- Canada

- /

- Real Estate

- /

- TSXV:HMT

We're Not So Sure You Should Rely on Halmont Properties's (CVE:HMT) Statutory Earnings

As a general rule, we think profitable companies are less risky than companies that lose money. That said, the current statutory profit is not always a good guide to a company's underlying profitability. In this article, we'll look at how useful this year's statutory profit is, when analysing Halmont Properties (CVE:HMT).

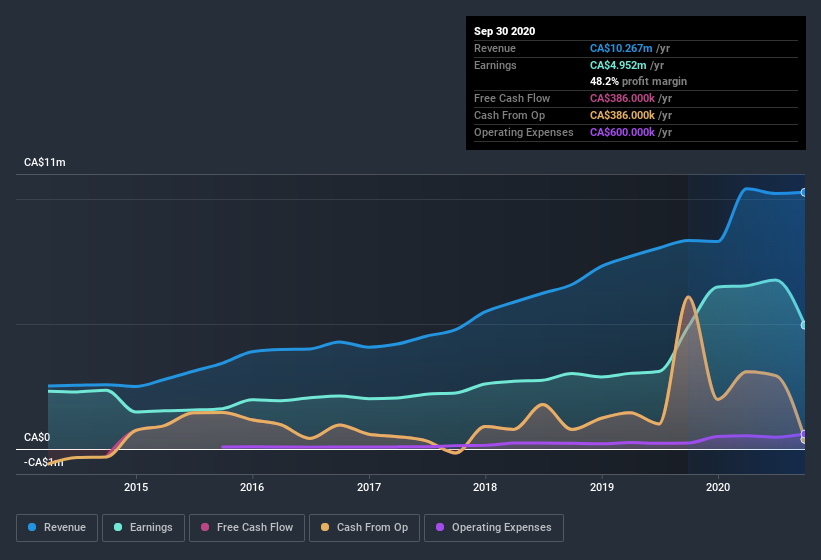

It's good to see that over the last twelve months Halmont Properties made a profit of CA$4.95m on revenue of CA$10.3m. Happily, it has grown both its profit and revenue over the last three years, as you can see in the chart below.

See our latest analysis for Halmont Properties

Not all profits are equal, and we can learn more about the nature of a company's past profitability by diving deeper into the financial statements. Today, we'll look at how the recent spike in non-operating revenue has impacted Halmont Properties' most recent results. Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Halmont Properties.

The Power Of Non-Operating Revenue

At most companies, some revenue streams, such as government grants, are accounted for as non-operating revenue, while the core business is said to produce operating revenue. Oftentimes, non-operating revenue spikes are not repeated, so it makes sense to be cautious where non-operating revenue has made a very large contribution to total profit. Importantly, the non-operating revenue often comes without associated ongoing costs, so it can boost profit by letting it fall straight to the bottom line, making the operating business seem better than it really is. Notably, Halmont Properties had a significant increase in non-operating revenue over the last year. Indeed, its non-operating revenue spiked from CA$8.34m last year to CA$10.3m this year. The high levels of non-operating are problematic because if (and when) they do not repeat, then overall revenue (and profitability) of the firm will fall. In order to better understand a company's profit result, it can sometimes help to consider whether the result would be very different without a sudden increase in non-operating revenue.

Our Take On Halmont Properties' Profit Performance

Because Halmont Properties' non-operating revenue spiked quite noticeably last year, you could argue that a focus on statutory profit would be too generous because profits may drop back in the future (when that non-operating revenue is not repeated). For this reason, we think that Halmont Properties' statutory profits may be a bad guide to its underlying earnings power, and might give investors an overly positive impression of the company. But the good news is that its EPS growth over the last three years has been very impressive. At the end of the day, it's essential to consider more than just the factors above, if you want to understand the company properly. So while earnings quality is important, it's equally important to consider the risks facing Halmont Properties at this point in time. For example, Halmont Properties has 2 warning signs (and 1 which makes us a bit uncomfortable) we think you should know about.

This note has only looked at a single factor that sheds light on the nature of Halmont Properties' profit. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you decide to trade Halmont Properties, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Halmont Properties might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSXV:HMT

Moderate risk with mediocre balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success