- Canada

- /

- Retail REITs

- /

- TSX:PLZ.UN

Undervalued Small Caps With Insider Buying In Global October 2025

Reviewed by Simply Wall St

In the current global market landscape, small-cap stocks have been gaining traction as the Russell 2000 Index outperformed large-cap indices, buoyed by lower-than-expected U.S. inflation and a resilient business activity outlook. As investors navigate these conditions, identifying stocks with strong fundamentals and positive insider buying trends can be crucial for uncovering potential opportunities in this dynamic segment.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Bytes Technology Group | 16.4x | 4.0x | 21.26% | ★★★★★☆ |

| Speedy Hire | NA | 0.3x | 29.01% | ★★★★★☆ |

| GDI Integrated Facility Services | 18.7x | 0.3x | 2.49% | ★★★★☆☆ |

| BWP Trust | 10.5x | 13.7x | 10.29% | ★★★★☆☆ |

| Hung Hing Printing Group | NA | 0.4x | 43.95% | ★★★★☆☆ |

| Morguard North American Residential Real Estate Investment Trust | 6.7x | 1.8x | 20.65% | ★★★★☆☆ |

| Sagicor Financial | 7.1x | 0.4x | -70.49% | ★★★★☆☆ |

| Senior | 24.8x | 0.8x | 26.15% | ★★★★☆☆ |

| Bumitama Agri | 11.9x | 1.7x | 41.93% | ★★★☆☆☆ |

| Ever Sunshine Services Group | 6.7x | 0.4x | -437.00% | ★★★☆☆☆ |

We're going to check out a few of the best picks from our screener tool.

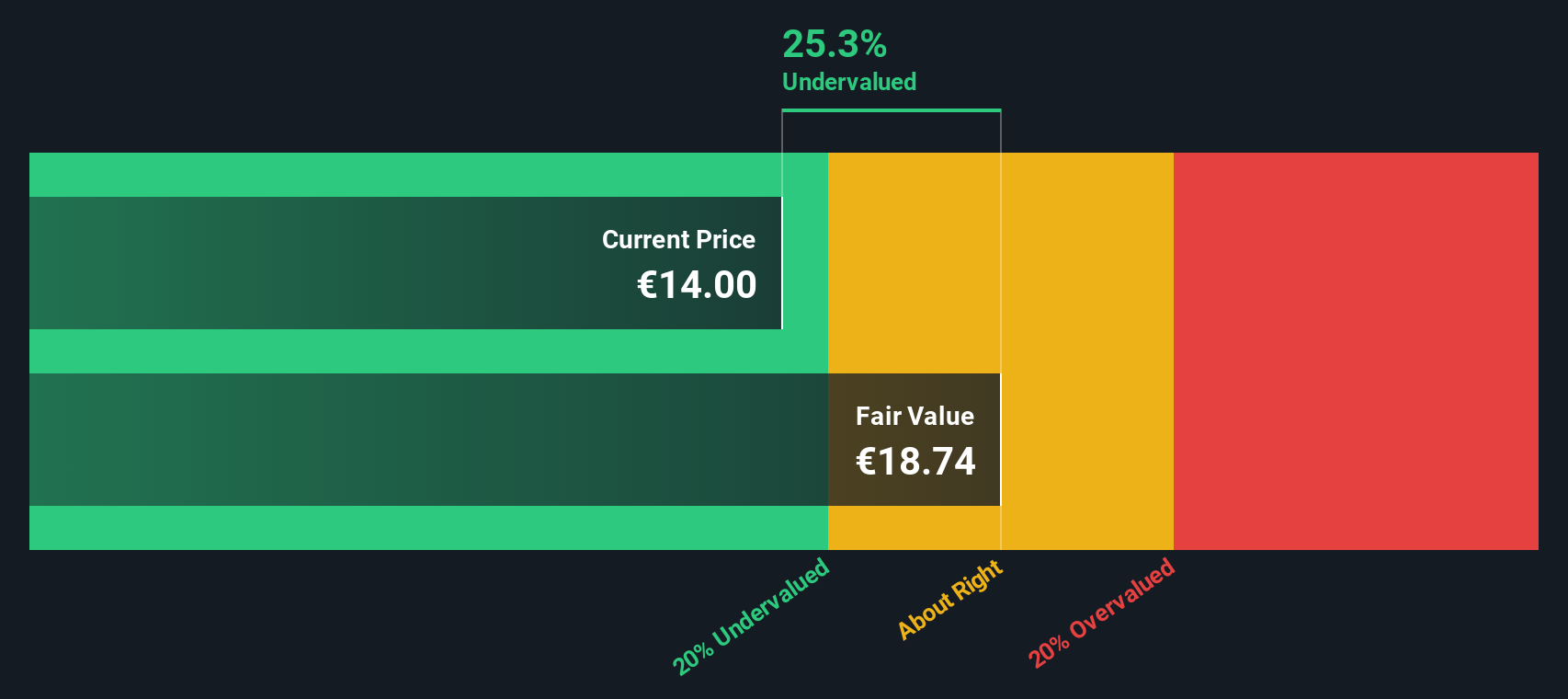

Gofore Oyj (HLSE:GOFORE)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Gofore Oyj is a Finland-based company that provides digital transformation consultancy and services, with a market capitalization of €0.49 billion.

Operations: The company generates its revenue primarily from computer services, with a recent total of €182.19 million. The cost of goods sold (COGS) reached €146.31 million, impacting the gross profit margin, which is currently at 19.70%. Operating expenses are significant at €27.44 million, contributing to a net income margin of 4.05%.

PE: 30.4x

Gofore Oyj, a company with a focus on external borrowing for funding, reported mixed financial results recently. Despite sales reaching €41.32 million in Q3 2025, net income fell to €1.66 million from €3.3 million the previous year, indicating challenges in maintaining profitability amid growing revenues. The company's ongoing share repurchase program reflects strategic moves to enhance shareholder value and support potential business acquisitions or incentives. Earnings are projected to grow annually by 26%, suggesting future growth potential despite current pressures on profit margins and earnings per share reductions over the past year.

- Delve into the full analysis valuation report here for a deeper understanding of Gofore Oyj.

Gain insights into Gofore Oyj's historical performance by reviewing our past performance report.

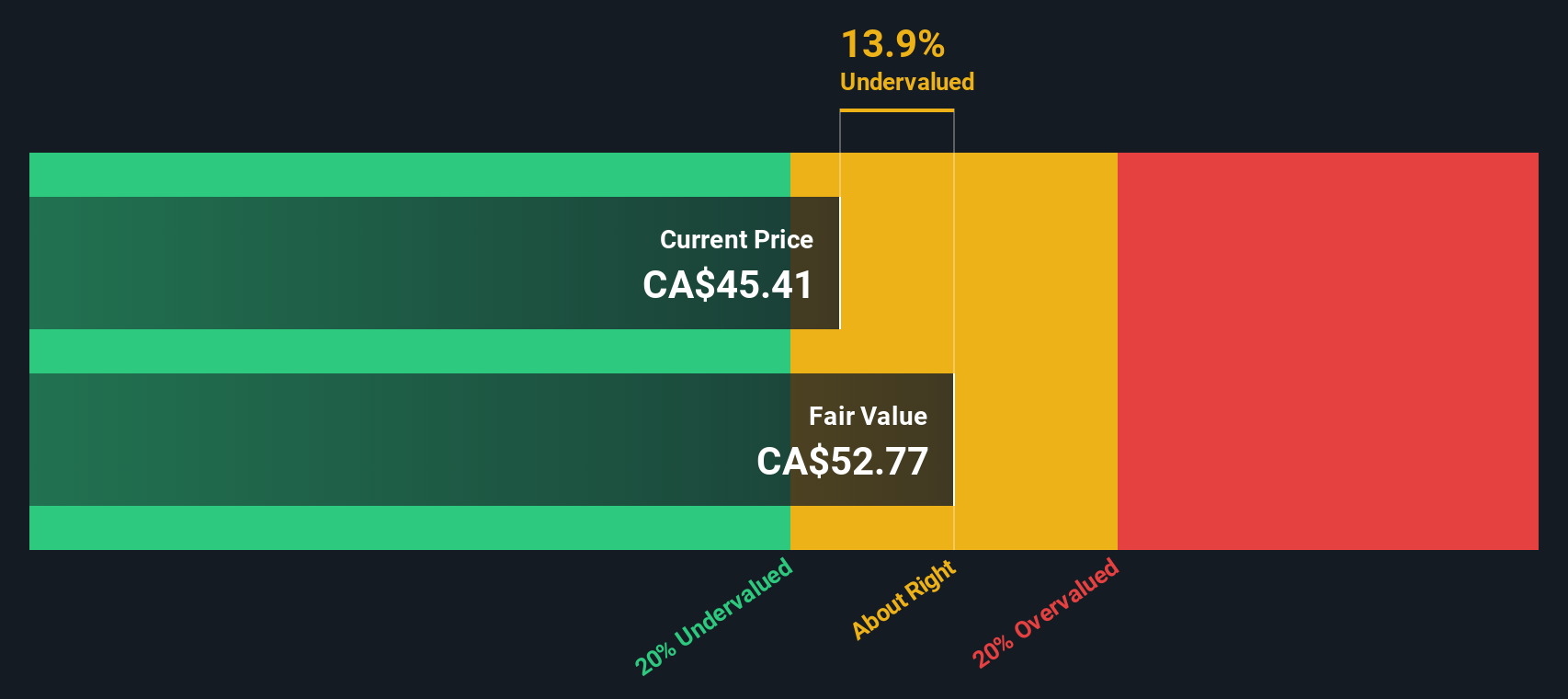

Badger Infrastructure Solutions (TSX:BDGI)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Badger Infrastructure Solutions specializes in providing non-destructive excavation services, primarily through its fleet of hydrovac trucks, and has a market cap of approximately C$1.16 billion.

Operations: Badger Infrastructure Solutions generates revenue primarily through its operations, with a recent figure of $777.39 million. The company has experienced fluctuations in its gross profit margin, reaching up to 29.71% in the latest period. Operating expenses have been significant, including notable costs for depreciation and amortization at $82.21 million and general and administrative expenses at $58.9 million, impacting overall profitability.

PE: 30.5x

Badger Infrastructure Solutions, a smaller company in the infrastructure sector, showcases potential for growth with earnings projected to increase by 22.33% annually. Despite relying on higher-risk external borrowing for funding, they reported improved financial performance in Q2 2025, with sales rising to US$208.21 million from US$186.84 million year-over-year and net income reaching US$18.5 million from US$11.91 million previously. Demonstrating insider confidence, their board approved a share repurchase plan covering up to 8.63% of outstanding shares by August 2026, reflecting management's belief in the company's value proposition amidst industry challenges and opportunities for expansion.

- Click to explore a detailed breakdown of our findings in Badger Infrastructure Solutions' valuation report.

Understand Badger Infrastructure Solutions' track record by examining our Past report.

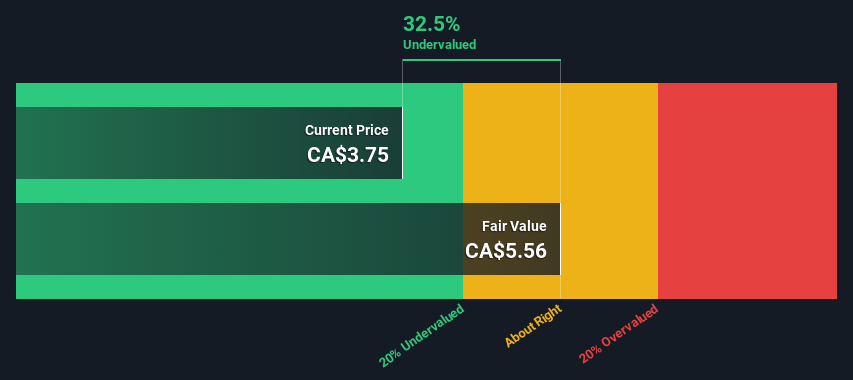

Plaza Retail REIT (TSX:PLZ.UN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Plaza Retail REIT focuses on the ownership and development of retail real estate, with operations generating CA$127.63 million in revenue.

Operations: The company generates revenue primarily from retail real estate ownership and development, with the latest reported revenue of CA$127.63 million. Over recent periods, the net income margin has shown variability, notably reaching 27.54% in mid-2025. Operating expenses have been consistently recorded around CA$12 million recently, impacting net income figures alongside notable non-operating expenses.

PE: 12.9x

Plaza Retail REIT, a smaller player in the retail real estate sector, shows potential for value with its consistent dividend payouts of CAD 0.0233 per share monthly, reflecting steady income distribution. Despite relying solely on external borrowing for funding—a higher-risk approach—recent earnings reveal promising growth. For Q2 2025, sales increased to CAD 31.79 million from CAD 30.67 million year-over-year, while net income surged to CAD 12.6 million from CAD 2.39 million previously, indicating improved profitability and resilience amidst financial challenges.

- Navigate through the intricacies of Plaza Retail REIT with our comprehensive valuation report here.

Gain insights into Plaza Retail REIT's past trends and performance with our Past report.

Where To Now?

- Investigate our full lineup of 118 Undervalued Global Small Caps With Insider Buying right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:PLZ.UN

Plaza Retail REIT

Plaza is an open-ended real estate investment trust and is a leading retail property owner and developer, focused on Ontario, Quebec and Atlantic Canada.

6 star dividend payer with solid track record.

Market Insights

Community Narratives