- Canada

- /

- Specialty Stores

- /

- TSX:GBT

This Is Why BMTC Group Inc.'s (TSE:GBT) CEO Compensation Looks Appropriate

The performance at BMTC Group Inc. (TSE:GBT) has been rather lacklustre of late and shareholders may be wondering what CEO Marie-Berthe Groseillers is planning to do about this. They will get a chance to exercise their voting power to influence the future direction of the company in the next AGM on 10 June 2021. It has been shown that setting appropriate executive remuneration incentivises the management to act in the interests of shareholders. In our opinion, CEO compensation does not look excessive and we discuss why.

Check out our latest analysis for BMTC Group

Comparing BMTC Group Inc.'s CEO Compensation With the industry

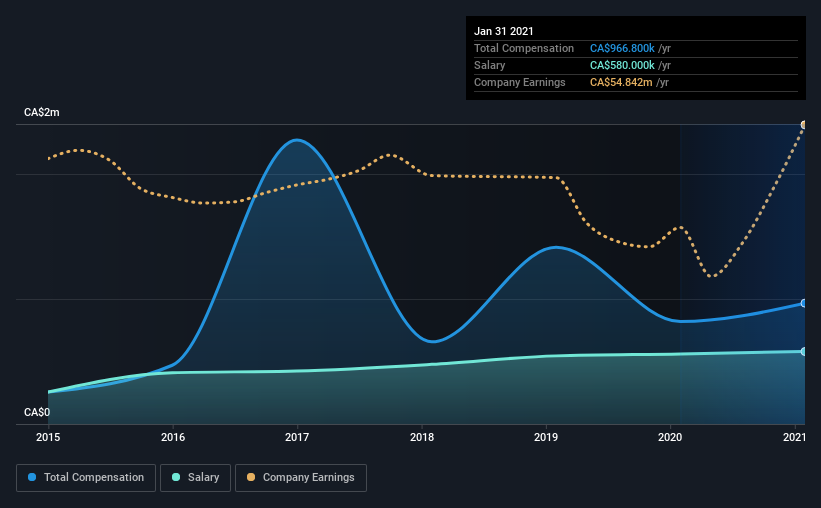

Our data indicates that BMTC Group Inc. has a market capitalization of CA$466m, and total annual CEO compensation was reported as CA$967k for the year to January 2021. Notably, that's an increase of 18% over the year before. In particular, the salary of CA$580.0k, makes up a fairly large portion of the total compensation being paid to the CEO.

For comparison, other companies in the same industry with market capitalizations ranging between CA$242m and CA$969m had a median total CEO compensation of CA$2.6m. That is to say, Marie-Berthe Groseillers is paid under the industry median. What's more, Marie-Berthe Groseillers holds CA$941k worth of shares in the company in their own name.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | CA$580k | CA$560k | 60% |

| Other | CA$387k | CA$259k | 40% |

| Total Compensation | CA$967k | CA$819k | 100% |

On an industry level, roughly 51% of total compensation represents salary and 49% is other remuneration. According to our research, BMTC Group has allocated a higher percentage of pay to salary in comparison to the wider industry. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at BMTC Group Inc.'s Growth Numbers

BMTC Group Inc.'s earnings per share (EPS) grew 8.8% per year over the last three years. In the last year, its revenue is down 9.8%.

We generally like to see a little revenue growth, but the modest improvement in EPS is good. It's hard to reach a conclusion about business performance right now. This may be one to watch. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has BMTC Group Inc. Been A Good Investment?

Given the total shareholder loss of 5.0% over three years, many shareholders in BMTC Group Inc. are probably rather dissatisfied, to say the least. This suggests it would be unwise for the company to pay the CEO too generously.

To Conclude...

It may not be surprising to some that the recent weak performance in the share price may be driven in part by rather flat EPS growth. In the upcoming AGM, shareholders will get the opportunity to discuss any concerns with the board and assess if the board's plan is likely to improve company performance.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. That's why we did some digging and identified 1 warning sign for BMTC Group that you should be aware of before investing.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if BMTC Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:GBT

BMTC Group

Manages and operates a retail network of furniture, household appliances, and electronic products in Canada.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives