- Canada

- /

- Retail REITs

- /

- TSX:PMZ.UN

Primaris REIT (TSX:PMZ.UN) Margin Miss Challenges Bullish Growth Narrative After CA$98.9M One-Off Loss

Reviewed by Simply Wall St

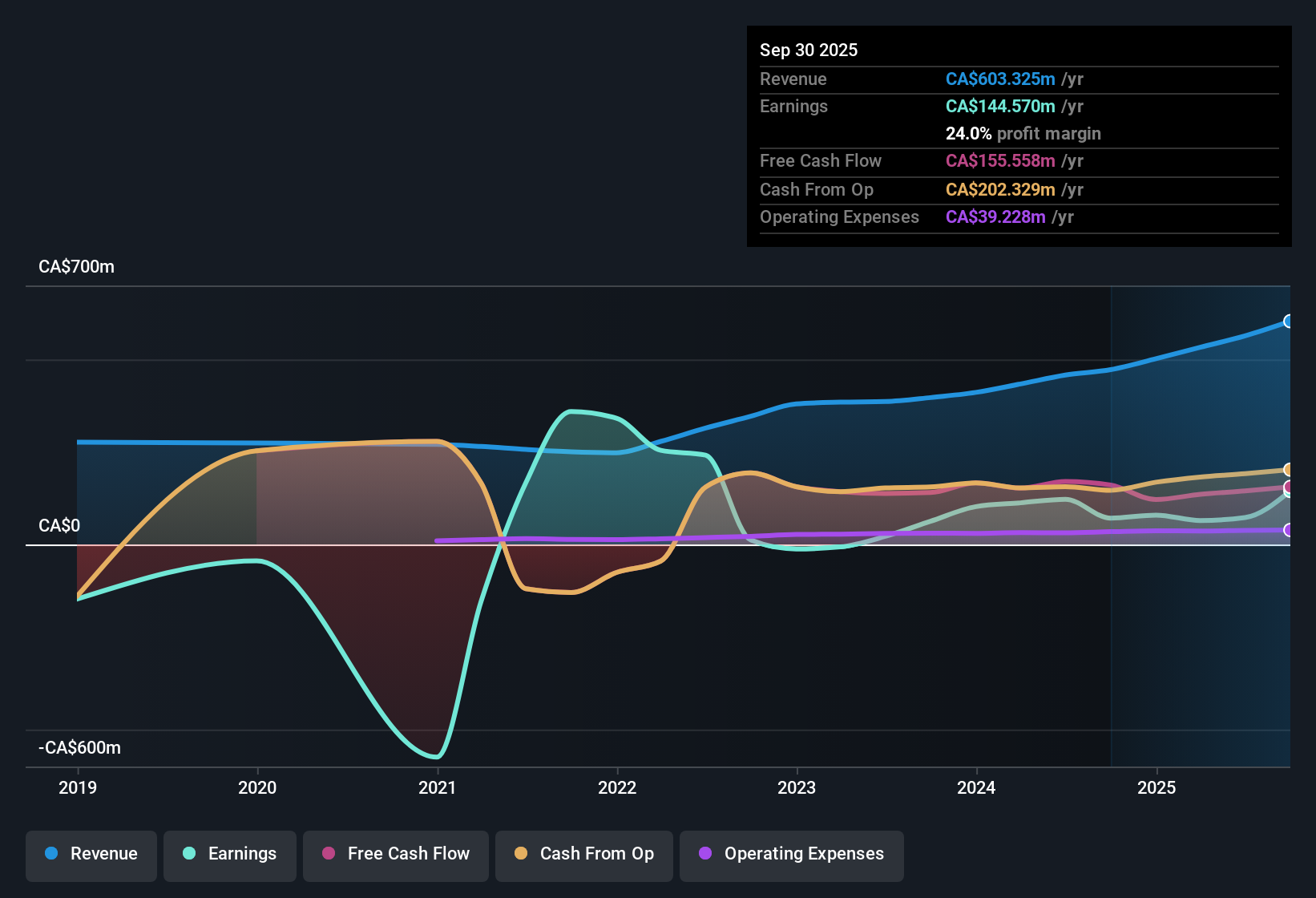

Primaris Real Estate Investment Trust (TSX:PMZ.UN) is on track for annual earnings growth of 12.74%, which is ahead of the Canadian market's 11.7% expectation. Revenue is forecast to rise 8.7% per year, surpassing the market's 5% projection. Despite these forward-looking gains, the latest net profit margin fell to 12.9% from last year's 26.7%. This reflects a squeeze in profitability and the impact of a CA$98.9 million one-off loss in the past twelve months. Shares are currently trading at CA$15.15, which is well below an estimated fair value of CA$36.57. However, the price-to-earnings ratio of 24.6x is above that of peers, making valuation a nuanced part of the story for investors.

See our full analysis for Primaris Real Estate Investment Trust.Next, we will weigh these headline results against the market’s existing narratives to highlight whether expectations are being met or defied.

Curious how numbers become stories that shape markets? Explore Community Narratives

One-Off Loss Alters Margins Picture

- The net profit margin has dropped sharply to 12.9%, driven in large part by a significant CA$98.9 million one-off loss in the last twelve months.

- Despite robust underlying growth forecasts, the prevailing view notes that recent profitability setbacks, such as the sudden appearance of this large non-recurring expense, raise questions about the consistency of cash flows.

- This margin compression, even as PMZ.UN remains profitable, raises concern about the smoothing effect of infrequent but material charges.

- Investors will be watching whether future periods show recovery or if cost pressures persist despite positive long-term earnings momentum.

Five-Year Profitability Trends Remain Positive

- PMZ.UN has shifted into profitability over five years with an average annual earnings growth rate of 16.1%, marking a durable turnaround despite temporary setbacks.

- The prevailing market narrative examines how this newfound profit resilience contrasts with near-term setbacks, underscoring a tension between the trust’s proven multi-year growth rate and recent margin compression.

- Long-term gains help to counterbalance the one-time loss impact, suggesting the margin decline may be a temporary blip given the broader profitability trend.

- Yet, investors keen on income stability must weigh the risk of future one-offs against management’s history of improving performance across cycles.

Valuation Gap and Premiums Create a Complex Mix

- Shares trade at CA$15.15, far below the DCF fair value of CA$36.57, though the trust’s 24.6x price/earnings ratio runs both above peers (16.8x) and just over the industry average (24x).

- Market watchers highlight the unusual dynamic where PMZ.UN appears deeply undervalued versus its estimated fair value, yet also sports a premium multiple that typically signals growth, but may reflect lingering caution after the large loss.

- While the discount to intrinsic value may tempt value-seeking investors, bulls and bears alike question if the high relative P/E means future expectations are already priced in.

- This blend of a wide fair value gap and elevated peer premium keeps the debate open on whether shares present a true bargain or conceal hidden risks.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Primaris Real Estate Investment Trust's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Although Primaris REIT’s long-term earnings growth is strong, recent one-off losses and sharp margin compression highlight risks to consistent profitability and cash flow stability.

If you want steadier returns through market cycles, use our stable growth stocks screener (2112 results) to discover companies delivering reliable growth without unexpected profit shocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:PMZ.UN

Primaris Real Estate Investment Trust

Primaris is Canada’s only enclosed shopping centre focused REIT, with ownership interests primarily in enclosed shopping centres in Canadian markets.

Reasonable growth potential with slight risk.

Market Insights

Community Narratives