- Canada

- /

- Retail REITs

- /

- TSX:REI.UN

RioCan (TSX:REI.UN) Valuation in Focus After Swing to Net Loss on Q3 Earnings

Reviewed by Simply Wall St

RioCan Real Estate Investment Trust (TSX:REI.UN) just released its third quarter earnings, showing revenue growth but swinging from a net income to a net loss compared to last year. This shift is drawing close attention from investors.

See our latest analysis for RioCan Real Estate Investment Trust.

Following the earnings release and the swing to a net loss, RioCan’s share price has held relatively steady in recent weeks. Over the past year, investors have seen a total shareholder return of 5.74%. The long-term picture is even more robust with a 46% total return over five years, suggesting momentum is still in play for patient holders.

If this mix of resilience and long-term growth appeals to you, it might be the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

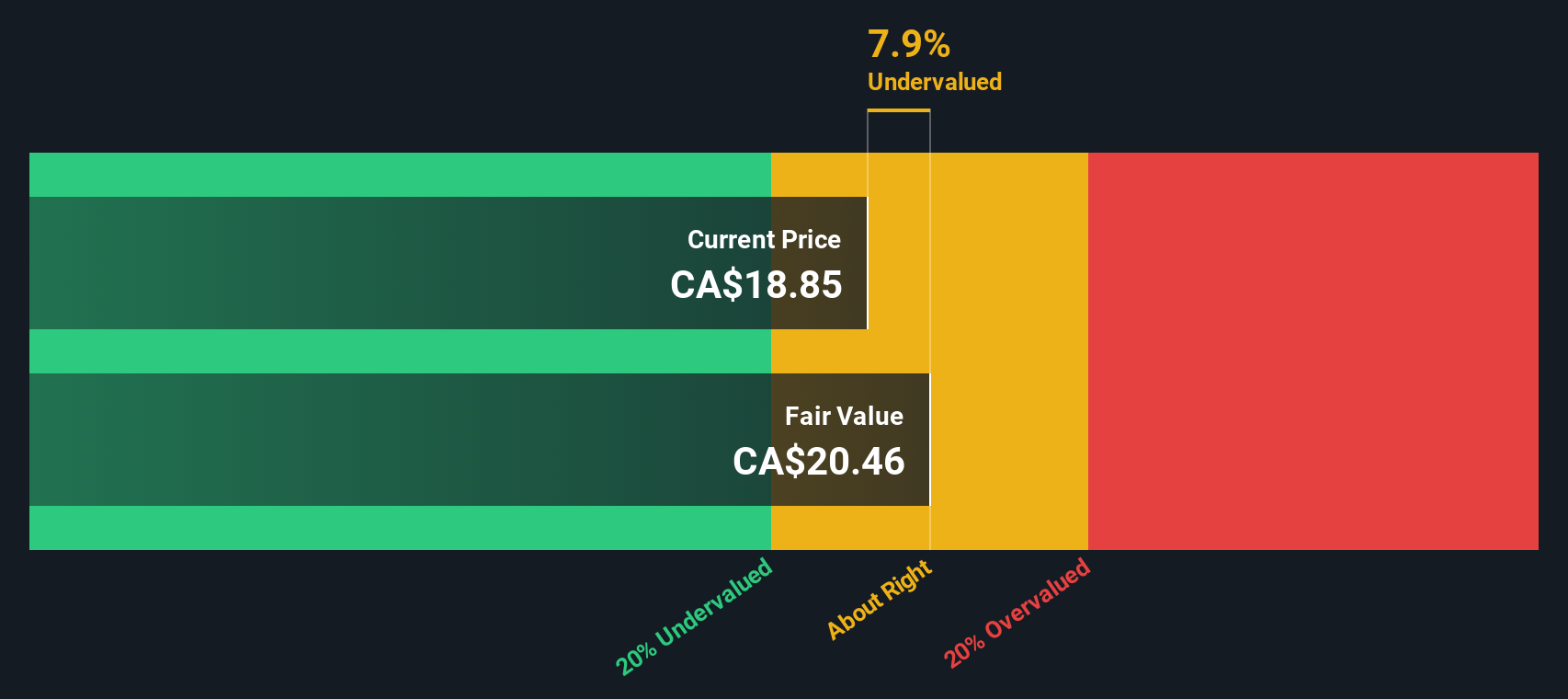

With RioCan trading at a slight discount to analyst targets and its recent results showing both growth and challenges, the real question is whether the stock is undervalued right now or if the market has already accounted for its future prospects.

Price-to-Earnings of 83.2x: Is it justified?

RioCan's current price-to-earnings (P/E) ratio of 83.2x is significantly higher than both its peers and the broader industry. At CA$18.83, the last close price reflects positive expectations, but does the lofty multiple have support?

The price-to-earnings ratio reflects how much investors are willing to pay for each dollar of earnings. For a retail REIT, P/E can signal projected growth or confidence in profit stability, but can also highlight pricing inefficiency if the numbers do not align. With RioCan's negative earnings growth over the past year and recent profitability challenges, the market might be factoring in a rapid turnaround or optimistic future profits.

Compared to the North American Retail REITs industry average of 23.4x and peer average of 14.3x, RioCan appears much more expensive. The estimated fair P/E of 29.6x suggests a level the market could revert to if current expectations do not materialize.

Explore the SWS fair ratio for RioCan Real Estate Investment Trust

Result: Price-to-Earnings of 83.2x (OVERVALUED)

However, risks remain, including potential underperformance if revenue growth stalls or if broader market volatility affects retail REIT valuations.

Find out about the key risks to this RioCan Real Estate Investment Trust narrative.

Another View: Discounted Cash Flow Says "Undervalued"

Turning to the SWS DCF model, the outlook changes. Based on projected cash flows, RioCan appears to be undervalued by about 11 percent compared to its estimated fair value of CA$21.21. This result sharply contrasts with the story suggested by its high earnings multiple. Could the market be missing something that the model identifies?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out RioCan Real Estate Investment Trust for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 868 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own RioCan Real Estate Investment Trust Narrative

If you see these results differently or want a deeper dive into the data, you can build your own RioCan narrative in just a few minutes. Do it your way

A great starting point for your RioCan Real Estate Investment Trust research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t limit your portfolio to just one opportunity. The smartest investors scan the markets for new themes, trends, and hidden value before others catch on. Make your next move now with these proven ideas:

- Capitalize on major tech breakthroughs and ride the AI wave by checking out these 24 AI penny stocks poised for exceptional growth.

- Cement your income strategy and secure attractive yields when you explore these 16 dividend stocks with yields > 3% offering sustainable payouts above 3%.

- Leap ahead in digital finance by tapping into these 82 cryptocurrency and blockchain stocks at the forefront of blockchain and cryptocurrency innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:REI.UN

RioCan Real Estate Investment Trust

RioCan meets the everyday shopping needs of Canadians through the ownership, management and development of necessity-based and mixed-use properties in densely populated communities.

Average dividend payer with slight risk.

Market Insights

Community Narratives