Earnings Dip and Bold Brand Moves Might Change the Case for Investing in Canadian Tire (TSX:CTC.A)

Reviewed by Sasha Jovanovic

- Canadian Tire Corporation reported third quarter 2025 earnings showing a net income of CA$169.1 million, down from CA$200.6 million a year ago, and announced a share buyback plan, an annual dividend increase, and the upcoming relaunch of the Hudson's Bay Stripes brand in stores nationwide starting December 5, 2025.

- The company is pursuing both financial and brand initiatives, including its 16th consecutive dividend increase and revitalization of a historic Canadian brand following the acquisition of Hudson's Bay Company's brand assets earlier this year.

- We'll review how Canadian Tire's earnings update and Hudson's Bay Stripes launch may influence its investment outlook and future growth expectations.

We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Canadian Tire Corporation Investment Narrative Recap

To be a shareholder in Canadian Tire Corporation, it's important to believe in the company’s ability to grow earnings and defend its place in Canadian retail through strong brands, operational improvements, and omnichannel strategies. The recent earnings report, which showed a decrease in net income, does not materially change the biggest short-term catalyst, a potential boost from the relaunch of the Hudson’s Bay Stripes collection, or the primary risk, which remains the impact of increasing fixed and variable costs on margins.

Among the recent announcements, the long-awaited relaunch of the Hudson’s Bay Stripes brand stands out as most relevant. This initiative ties directly into Canadian Tire’s strategy of leveraging owned brand assets for differentiation and margin improvement, aligning with current efforts to drive store traffic and stimulate sales in a changing consumer environment.

However, despite new brand launches and digital investments, investors should be aware that rising cost pressures and margin risks could still ...

Read the full narrative on Canadian Tire Corporation (it's free!)

Canadian Tire Corporation is forecast to reach CA$16.9 billion in revenue and CA$732.2 million in earnings by 2028. This outlook assumes a 0.4% annual decline in revenue and a CA$83.4 million decrease in earnings from the current level of CA$815.6 million.

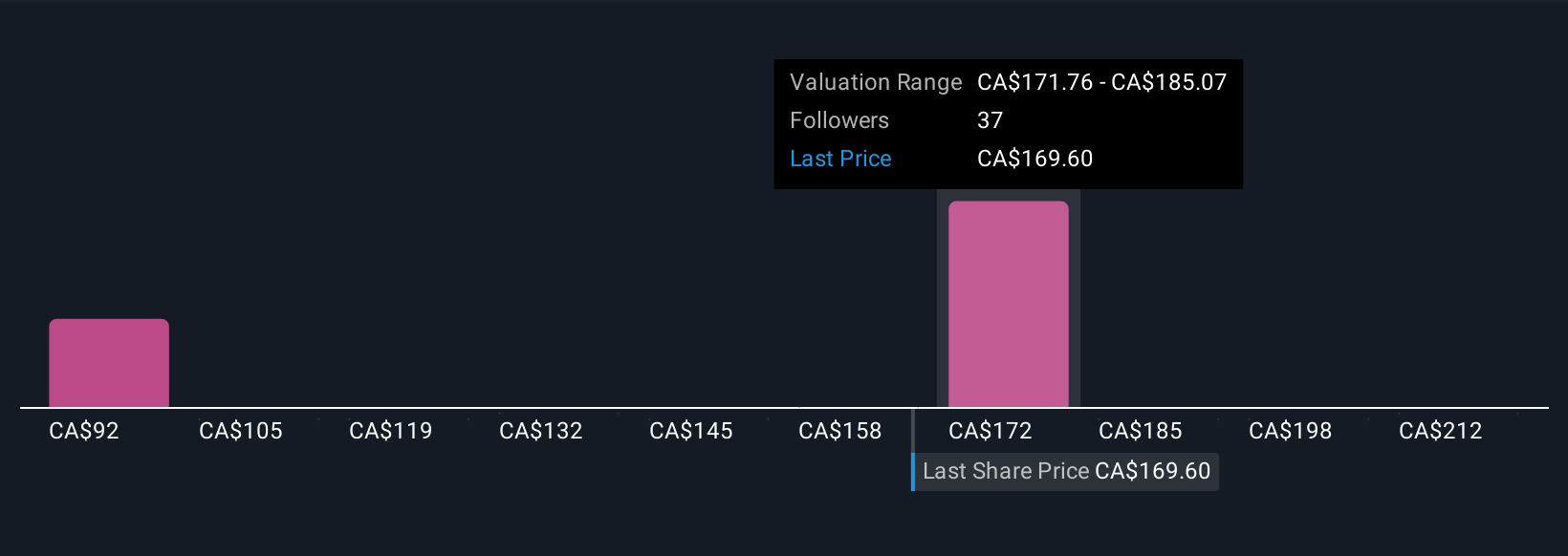

Uncover how Canadian Tire Corporation's forecasts yield a CA$174.91 fair value, a 3% upside to its current price.

Exploring Other Perspectives

Eight fair value estimates from the Simply Wall St Community span from CA$84 to CA$225, reflecting sharply varied outlooks on Canadian Tire’s potential. With cost inflation and delayed efficiency gains cited as key risks, you can see why opinions differ so widely, see how your expectations compare.

Explore 8 other fair value estimates on Canadian Tire Corporation - why the stock might be worth as much as 32% more than the current price!

Build Your Own Canadian Tire Corporation Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Canadian Tire Corporation research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Canadian Tire Corporation research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Canadian Tire Corporation's overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CTC.A

Canadian Tire Corporation

Provides a range of retail goods and services in Canada.

Established dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives