- Canada

- /

- Specialty Stores

- /

- TSX:ACQ

AutoCanada Inc.'s (TSE:ACQ) Shares Leap 28% Yet They're Still Not Telling The Full Story

AutoCanada Inc. (TSE:ACQ) shareholders would be excited to see that the share price has had a great month, posting a 28% gain and recovering from prior weakness. Looking back a bit further, it's encouraging to see the stock is up 44% in the last year.

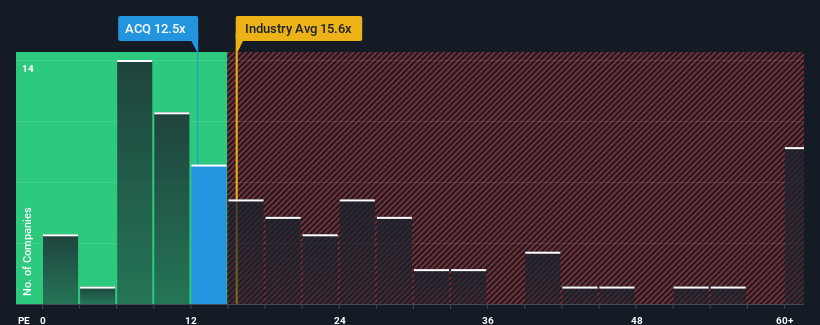

Although its price has surged higher, you could still be forgiven for feeling indifferent about AutoCanada's P/E ratio of 12.5x, since the median price-to-earnings (or "P/E") ratio in Canada is also close to 14x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

AutoCanada has been struggling lately as its earnings have declined faster than most other companies. One possibility is that the P/E is moderate because investors think the company's earnings trend will eventually fall in line with most others in the market. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. Or at the very least, you'd be hoping it doesn't keep underperforming if your plan is to pick up some stock while it's not in favour.

View our latest analysis for AutoCanada

How Is AutoCanada's Growth Trending?

The only time you'd be comfortable seeing a P/E like AutoCanada's is when the company's growth is tracking the market closely.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 35%. This has erased any of its gains during the last three years, with practically no change in EPS being achieved in total. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Shifting to the future, estimates from the nine analysts covering the company suggest earnings should grow by 31% over the next year. Meanwhile, the rest of the market is forecast to only expand by 19%, which is noticeably less attractive.

In light of this, it's curious that AutoCanada's P/E sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Bottom Line On AutoCanada's P/E

AutoCanada's stock has a lot of momentum behind it lately, which has brought its P/E level with the market. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that AutoCanada currently trades on a lower than expected P/E since its forecast growth is higher than the wider market. There could be some unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

There are also other vital risk factors to consider and we've discovered 2 warning signs for AutoCanada (1 is a bit unpleasant!) that you should be aware of before investing here.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:ACQ

AutoCanada

Through its subsidiaries, operates franchised automobile dealerships and related business.

Slight risk and fair value.

Similar Companies

Market Insights

Community Narratives