- Canada

- /

- Industrial REITs

- /

- TSX:DIR.UN

Dream Industrial (TSX:DIR.UN) Margin Expansion Challenges Bearish Narratives on Earnings Turnaround

Reviewed by Simply Wall St

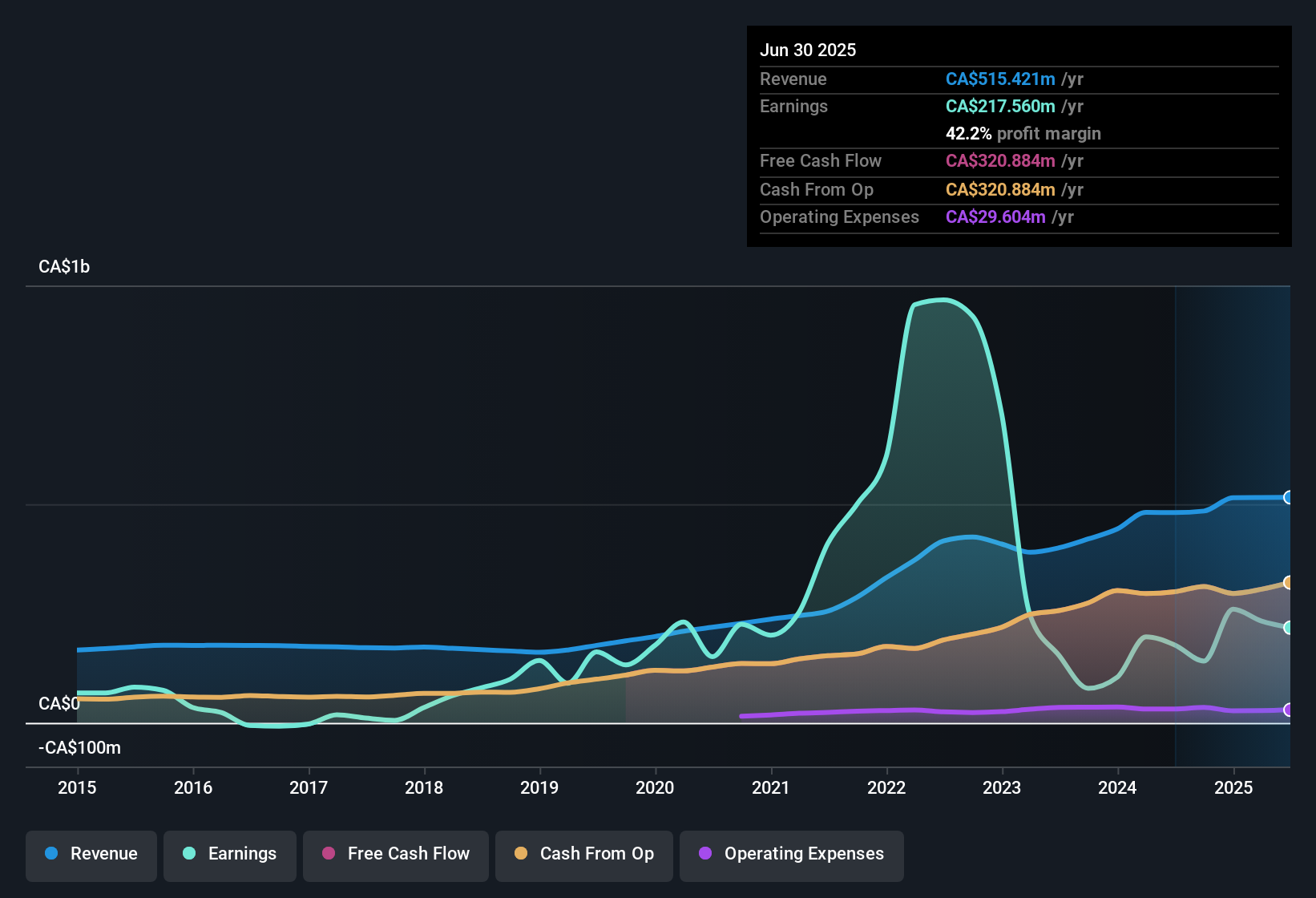

Dream Industrial Real Estate Investment Trust (TSX:DIR.UN) posted another set of robust numbers, with revenue projected to grow at 9.5% per year and earnings forecast to rise at 13.1% per year, outpacing the Canadian market. Over the past year, DIR.UN’s earnings climbed 22.3%, marking a strong turnaround from its previous five-year average annual decline of 18.7%. Net profit margins have also expanded, now reaching 42.2%, up from 37% a year ago. This reflects a notable improvement in overall profitability that investors will be watching closely.

See our full analysis for Dream Industrial Real Estate Investment Trust.Next, we will see how these latest figures measure up to the market’s most popular narratives for DIR.UN, and where the numbers might tell a different story.

See what the community is saying about Dream Industrial Real Estate Investment Trust

Margin Expansion on the Horizon

- Analysts project net profit margins to rise from 42.2% today to 57.3% within three years, signaling expectations that operating leverage and portfolio upgrades will significantly boost profitability.

- According to the consensus narrative, expanding leasing activity and targeted upgrades of urban logistics assets are set to drive higher occupancy. As a result:

- Long-term revenue growth receives a lift from stronger property income margins as recent leasing gains begin to show in active results.

- Diversification across markets and sustainable build-to-suit development is viewed as strengthening recurring earnings resilience. However, persistent cost pressures could put the forecasted margin trajectory to the test.

- Recent results reinforce analyst expectations that the business model’s focus on occupancy and asset quality can fuel significant margin expansion in the years ahead. 📊 Read the full Dream Industrial Real Estate Investment Trust Consensus Narrative.

Debt Leverage Remains a Key Watchpoint

- DIR.UN reports a net debt-to-EBITDA ratio of 8.2x, a level that draws attention to leverage management as interest rates remain elevated and growth ambitions persist.

- Consensus narrative highlights resilience from proactive debt management and strong liquidity, but also flags:

- Bears focus on the risk that persistent high interest rates or a credit market tightening could compress net margins by driving up interest expense, putting constraints on both acquisition and development plans.

- Analysts counter that the ample liquidity and focus on capital recycling are intended to help the trust navigate these scenarios. However, success ultimately hinges on maintaining strong operating cash flows.

Valuation Signals Relative Upside

- DIR.UN's share price of CA$12.48 trades at a discount to its DCF fair value of CA$14.50, while the analyst price target of CA$13.93 sits 11.6% above the current market level.

- Consensus narrative sees the current valuation as attractive for income-oriented and value investors, offering:

- A higher price-to-earnings ratio than direct Canadian REIT peers, yet below the average for global industrial REITs, providing appeal for those seeking diversified exposure.

- Potential for ongoing dividend yield and profit growth, though both are partly contingent on continued execution amid industry risks like oversupply and cost escalations.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Dream Industrial Real Estate Investment Trust on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Not seeing the figures the same way? Share your own take and shape your perspective with a new narrative in just a few minutes: Do it your way

A great starting point for your Dream Industrial Real Estate Investment Trust research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

While Dream Industrial has improved profits, high debt levels and sensitivity to interest rates leave its balance sheet more exposed than some peers.

If you want more resilience, check solid balance sheet and fundamentals stocks screener (1979 results) to discover companies with stronger balance sheets and lower financial leverage. These companies may be better positioned to weather uncertainty.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:DIR.UN

Dream Industrial Real Estate Investment Trust

Dream Industrial REIT is an owner, manager and operator of a global portfolio of well-located, diversified industrial properties.

Proven track record average dividend payer.

Market Insights

Community Narratives