- Canada

- /

- Real Estate

- /

- TSX:GDC

Would Shareholders Who Purchased Genesis Land Development's (TSE:GDC) Stock Three Years Be Happy With The Share price Today?

As an investor its worth striving to ensure your overall portfolio beats the market average. But if you try your hand at stock picking, your risk returning less than the market. We regret to report that long term Genesis Land Development Corp. (TSE:GDC) shareholders have had that experience, with the share price dropping 40% in three years, versus a market return of about 27%.

See our latest analysis for Genesis Land Development

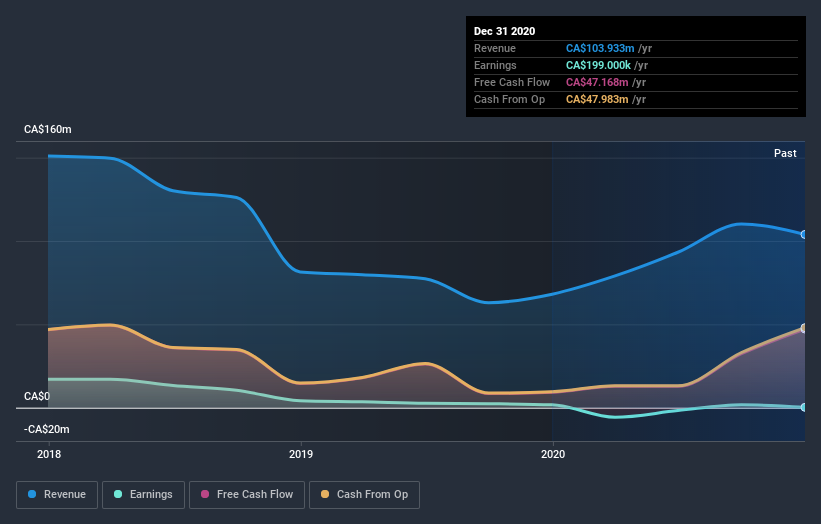

We don't think that Genesis Land Development's modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

In the last three years Genesis Land Development saw its revenue shrink by 18% per year. That means its revenue trend is very weak compared to other loss making companies. On the face of it we'd posit the share price fall of 12% compound, over three years is well justified by the fundamental deterioration. The key question now is whether the company has the capacity to fund itself to profitability, without more cash. The company will need to return to revenue growth as quickly as possible, if it wants to see some enthusiasm from investors.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. It might be well worthwhile taking a look at our free report on Genesis Land Development's earnings, revenue and cash flow.

What about the Total Shareholder Return (TSR)?

We've already covered Genesis Land Development's share price action, but we should also mention its total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Genesis Land Development's TSR of was a loss of 32% for the 3 years. That wasn't as bad as its share price return, because it has paid dividends.

A Different Perspective

Genesis Land Development provided a TSR of 42% over the last twelve months. But that was short of the market average. The silver lining is that the gain was actually better than the average annual return of 4% per year over five year. It is possible that returns will improve along with the business fundamentals. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Like risks, for instance. Every company has them, and we've spotted 3 warning signs for Genesis Land Development (of which 1 can't be ignored!) you should know about.

Genesis Land Development is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

If you decide to trade Genesis Land Development, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:GDC

Genesis Land Development

An integrated land developer and residential home builder, owns and develops residential lands and serviced lots in the Calgary Metropolitan Area, Canada.

Mediocre balance sheet second-rate dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success