- Canada

- /

- Industrial REITs

- /

- TSX:GRT.UN

Granite REIT (TSX:GRT.UN): Assessing Valuation After Fifteenth Consecutive Annual Dividend Hike and 2026 Growth Outlook

Reviewed by Simply Wall St

Granite Real Estate Investment Trust (TSX:GRT.UN) just announced another increase to its monthly dividend, marking fifteen years of annual growth. Investors will see a 4% higher distribution in 2026, reflecting the company’s steady approach despite ongoing industry shifts.

See our latest analysis for Granite Real Estate Investment Trust.

Granite’s steady 2026 dividend hike comes as the stock’s year-to-date share price return stands at 9.6%, building on a resilient long-term record even as short-term price movement has cooled. The recently declared November distribution provides another boost for shareholders, tying Granite’s ongoing property acquisitions and portfolio modernization to its reputation for stable and growing returns.

If consistent income streams like Granite’s pique your interest, this could be the perfect moment to discover fast growing stocks with high insider ownership.

But after a solid run and a newly announced dividend hike, are Granite’s shares still trading at a bargain, or is the market already factoring in its future growth prospects?

Price-to-Earnings of 15.9x: Is it justified?

Granite Real Estate Investment Trust is trading at a price-to-earnings ratio of 15.9x, which suggests the market is valuing today’s earnings somewhat in line with the broader Industrial REITs sector and close to its own fair value estimate.

The price-to-earnings (P/E) ratio measures how much investors are willing to pay per dollar of earnings. This makes it a key metric for income-producing REITs like Granite. It is used to compare companies with steady profits and cash flows.

Granite’s P/E of 15.9x is slightly below the global Industrial REITs industry average of 16.1x. This hints at a valuation that recognises its steady earnings profile and moderate growth prospects. Relative to its estimated fair P/E of 16.5x, there is a small gap that could close if growth forecasts pan out and market conditions remain supportive.

When comparing against Canadian peers, Granite does appear more expensive, with the peer average at 11.6x. However, based on its fair ratio, there is still room for minor upside should sentiment or fundamentals improve.

Explore the SWS fair ratio for Granite Real Estate Investment Trust

Result: Price-to-Earnings of 15.9x (UNDERVALUED)

However, slower revenue growth or a change in market sentiment could limit further upside and put pressure on Granite’s valuation narrative.

Find out about the key risks to this Granite Real Estate Investment Trust narrative.

Another View: What Does the SWS DCF Model Say?

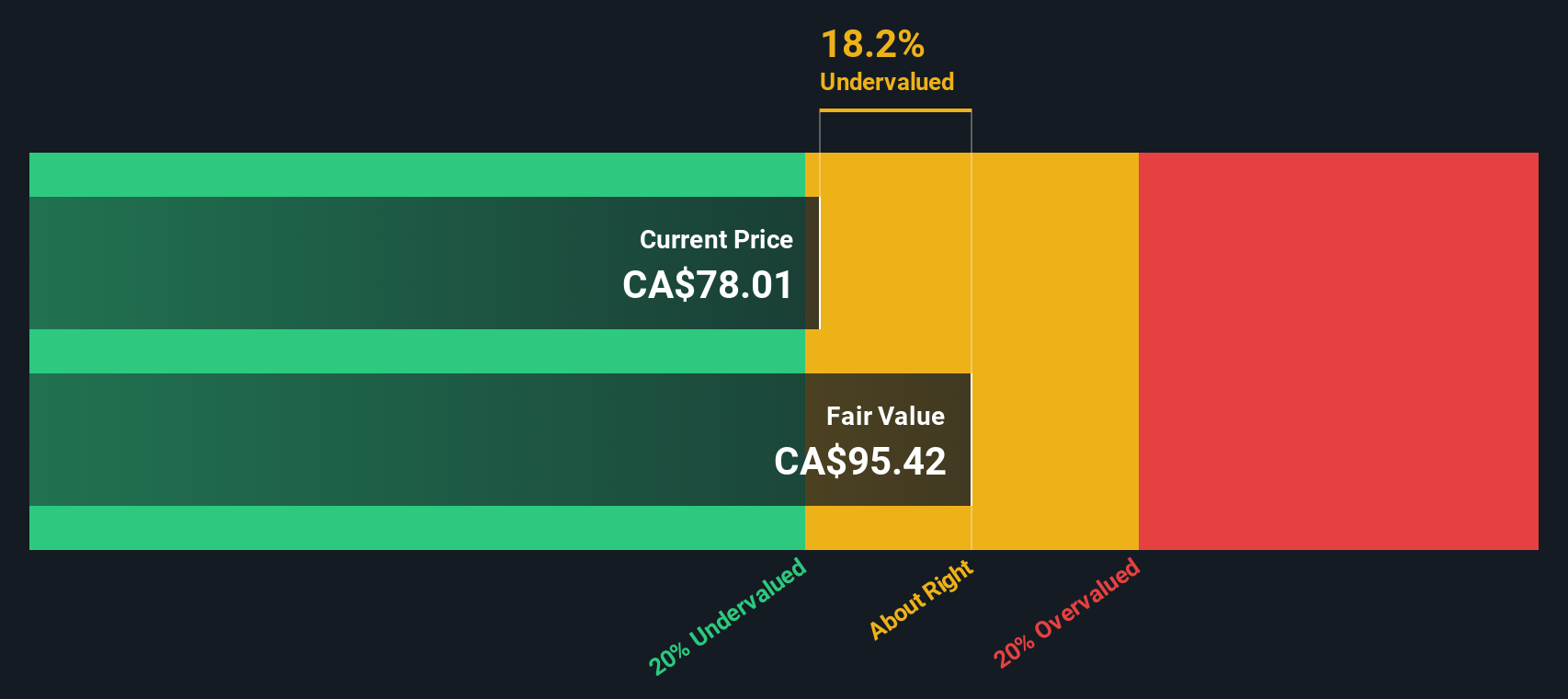

Looking beyond earnings ratios, the SWS DCF model offers a fresh angle. This approach suggests Granite Real Estate Investment Trust is trading about 19.5% below its estimated fair value, which may indicate potentially greater undervaluation than the P/E ratio implies. Could this gap be a sign of hidden opportunity, or does it simply reflect market caution?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Granite Real Estate Investment Trust for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 926 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Granite Real Estate Investment Trust Narrative

If you have a different perspective or want to dig into the numbers yourself, you can quickly build your own Granite Real Estate Investment Trust view in just a few minutes. Do it your way

A great starting point for your Granite Real Estate Investment Trust research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Uncover compelling opportunities beyond Granite and make your next move confidently. The right mix of growth, innovation, and income might be just a click away.

- Capitalize on next-generation breakthroughs by reviewing these 26 quantum computing stocks, which are transforming computing as we know it.

- Maximize your portfolio's income potential by checking out these 15 dividend stocks with yields > 3%, offering yields above 3%.

- Seize overlooked potential with these 926 undervalued stocks based on cash flows, trading for less than their intrinsic cash flow value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:GRT.UN

Granite Real Estate Investment Trust

Granite is a Canadian-based real estate investment trust ("REIT") focused on acquiring, the development, ownership and management of buildings, mainly logistics facilities, warehouses and industrial buildings in North America and Europe.

Fair value second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives