- New Zealand

- /

- REITS

- /

- NZSE:ARG

3 Undervalued Small Caps In Global With Recent Insider Buying

Reviewed by Simply Wall St

As global markets experience shifts driven by rate cut expectations and AI optimism, small-cap stocks have been gaining attention, with the Russell 2000 Index marking its sixth consecutive week of gains. In this dynamic environment, identifying promising small-cap stocks often involves looking for those with strong fundamentals and recent insider buying activity, which can signal confidence in their future prospects.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| GDI Integrated Facility Services | 18.2x | 0.3x | 4.63% | ★★★★★☆ |

| Bytes Technology Group | 17.8x | 4.5x | 9.51% | ★★★★☆☆ |

| BWP Trust | 9.9x | 12.9x | 14.84% | ★★★★☆☆ |

| Hung Hing Printing Group | NA | 0.4x | 42.69% | ★★★★☆☆ |

| Sagicor Financial | 7.6x | 0.4x | -79.73% | ★★★★☆☆ |

| Daiwa House Logistics Trust | 13.5x | 7.0x | 9.98% | ★★★★☆☆ |

| Pizu Group Holdings | 12.1x | 1.2x | 41.33% | ★★★☆☆☆ |

| Morguard North American Residential Real Estate Investment Trust | 6.8x | 1.8x | 18.49% | ★★★☆☆☆ |

| CVS Group | 46.5x | 1.3x | 36.14% | ★★★☆☆☆ |

| Asante Gold | NA | 1.8x | 0.22% | ★★★☆☆☆ |

We're going to check out a few of the best picks from our screener tool.

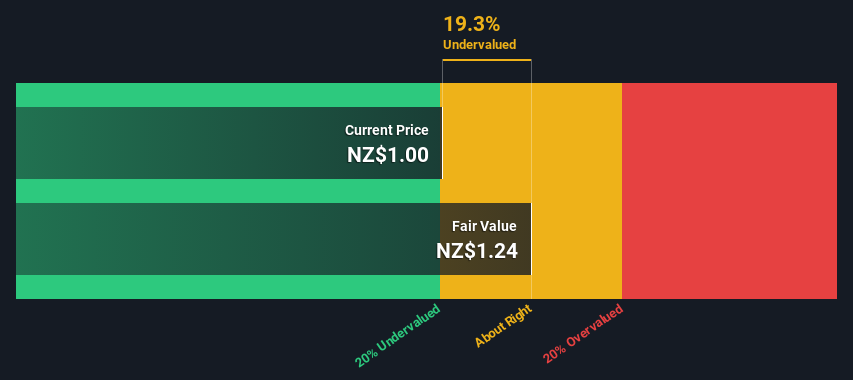

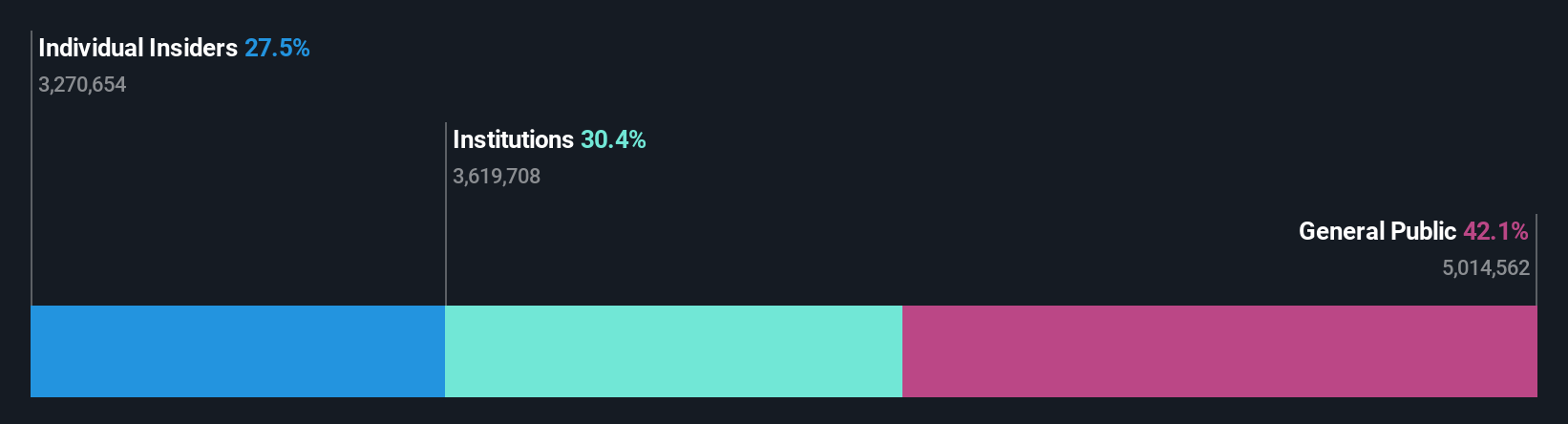

Argosy Property (NZSE:ARG)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Argosy Property is a New Zealand-based real estate investment trust focused on investing in and managing a diversified portfolio of industrial, office, and retail properties with a market cap of approximately NZ$1.48 billion.

Operations: Argosy Property's revenue model primarily involves generating income through its operations, with a notable focus on maintaining a strong gross profit margin, which was 81.38% in September 2016 and declined to 75.06% by March 2025. The cost of goods sold (COGS) has shown an upward trend over the years, impacting the company's profitability metrics. Operating expenses have remained relatively stable around NZ$11 million during recent periods, while non-operating expenses have fluctuated significantly, affecting net income outcomes.

PE: 8.4x

Argosy Property, a smaller company in the property sector, has recently expanded its bank facilities by NZ$100 million to a total of NZ$625 million, enhancing its financial flexibility. The company's funding structure relies entirely on external borrowing, which carries higher risk compared to customer deposits. Insider confidence is evident with Peter Mence's purchase of 181,774 shares valued at approximately NZ$199,550. Despite high-quality earnings and recent dividend announcements, future earnings are expected to decline by 3.7% annually over the next three years.

- Delve into the full analysis valuation report here for a deeper understanding of Argosy Property.

Understand Argosy Property's track record by examining our Past report.

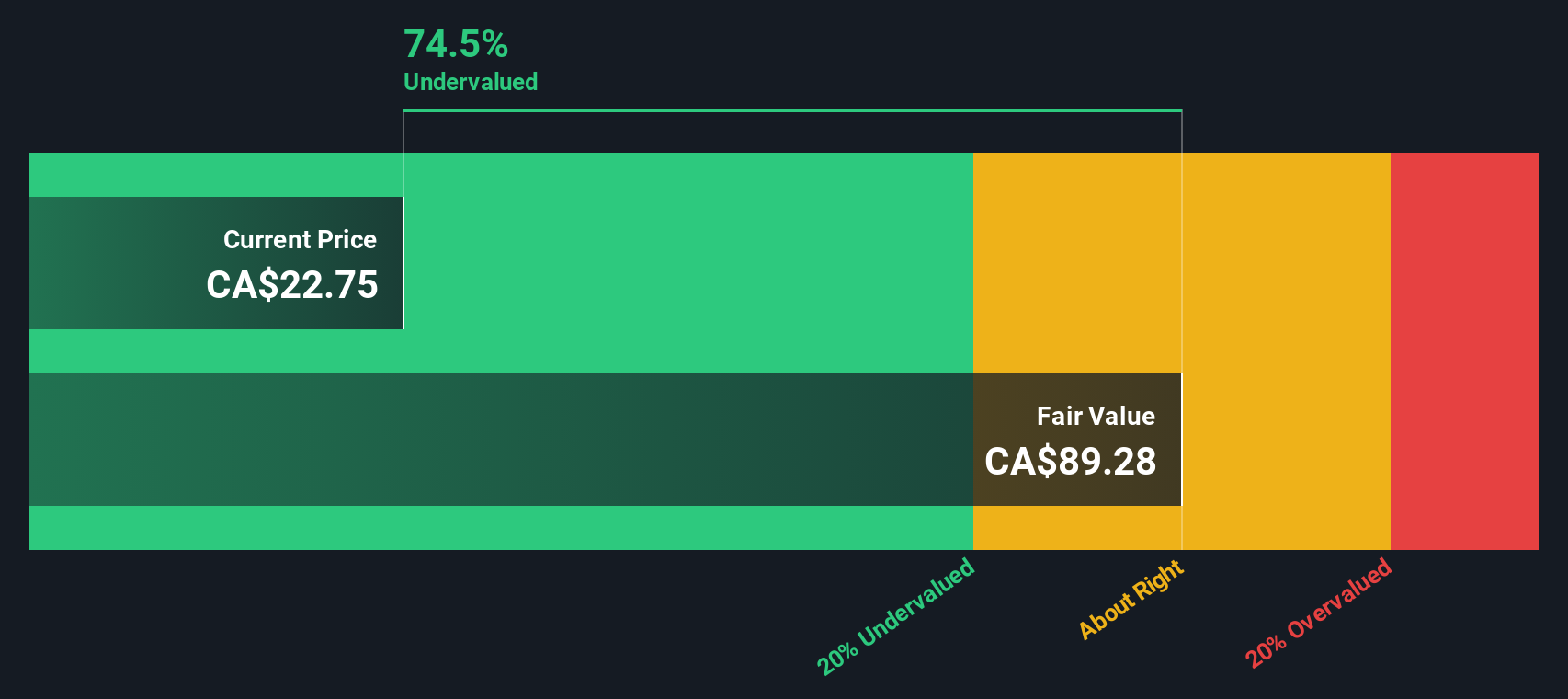

AutoCanada (TSX:ACQ)

Simply Wall St Value Rating: ★★★★☆☆

Overview: AutoCanada operates as a multi-location automobile dealership group in Canada, with a market capitalization of CA$0.49 billion.

Operations: AutoCanada generates revenue primarily from its Retail Automobile Dealerships, with the latest reported figure at CA$5.34 billion. The company's cost of goods sold (COGS) for the same period was CA$4.45 billion, resulting in a gross profit of CA$887.35 million and a gross profit margin of 16.63%. Operating expenses totaled CA$719.75 million, impacting net income which stood at CA$50.84 million with a net income margin of 0.95%.

PE: 15.6x

AutoCanada, a smaller player in the automotive retail sector, has shown signs of financial improvement despite facing challenges. For Q2 2025, they reported net income of C$17.36 million, reversing a loss from the previous year. Basic earnings per share rose to C$0.75 from a loss of C$1.47 previously. However, earnings are projected to decline by 29% annually over the next three years due to high-risk external funding and insufficient interest coverage by earnings. Recent board changes include Felix-Etienne Lebel's appointment, bringing extensive private equity expertise that could influence strategic direction positively amidst these financial hurdles.

- Get an in-depth perspective on AutoCanada's performance by reading our valuation report here.

Examine AutoCanada's past performance report to understand how it has performed in the past.

Hammond Power Solutions (TSX:HPS.A)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Hammond Power Solutions is a company focused on the manufacture and sale of transformers, with a market capitalization of CA$0.59 billion.

Operations: The company's revenue primarily comes from the manufacture and sale of transformers, with recent figures showing CA$826.27 million in revenue. Over time, the gross profit margin has shown a notable upward trend, reaching 33.46% recently. Operating expenses are significant, with sales and marketing being a major component alongside general and administrative costs.

PE: 17.4x

Hammond Power Solutions, a smaller player in the industry, is actively seeking acquisitions to leverage its expanded factory capacity amidst growing global demand for data and electricity. Despite a dip in quarterly net income to C$13.38 million from C$23.59 million last year, their sales climbed to C$224.42 million from C$197.21 million, showcasing potential for future growth. Insider confidence is evident with recent share purchases by key figures within the company, signaling belief in its long-term prospects.

- Dive into the specifics of Hammond Power Solutions here with our thorough valuation report.

Learn about Hammond Power Solutions' historical performance.

Make It Happen

- Get an in-depth perspective on all 102 Undervalued Global Small Caps With Insider Buying by using our screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NZSE:ARG

Argosy Property

Argosy Property Limited (APL or the Company) is an FMC Reporting Entity under the Financial Markets Conduct Act 2013 and the Financial Reporting Act 2013.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives