- Canada

- /

- Health Care REITs

- /

- TSX:NWH.UN

With EPS Growth And More, NorthWest Healthcare Properties Real Estate Investment Trust (TSE:NWH.UN) Is Interesting

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like NorthWest Healthcare Properties Real Estate Investment Trust (TSE:NWH.UN). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

View our latest analysis for NorthWest Healthcare Properties Real Estate Investment Trust

How Fast Is NorthWest Healthcare Properties Real Estate Investment Trust Growing Its Earnings Per Share?

Over the last three years, NorthWest Healthcare Properties Real Estate Investment Trust has grown earnings per share (EPS) like young bamboo after rain; fast, and from a low base. So I don't think the percent growth rate is particularly meaningful. Thus, it makes sense to focus on more recent growth rates, instead. Like a firecracker arcing through the night sky, NorthWest Healthcare Properties Real Estate Investment Trust's EPS shot from CA$0.47 to CA$1.40, over the last year. You don't see 196% year-on-year growth like that, very often.

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. Not all of NorthWest Healthcare Properties Real Estate Investment Trust's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers I've used might not be the best representation of the underlying business. The good news is that NorthWest Healthcare Properties Real Estate Investment Trust is growing revenues, and EBIT margins improved by 3.1 percentage points to 74%, over the last year. That's great to see, on both counts.

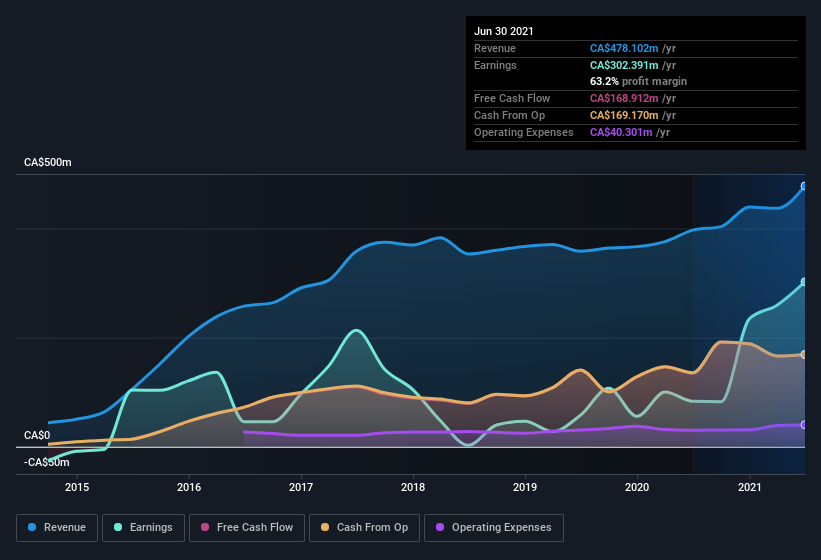

In the chart below, you can see how the company has grown earnings, and revenue, over time. For finer detail, click on the image.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are NorthWest Healthcare Properties Real Estate Investment Trust Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

We did see some selling in the last twelve months, but that's insignificant compared to the whopping CA$25m that the Chairman & CEO, Paul Dalla Lana spent acquiring shares. The average price paid was about CA$12.60. Big purchases like that are well worth noting, especially for those who like to follow the insider money.

The good news, alongside the insider buying, for NorthWest Healthcare Properties Real Estate Investment Trust bulls is that insiders (collectively) have a meaningful investment in the stock. Notably, they have an enormous stake in the company, worth CA$388m. Coming in at 13% of the business, that holding gives insiders a lot of influence, and plenty of reason to generate value for shareholders. Very encouraging.

Is NorthWest Healthcare Properties Real Estate Investment Trust Worth Keeping An Eye On?

NorthWest Healthcare Properties Real Estate Investment Trust's earnings have taken off like any random crypto-currency did, back in 2017. The incing on the cake is that insiders own a large chunk of the company and one has even been buying more shares. Because of the potential that it has reached an inflection point, I'd suggest NorthWest Healthcare Properties Real Estate Investment Trust belongs on the top of your watchlist. However, before you get too excited we've discovered 5 warning signs for NorthWest Healthcare Properties Real Estate Investment Trust (2 are potentially serious!) that you should be aware of.

The good news is that NorthWest Healthcare Properties Real Estate Investment Trust is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if NorthWest Healthcare Properties Real Estate Investment Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:NWH.UN

NorthWest Healthcare Properties Real Estate Investment Trust

Northwest Healthcare Properties Real Estate Investment Trust (TSX: NWH.UN) (Northwest) is an unincorporated, open-ended real estate investment trust established under the laws of the Province of Ontario.

Good value with moderate growth potential.