger future profit growth and operational performance compared to sector peers, but it can also signal that expectations are running high.

This elevated multiple suggests the market is pricing in significant future growth for Groupe Dynamite, potentially overestimating what the company can deliver relative to its industry and peers. Whether the current momentum justifies this premium remains a core question for investors.

Result: Fair Value of $52.06 (OVERVALUED)

See our latest analysis for Groupe Dynamite.However, rising expectations set a high bar for any future earnings miss or slowdown in sales growth. Either of these factors could quickly dampen current enthusiasm.

Find out about the key risks to this Groupe Dynamite narrative.Another View: What Does the DCF Model Say?

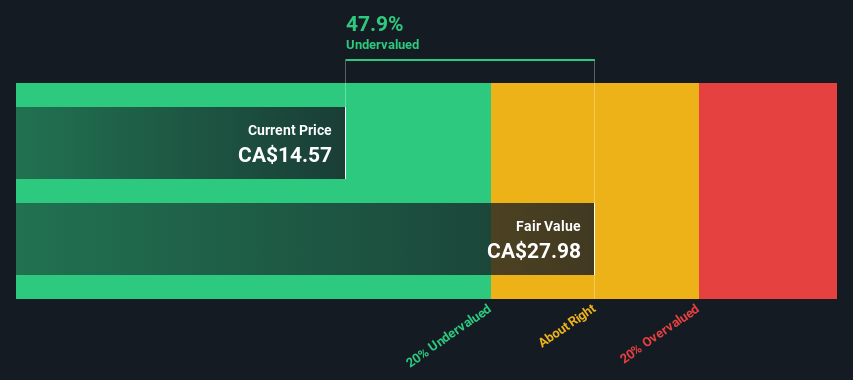

Looking at valuation through our DCF model provides a different perspective. This approach suggests shares could actually be undervalued, which contrasts with what the market's earnings-based multiple implies. So which lens tells the truer story?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Groupe Dynamite Narrative

If you see things differently or want to dig into the numbers yourself, you can pull together your own view in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Groupe Dynamite.

Looking for more investment ideas?

Stop waiting on the sidelines when new opportunities could be just a click away. Use the Simply Wall Street Screener to target powerful themes driving tomorrow's market leaders.

- Supercharge your strategy by targeting stocks trading below their cash flow value with undervalued stocks based on cash flows.

- Tap into the momentum behind innovative companies transforming medicine and patient care through healthcare AI stocks.

- Unlock hidden gems poised for explosive growth with penny stocks with strong financials.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:GRGD

Groupe Dynamite

Designs, distributes, and sells women’s apparel under the Dynamite and Garage brand names in Canada and the United States.

Outstanding track record with excellent balance sheet.

Market Insights

Community Narratives